How does actively selling in Europe affect different approaches to deliveries and returns? Martin Shaw highlights the surprising results revealed by our research

More obviously than with other areas of retail craft, logistics is a problem-solving exercise. When a customer orders a shirt or dress via the website, or indeed any channel other than buying in-store and walking out with the goods, a process begins. Where does the customer want the item delivered? If to home, where does the customer live? Does the customer want the item by 10am tomorrow or is within the week acceptable? From the retailer’s perspective, is it more efficient to use Royal Mail or another delivery company? Is it better to send an item direct from the store or via a fulfilment centre?

Repetition – successfully answering these questions again and again – is key to building logistics expertise but this rather mechanical view of deliveries obscures some subtleties in the process. A British retailer that routinely sells into a European Union neighbour, for instance, has a different set of problems to deal with than one targeting only the British market. While, at least pre-Brexit, there are no issues around customs to deal with, there are potential complexities here around negotiating with foreign couriers and distribution centres.

Thinking about this led us in turn to think about how offering international delivery might change retailers’ approaches to logistics. Intuitively, we suspected that retailers with international expertise might also be more efficient in their home markets and that retailers would routinely apply the lessons from expanding abroad to their UK operations.

Home gains

The results therefore surprised us as there’s no simple or direct correlation here. Rather, a more nuanced picture emerges, suggesting that retailers that don’t offer international delivery operate in subtly different ways to their Europe-targeting counterparts.

To drill down into the figures, 60% of IRUK Top500 retailers deliver in the UK and elsewhere. Of the 40% that trade only in the UK, these retailers offer an average of 2.5 delivery options. The standard delivery time for these retailers is four days and the average cost for standard delivery is €6.50.

In contrast, IRUK retailers that operate in various EEA countries offer on average 1.4 currencies and 2.2 unique languages for their customers. They also offer cheaper standard deliveries to their customers across Europe – €5.54. However, these retailers only offer, on average, two delivery options, while the average standard delivery timeframe is over five days.

In short, the figures suggest that retailers that focus on the UK market are able to be quicker and offer more choice in delivery options. However, they’re also slightly more expensive than competitors that also trade in Europe.

Returns

When it comes to returns, IRUK Top500 retailers that deliver only in the UK offer a 30-day returns policy and typically process refunds in eight days. The return fee is, on average, €0.60.

In contrast, IRUK retailers that deliver internationally, while offering a 30-day returns policy, take around 10 days to process the refund. The average return fee is €2.00, a considerable difference that can probably be explained by needing to process international returns.

What the findings reveal

In great part, we suspect the differences in costs for deliveries here are down to economies of scale. Larger retailers, after all, are far more likely to sell abroad than their smaller competitors. These are companies that are operating at scale, so can therefore pass on savings associated with this to their customers.

Against this, it seems that focusing on the domestic market enables companies to handle deliveries more efficiently in some respects. While retailers that focus on the UK charge more, they’re able to compete on the number of delivery options and by being just a little quicker than their competitors. In contrast, when UK retailers move abroad, we suspect they may adopt standard practices for those regions.

As to how important all this is when it comes to looking at the overall UK market, that’s more difficult to tell and this is an area where we need to do more research. It will also be interesting to see how the growing popularity of Amazon Prime affects the market here. It may be that, whether they operate at home or abroad, retailers have to look anew at deliveries and returns to compete with the multinational behemoth.

As Sean Fleming points out in our strategic overview, offering free delivery is subject to diminishing returns from the perspective of retailers because customers become rather blasé about ordering items – ironically, free delivery has no value to customers. In contrast, Prime offers free delivery-plus in that it lets you binge-watch Bosch, The Man In The High Castle, and Jeremy Clarkson and co mucking around with cars in The Grand Tour too.

Might offering specialist delivery services, such as same-day delivery within urban areas, be a better way for retailers to differentiate themselves? Or might this all be a distraction for many retailers, which would be better advised to compete by, for example, offering expert support to customers?

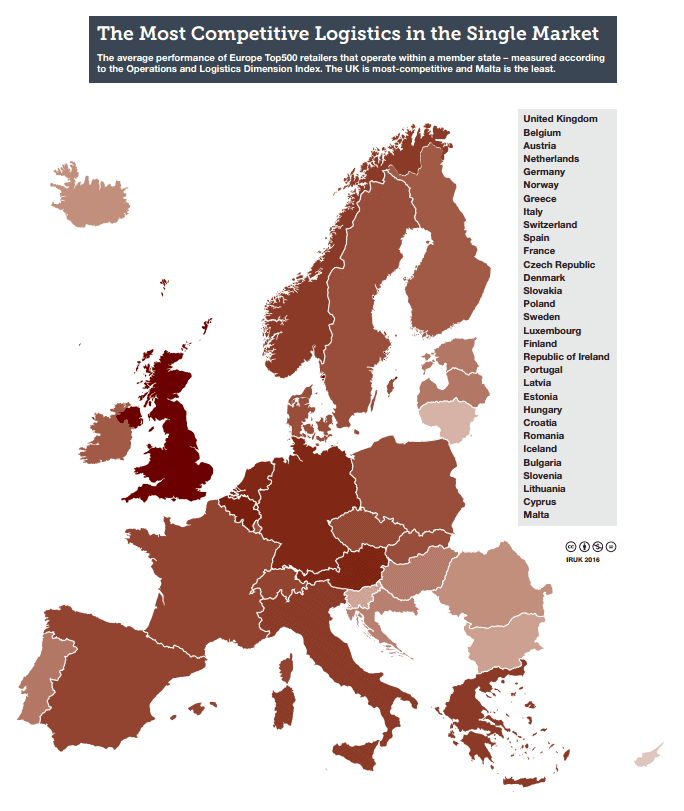

Finally, as a way to add context, it’s worth noting that the UK is the most competitive market within the Operations & Logistics Dimension. This may give UK retailers an in-built advantage when it comes to expanding abroad. Austria, the Netherlands and Germany are the next highest-performing countries. It’s worth at least considering the idea that Brexit may erode that advantage, if it makes it more difficult for UK retailers to sell abroad. The heatmap below shows which markets are currently most competitive. Our ongoing research will reveal any new patterns here.