Going the extra mile

Schuh sets the pace in the Operations and Logistics Dimension of the Top500. The footwear retailer leads the Elite cluster of companies, thanks to its market-beating convenient collection, delivery and returns options.

“IT’S NOT SURPRISING to see Schuh at the top,” says InternetRetailing researcher Martin Shaw . “Click and collect pick-up within the hour, five delivery options, in-store and Collect+ collection, free delivery, 365-day unwanted returns policy, three options for return and online order tracking make it a very capable logistics performer.” Amazon , House of Fraser , Superdry , John Lewis and Boots complete the Elite group in this Dimension (see the Top Six section below for more).

Fashion companies set trends in multichannel developments because they compete to set the highest level of responsiveness to customers who want their products as quickly as possible. The Leading group of companies includes fashion merchants River Island , Selfridges , Topshop , Monsoon and Ted Baker , along with footwear retailer Clarks . But other companies are also recognised.

Maplin Electronics , for example, has made a point of delivering from store in the fastest time, while Toys Я Us and Halfords have put an emphasis on fulfilment as part of well-defined multichannel strategies. Screwfix parent company Kingfisher recently pointed out that its mobile click, pay and collect offer had helped to grow sales by 23.3 per cent to £386 million in the half-year to 2 August 2014.

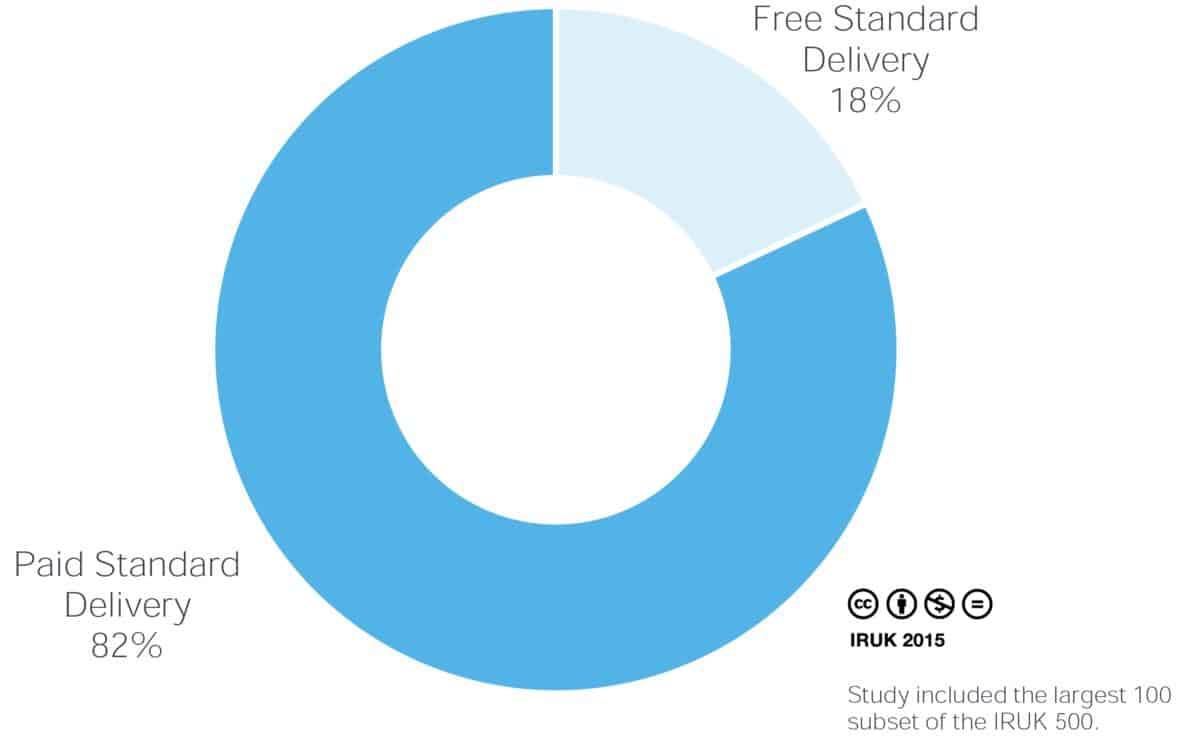

82 per cent of the retailers that offering standard delivery charge for the service. The median cost is £3.99. This was also the amount most commonly charged, followed closely by £3.95

