Apps are increasingly important in helping retailers to bind together multichannel experiences. But, discovers Jonathan Wright, many retailers have yet to make the most of the merchandising opportunities they offer

As we’ve already identified in our analysing the numbers feature, mobile sales are becoming more and more important within retail. According to research by IMRG, retailers reported an average of 54.5% of all online sales coming through mobile devices between February and April 2017.

But in many respects, it’s been customers who have led the way here, not retailers, and as a result many companies are still playing catch-up. This is seen in the way that many companies have apps that lack functionality or appear to have been built quickly, sometimes seemingly without any thought about how customers may wish to interact with the brands.

Apps by sector

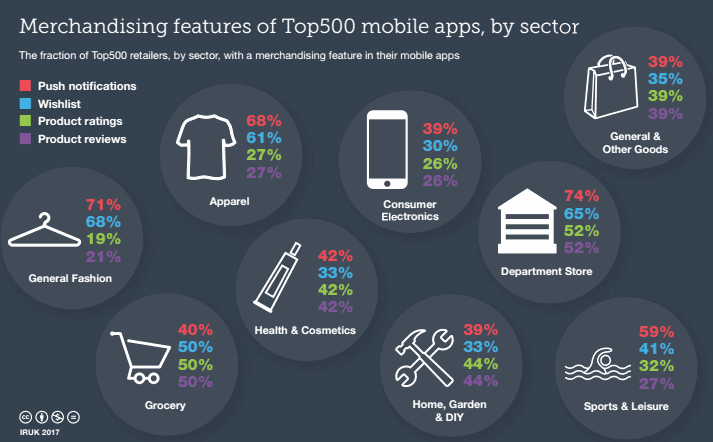

While our research, undertaken in conjunction with Knowledge Partner Poq, shows this situation is improving compared to last year, it’s not uniform across different sectors. Of those sectors that perform most strongly (and we analysed the performance of the 204 Top500 retailers that had an iOS mobile app), the apparel sector is among those that stands out for consistency. It’s also a sector where companies typically have apps that are strong in searchandising and offer multiple product images.

Department stores are even more consistent, scoring highest for offering personalisation and push notifications, and most likely to show star ratings and written reviews for products. Of the other app metrics we considered, general fashion performs most strongly in terms of offering customers the ability to zoom in on images and create wishlists.

What’s revealing about this research is that sectors where merchandising has always been seen as particularly important lead the way. In contrast, retailers in the food and wine sector have apps that offer less functionality, although the grocery sector excels in offering daily deals, perhaps because the goods sold have shorter shelf lives than most. Regardless, they’re demonstrating a valuable capacity to entice regular returns to their digital shopfronts.

It’s outside the scope of our research, but it may be that retailers dealing in more ‘functional’ and, typically, cheaper goods in terms of price per item, don’t yet see the need for advanced app functionality. They may have a point: a weekly supermarket shop undertaken in the company of a toddler can be overwhelming enough in itself, who needs a smartphone pinging away or offering the chance to zoom in on a tin of beans?

Yet the nagging thought occurs that it’s the smartphone that binds together modern multichannel retail. If retailers can’t make the most of its capabilities, how are they to prepare for a coming age where all kinds of devices have a digital presence?

Apps by retailer

Turning to specific retailers, the Top50 in the Merchandising Dimension typically tend to outperform competitors to a substantial degree across many different metrics. However, it’s noticeable that some retailers’ apps don’t perform as strongly as their Top50 placing suggests they should. Technically, this is because the Mobile & Cross-channel Dimension also takes account of retailers’ mobile web performance and, for retailers with stores, how they’ve tied together the customer journey between online and offline access points.

Of those that do have strongly performing apps, Footprint, or size, is strongly correlated with how the average retailer performs. Overall, larger companies appear to have invested more in their apps, as you might reasonably expect. Amazon , Argos , B&Q , Boots , Debenhams , Homebase , John Lewis , Marks & Spencer , Mothercare , PC World and Screwfix all have apps that our research rated highly, and which contribute significantly to their placing in the Top50.

Turning to other companies, there were some intriguing entrants here. The Fragrance Shop’s app offers customers the opportunity to create a taste profile to determine which scents might be most appropriate. More generally, the app enables the company to build customer profiles that also encompass the kinds of scents they typically buy as gifts.

The Pets At Home app is closely linked to its VIP (Very Important Pets…) club so that signing up gives customers access to exclusive savings and offers. Register a VIP’s birthday and customers receive an exclusive treat on the day, plus the app can be personalised with images and information on customers’ VIP(s). Again, this is a canny use of the app to gather information, especially as even customers who are suspicious of giving out personal information will happily chat digitally about their creature companions.

Again, it’s outside the research remit, but the wider point we’re trying to make here is that thinking through app deployments by focusing on how customers might use them – and this means offering genuinely useful functionality that gets used and improved rather than retailers imposing what they think would be good for customers – produces results. Where retailers have more information, they’re better able to segment and personalise merchandising.

As we conduct our ongoing research, we expect to see more apps being rolled out. We will be monitoring whether these are apps that seem to be built around the customer or whether they’re a case of ticking a box. Where we find the former, we would suggest, we also find evidence of a retailer preparing for a mobile-first future.