How do leading UK retailers measure up when it comes to Operations & Logistics? InternetRetailing researcher Fernando Santos explores the figures that underpin delivery, collection and stock checking findings in this Dimension

Retailers that stand out in the IRUK Operations & Logistics Performance Dimension Report do so when they offer delivery and collections services that not only meet but exceed customer expectations. By going the extra mile, they give shoppers a convenient experience, enabling them to take delivery of their online orders wherever and whenever they want.

Our research looked at the delivery promise, to see how wide a range of options were on offer, at the costs, the time delivery would take, collections, and also at the use of stock finder functionality in retailers’ mobile apps. Given the growing importance of returns in current retailing, we’ve focused our findings in this area in a separate research feature.

What the Top500 do

More than half of leading UK retailers now offer a click-and-collect service, while the same proportion offer next-day delivery. InternetRetailing research also found that new kinds of services, such as same-day delivery and nominated time delivery, are still relatively hard to find.

For while 55.7% of IRUK Top500 traders enable shoppers to collect their online orders from a shop and 56.8% offer next-day delivery, just 5% offer same-day delivery, and 3% deliver at a named time. Named-day delivery is more widely found, offered by 15% of Top500 retailers. Saturday delivery (25.4% of retailers) is more common than Sunday delivery (9.2%).

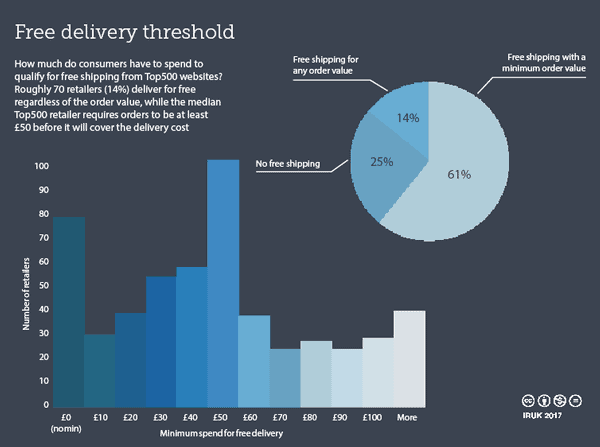

Standard delivery typically takes up to five days to arrive, with a median cost of £4.95. Of the 317 retailers that offer free delivery, the median minimum spend to qualify is £49.40.

The average Top500 retailer offers between two and three delivery options.

We consider stock checking from the mobile app to be an emerging and important part of the fulfilment service. When we looked at the Top500, we found that while 16.6% enable users to check stock from the app, only 2.9% offer any extra stock checking functionality, such as the use of a barcode scanner.

Same-day delivery is most commonly found in the food and wine and grocery sectors, perhaps reflecting the urgency of food deliveries

How the delivery promise varied by category

Click-and-collect services are most commonly found in department stores, where 71% offer pick-up as a fulfilment option. That is followed by apparel (68%), fashion (63%) and footwear (65%) retailers. Almost two-thirds (63%) of grocers also offer click and collect. The service is least commonly found among those trading in the stationery, books and craft category (40%), followed by business goods (46%) and home, garden and DIY (47%).

The threshold for free delivery varies markedly between categories. Those selling books, stationery and craft typically require a minimum spend of £25, followed by health and cosmetics (£30) and food and wine (£31). At the other end of the scale, those selling jewellery, department stores and home, garden and DIY require a £50 spend before delivery is free. The relatively low threshold for free delivery in the health and cosmetics, food and wine, and books and stationery markets may reflect the more competitive nature of those sectors, where, in general, the products on offer are not unique to the seller.

Retailers across the sectors offer between two and three delivery options, although retailers selling health and cosmetic products do offer slightly more choice, with an average of 2.9 options, followed by apparel (2.8), general fashion and department stores (both 2.7). An average of 2.2 options are available to customers in the food and wine category, although grocers offer 2.4 options.

The cost of standard delivery is lowest in the grocery category (£3.60) and highest in home, garden and DIY (£6.17), while the time taken for standard delivery during our research was fastest for business goods (two days), food and wine (three days) and grocery (also three days). It was slowest for home garden and DIY retailers (five days) and department stores (five days).

Next-day delivery is most common in the business goods category, where it is offered by 75% of retailers, perhaps recognising business customers’ need for speedy fulfilment. This is followed by health and cosmetics (66%), apparel (58%) and sports and leisure (58%). Only 49% of stationery, books and craft retailers offer the service, while 51% of jewellery and accessories retailers offer it.

Same-day delivery is most commonly found in the food and wine (16% of retailers), business goods (16%) and grocery (15%) sectors, perhaps reflecting the urgency of food deliveries. At the other end of the scale, no jewellery, sports and leisure or accessories retailers offer it, perhaps because there’s little demand among customers for this premium service.

Nominated-day delivery is offered by 44% of grocers – perhaps reflecting the need to deliver fresh items to a set timetable – by 34% of food and wine traders and by 28% of department stores. It is least common in the jewellery, stationery, books and craft as well as the sports and leisure categories, where fewer than 10% of retailers in each category offer it. Nominated time delivery is again most commonly found among grocers (27%) and food and wine retailers (20%). No jewellers or retailers selling accessories offer this option.

Saturday delivery is more common among food and wine retailers (46%), along with sellers of health and cosmetics products (41%). It is least commonly found among those selling stationery books and craft (15%) and jewellery (22%). There is less overall take-up for Sunday delivery but it is offered by 19% of grocery retailers and 16% of food and wine sellers, along with 17% of footwear retailers. In keeping with the sector, no business goods retailers offer Sunday delivery. Other categories where it is less commonly found include stationery, books and craft (5%), children’s goods (6%) and home, garden and DIY (7%).

Checking stock

Stock checking functionality is most commonly found on mobile apps from fashion (34%) and apparel (31%) retailers, followed by sports and leisure retailers (18%). But when it comes to extra stock checking functionality, apparel retailers (5%) are behind sports and leisure (9%) and home, garden and DIY retailers. At the other end of the scale, no retailers in the books and craft, grocery, or food and wine sectors offer stock-checking functionality at all.

What leading retailers did

Asos stood out in this research for its wide delivery offer, with eight delivery and collection options, including the relatively uncommon nominated-day-and-time delivery. Additionally, it offers unlimited next-day delivery for all of its premier subscribers.

We consider stock checking from the mobile app to be an emerging and important part of the fulfilment service

Amazon is among the few retailers that offer same-day delivery, nominated day and time deliveries among its nine delivery and collection options. Its subscription plan, Amazon Prime, is one of the standout services in this area.

Marks & Spencer has a flexible approach to delivery that includes next-day home delivery for items ordered before 10pm. But it’s for its returns policy that it stands out in this Dimension. For more on this, see our second research paper, which focuses on returns.

Supermarkets Tesco and Sainsbury’s both have highly convenient delivery policies. Both offer Sunday, same-day and nominated time delivery. In the home and DIY sector, Screwfix offers Sunday delivery and nominated time delivery. It is also among the relatively small number of Top500 retailers that enable shoppers to check stock from the mobile app. Some 16.6% of Top500 traders offer this, as do 16.6% of home, garden and DIY retailers.