Retail on the move

Argos achieved a near-perfect index value in the Mobile and Cross-channel Dimension. The home goods retailer is top of the Elite trio of companies because its mobile offering is coherent and complete, and because customers can collect orders from any store.

“ARGOS HAS CLEARLY thought through its mobile and cross-channel operations,” says InternetRetailing researcher Martin Shaw . “Retail experts sometimes talk about mobile as if it’s not a separate channel anymore, their reasoning being that everyone uses their phones and tablets when it comes to researching and buying goods these days. Despite this, many retailers still have big gaps in their mobile offerings, or even no mobile offering at all, suggesting a big discrepancy between an understanding of best practice and implementation.”

The Elite group is completed by plus-size clothing retailer Evans , and trainers and sports retailer JD Sports . It’s significant that none of these retailers operates at the luxury end of the market, so often associated with state-of-the-art mobile offerings. It’s not just the well-to-do carrying the latest smartphones who are cross-channel shoppers, this is technology that’s gone mainstream.

The Leading group of retailers is also comprised of familiar names, with House of Fraser , Mothercare , Boots , Ernest Jones and Topman all achieving an index value of between 10.5 and 11 out of a possible 12.5. These are retailers that didn’t quite make the Elite group because one part of the mobile offering didn’t rank highly. House of Fraser, for example, doesn’t have a dedicated iPad app.

Four retailers have five-star-rated apps: LivingSocial , Quiz , ASOS and Trip

While big retailers such as Miss Selfridge , John Lewis , Apple , M&S and Halfords are well represented in the Model group of companies, there are also some less familiar names here. Blue Inc , for instance, is a rapidly expanding clothes chain selling affordable, urban-styled menswear. Its app performed well in our assessment.

While the ratings system favoured clicks-and-mortar retailers, pureplay LivingSocial still made its way into the Model group. That’s because the local marketplace company, which promotes city-specific deals, achieved the maximum index value in seven of the 10 categories. Further down the list, pureplay fashion retailer Mr Porter also performed well in the same categories, proving that a mobile offering can be strong even for retailers that don’t have a high street presence.

The Elite group: what set them apart?

Argos, Index Value: 12 out of a possible 12.5

Perhaps because its catalogue-shopping-on-the-high-street model lends itself to cross-channel retail, Argos achieved a near-perfect index value of 12. App rating based on user reviews was the only area in which it fell short.

Link: How mobile sales now account for 20 per cent of business at Argos

Evans, Index Value: 11.75

Similarly to Argos, Evans has got the basics right. This reflects a substantial investment by the Arcadia Group, which owns the retailer, and is also reflected in several other Arcadia brands, Topman, Miss Selfridge, Topshop, Wallis, BHS and Dorothy Perkins, being included in the Model group.

Link: How Arcadia is investing in mobile

JD Sports, Index Value: 11.25

JD Sports’ app was highly rated. However, the company doesn’t offer customers the facility to scan goods in-store, which brought its overall mark down. Nonetheless, the rest of the company’s mobile and cross-channel offering is exemplary.