High street performers are represented throughout the rankings, with consistent high performers Argos , M&S and BHS all in the Model group. It’s testament to the service offered by Amazon that it is ranked so highly. The research appears to demonstrate the principle that multichannel retailers gain a real advantage from a high street presence. Shaw says: “It’s not surprising that AO.com scores zero for the collect category, or that returning appliances is difficult for the customer. But the retailer, which offers Saturday, Sunday, nominated day and same-day delivery, scores highly for delivery.”

Many retailers need to improve service levels. For example, 34 of the largest 100 retailers, companies we analysed in additional detail, have yet to introduce click and collect or other collection services. In contrast, the leaders in this Dimension make specific promises about fast delivery – and then keep them.

How Schuh achieved its market-beating logistics capability

Schuh says promising – and delivering – choice is key to its fulfilment operation. “Most of the product we sell isn’t exclusive, so we take the view that choice and efficiency are actually very important in terms of our relationship with the customer because they could simply choose to buy it somewhere else,” says Sean McKee , head of ecommerce at Schuh.

The choice starts with free standard three-day delivery to customers in the UK and Northern Ireland. Around a quarter of ecommerce fulfilment takes place from the stores, which dispatch four times a day – when the product is only available there. Shoppers can nominate their delivery day, get same-day delivery through Shutl, or pick up using Collect+ or UPS Access Points. They can check store stock and reserve, with reservations ready within 20 minutes, or they can buy and collect within the hour if the product is in-store.

Over the last year the focus has been on enabling a 10pm last-order time for next-day delivery, costing £1 in response to high customer interest in same-day and next-day delivery. Last November Edinburgh-based Schuh opened a mini distribution centre in the Midlands: daytime orders are fulfilled from Edinburgh and evening orders from the Midlands. “We have a very, very clear sense of which time of day drives which distribution centre to give us the most efficient fulfilment,” says McKee.

Towards the end of 2014, Schuh introduced Sunday delivery. “Moving to next day, seven days, is going to be a really exciting development for us,” says McKee. “It really does reflect customer demand.” The single biggest area customers ask about is order tracking, and they respond well to being informed. Schuh sends out three or four emails during a buy-and-collect transaction, for example, and also uses text messaging to ensure timely communication.

WHAT WE LEARNED

The retailers that lead in this Dimension build delivery and collection options around what works for customers. To take just three as an example, John Lewis, House of Fraser and Schuh all asked customers what they wanted from delivery, and then developed multichannel services in such a way as to reflect customers’ wishes.

So what can we understand of what customers want from this list? Strong delivery and collection options go beyond company premises to Underground and mainline stations, to petrol stations and corner shops, and through third-party collection services such as Collect+. Sometimes, companies even deliver to other retailers’ stores, as with the partnership between sister companies John Lewis and Waitrose . All this activity is because delivery is now a key differentiator for customers: how retailers deliver – and enable collection – makes a world of difference when customers choose to buy from one retailer rather than another.

House of Fraser and Amazon both offered the widest choice of delivery, with seven options

Getting delivery right also matters because more people are now ordering online. Figures from etail trade association IMRG suggest ecommerce orders will grow by 20 per cent this year. Delivery volumes will grow too. IMRG/Metapack’s Delivery Index for May 2014 suggested that, by the end of this year, UK carriers will have collected 930 million parcels on behalf of UK e-retailers. Of these, an estimated 160 million will be destined for non-UK shoppers. A subsequent IMRG/Blackbay study, however, warned that failed online deliveries would cost UK retailers £473 million this year, or £771 million where marketplace deliveries are added in.

Getting delivery and the underlying operations right makes a real difference both to the end customer – and the bottom line.