Link: How JD Sport’s profitability and turnover is being driven by digital

WHAT WE LEARNED

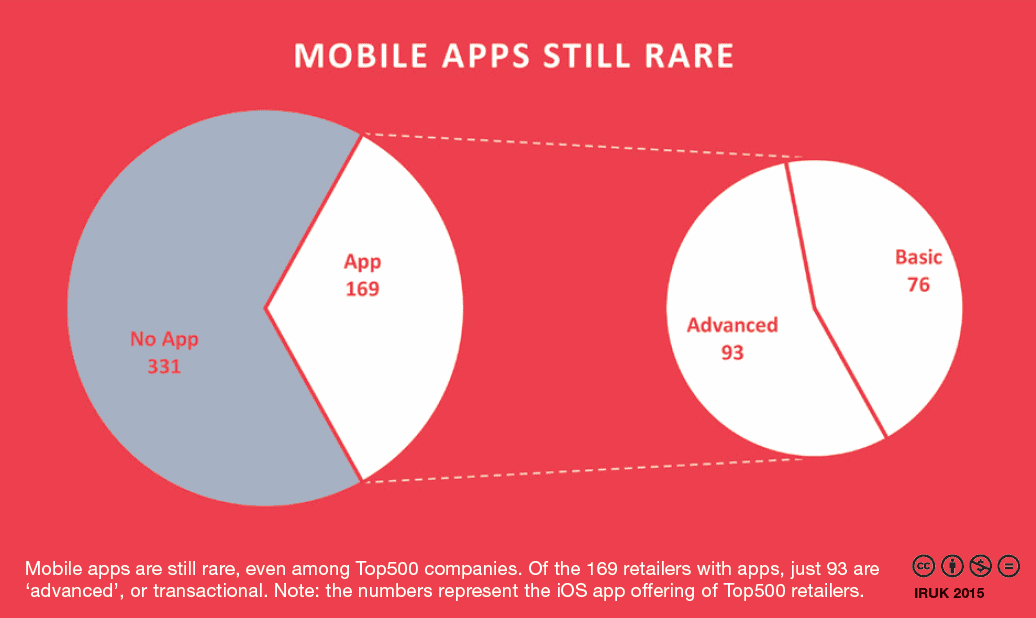

One of the most striking statistics here is that of the Top500, 349 retailers, more than two-thirds, scored two points or less in the Mobile and Cross-channel Dimension. In addition, 331 companies have no mobile offering. Frankly, these are figures that surprised us, perhaps because we so often report on companies that have been steadily working on mobile strategies for many years. Look too closely at the leading 30 retailers and it’s all too easy to believe that British retail is indeed leading the way in mobile.

“This is why this kind of quantitative research is so valuable,” says Martin Shaw. “The best retailers are good at marketing and selling themselves, it’s built into the company DNA. That means those making big strides promote what they’re doing. Conversely, those that are lagging in mobile make a noise and fuss about those facets of the business where they’re stronger.” That’s not to say British retailers aren’t doing well in mobile when compared to retailers in other territories, it’s more that we need to be realistic about the gap between best-in-breed companies and the rest.

So what is it that sets these best-in-breed companies apart? The 30 leading companies in this Dimension all achieve an index value of at least 8.5 out of a possible 12.5. While individual retailers may rank poorly in certain categories, these are companies that have grasped that a mobile offering, made as part of a wider cross-channel strategy, needs to be comprehensive. Why bother to roll out in-app purchases, for instance, if a customer who’s out and about in town can’t then go and pick up the item they’ve just bought?

The wider point is that as soon as retailers start to think about mobile, this has to be at a strategic level. The alternative is the kind of meeting where someone in senior management, perhaps because they’ve been given an iPhone for Christmas, suddenly decides the company needs an app. An app is then commissioned, but nobody is entirely certain what it’s for, which means in turn that nobody uses it.

Many companies don’t seem to see the point in offering scanning functionality. Even within the Elite, Leading and Model categories, only 18 companies of 30 offer this

A quick glance at industry statistics offers ample evidence of why this isn’t good enough. In 2013, according to IMRG figures, UK shoppers spent £91 billion, an increase of 16 per cent over the previous year. This increase was driven by mobile. The number of sales via smartphones and tablets grew by 138 per cent compared to 2012.

We expect 2014 and 2015 statistics to reflect the same trends. Those retailers that don’t implement retail strategies won’t just miss out on sales via the mobile channel, but will find that even loyal customers drift away to competitors, perhaps never to return.

How Argos has led the way in Mobile and Cross-channel

Tracing the Argos story over recent years, it’s immediately tempting to ask how big a part its company history played into its mobile and cross-channel strategy. As a catalogue retailer with high street premises, it’s always put the emphasis on range and stock availability rather than conventional merchandising. It’s perhaps telling that its check-and-reserve model pre-empted other retailers’ click and collect models.