The top six: what set them apart?

Schuh, Index Value: 79%

Not content with offering a range of home delivery options, Schuh gives choice when it comes to click and collect too – with options that include one-hour pick-up from a local store. Returns are easy too, with money back within 365 days on unwanted items.

Link: How delivery plays into Schuh’s store strategy

House of Fraser, Index Value: 70%

With a choice of seven delivery options, House of Fraser offers a flexible service to fit customer needs.

Link: House of Fraser’s site reviewed, with a focus on delivery

Superdry, Index Value: 67%

Free is key for Superdry’s logistics service, with no charge for standard, two-day delivery, click and collect, or international delivery.

Link: Superdry’s multichannel development

John Lewis, Index Value: 66%

We’d expect no less than a belt-and-braces approach from reliable John Lewis. That’s something it delivers, with six UK delivery options including, notably, next working day before 10.30am or on a nominated day. Returns are good for 90 days.

Link: John Lewis extends its click and collect reach

Boots, Index Value: 62%

Boots boasts five delivery options including next-day, Saturday and nominated day delivery. Shoppers can click and collect for next-day pick-up, with orders over £20 delivered for free.

Link: How the Boots site fulfils orders

Amazon, Index Value: 61%

Amazon has so many delivery options that it is able to compensate in large measure for the fact that it cannot offer store collection. Its range includes free delivery for items costing over £10, delivery to an Amazon locker, Collect+ and same evening delivery. Those customers who’ve subscribed to Amazon Prime normally have no minimum order value for free delivery.

Link: Amazon delivers to London Underground

WHERE NEXT?

At the cutting edge, innovations are likely to include enabling customers to view stock levels across touchpoints such as the store or the warehouse. This will be underpinned by a single view of inventory that will also allow retailers to ship from store. Schuh is among the relatively few retailers doing this already. Debenhams has won plaudits for its ability to ship from store.

Our research shows plenty of room for improvement across the industry. A significant minority of the retailers analysed in this research currently offer no click and collect options, despite the growing popularity of such services with shoppers. But in the next year, expect shoppers’ awareness and demand for such options to grow. A recent Venda study found 73 per cent of people had yet to use such alternative delivery options – and a quarter of the 2,340 questioned in the survey had never previously heard of them. But 76 per cent said they’d prefer to use a click and collect service for same-day deliveries rather than waiting two or three days for standard delivery.

Interesting ideas in this space include high street lockers placed in Oxfordshire towns by ByBox, with the aim of driving footfall. Collect+ is now delivering to local shopping centres owned by Capital & Regional in the Midlands. House of Fraser is bringing ordering and collection to a Cambridge Caffé Nero branch. We anticipate that delivery will come ever closer to the customer over the year ahead: collecting goods from a London Underground station is becoming commonplace, but we’ll watch with interest to see which other locations emerge around transport hubs and other places where shoppers spend time.

For many, there’s still a significant opportunity in training staff across the business around multichannel customer service. If an order arrives at store only to be lost, or if customers are not kept up to date with progress, the whole transaction is likely to fail, deterring shoppers from buying again.

We’ll continue to measure all these metrics over the year ahead, assessing how retailers respond to customer demands to take delivery of their online orders, however, wherever and whenever they want.

The Methodology

The team at Micros Systems UK (now owned by Oracle) adapted the extensive research they undertake for their Golden Chariot Awards to contribute to our assessment criteria for our Operations and Logistics Dimension.

Our researchers analysed the websites and delivery offer and experience of the largest 100 considering dozens of data points over two months, including: whether delivery and returns information was clearly signposted on the website; number and type of delivery options offered; returns options.

We tested the delivery services of the top retailers with live orders assessing the order process, making enquiries, the delivery experience and then returning items.

We condensed our results into 24 delivery metrics, plus 11 for click and collect services and 13 for returns.

Grocers’ services were not tested, nor were travel services or digital-only services. These retailers were not penalised – the results were used to redistribute the largest 100’s Index Value.