Here, its high street presence is a real advantage. Whatever channel customers use, and Argos has said that around 50 per cent of sales now begin online, they can check item availability before they head for a store rather than waste a journey. Increasingly, customers are doing this using mobile devices. In 2012, reflecting this, Argos launched its iPad, iPhone and Android apps and a mobile-optimised site.

When Emma Robertson, managing director of digital and strategic agency Transform reviewed the iPad app for InternetRetailing, she approvingly noted that it “pushes the boundaries of mobile retail”. She added “[The app] addresses the evolution of the printed catalogue, building on [the company’s] heritage whilst using the opportunities provided by new technologies to update and evolve it for digitally enabled customers. Where the app really innovates is in supporting the two key customer missions of browse and buy – achieving this through a single journey, with a single trolley. Interactive content hotspots provide the link, pulling in live pricing, shortlist, full details and add-to-trolley functionality. This combination of journeys mean the customer can uniquely explore without having to flick between apps or visit the website.”

Mobile apps are still rare, even among Top500 companies. Of the 169 retailers with apps, just 93 are ‘advanced’, or transactional. Note: the numbers represent the iOS app offering of Top500 retailers.

WHERE NEXT?

New devices are rapidly changing retail. More web browsing now occurs on mobile than desktop. At some point in the very near future, as consumers get increasingly familiar with the idea of shopping with whatever device comes to hand, it probably won’t make sense to think of mobile as a standalone sales channel. However, our research serves as a sharp reminder that this day, when the much-promised era of omnichannel retail arrives in earnest, isn’t here yet.

Against this backdrop, one blunt answer to the question ‘where next?’ is back to the drawing board, back to doing the strategic work necessary to prepare for a world where more and more customers will expect seamless mobile experiences.

Our research suggests plenty of retailers urgently need to address these basic questions. Against this, it may be that a year hence we will find far more retailers with sophisticated mobile offerings. That’s because the all-or-nothing nature of mobile implementation – if retailers are going to invest in mobile, the retailer has to commit in earnest – may make this a volatile Dimension to chart in the years ahead. While we’re wary of making predictions, it may be that we’ll see a rush of retailers investing in mobile in the next year or two as companies see mobile is essential to a cross-channel strategy.

Especially for those that already have a sophisticated mobile presence, it will also be intriguing to see how the use of digital technologies within the store affects the industry here. The use of in-store beacons, for example, is growing. Further down the line, researchers are conducting trials on technologies that monitor people’s facial expressions to see if they’re reacting positively or negatively to store displays.

At the cutting edge, retailers are already trialling new ways of doing business that build on changing patterns of customer behaviour. Recently, for example, House of Fraser, in the Leading group in the Mobile and Cross-channel Dimension, announced it was teaming up with Caffè Nero to launch a concept shop in Cambridge where customers will, on the ground floor, be able to browse on House of Fraser tablets while they sup coffee. Up on the first floor, customers will be able to view products, try on items and collect online orders.

The Methodology

We worked with mobile commerce specialists Poq Studio in analysing retailers’ use of mobile and adoption of cross-channel retail. Of the retailers listed in the InternetRetailing Top500, 208 companies had an index value of zero points. In addition, only 169 of the companies have a mobile app.

We assessed retailers based on the following mobile criteria: whether a retailer has iPhone and iPad apps; whether the app uses push-messaging; a rating for any app; whether it’s possible to scan products in the app; social-sharing capability; a higher index value was accorded to those retailers.

For the cross-channel element here, a higher index value was accorded to those retailers that have collection points in stores, weighted according to how many stores have these, and store-finder functionality.

Not all categories were ranked equally. App user reviews contribute an index value of up to 2.5 out of a possible total of 12.5, while cross-channel collection capability has an index value of between zero and two. The 169 retailers that have apps and those with a clicks-and-mortar presence thus have a built-in advantage. The maximum index value was 12.5. The highest index value achieved was 12 (96 per cent) by Argos.