Chloe Rigby considers how European retailers are using merchandising to help visitors navigate their ranges

MERCHANDISING CAN MAKE all the difference for retailers competing to ensure that their websites stand out in the European Economic Area market (plus Switzerland). This geographic area is one of enormous potential, spanning 32 countries that are home to almost half a billion consumers. At the same time, it’s a complicated market to target. The residents of those 32 countries speak 26 different official languages and, as InternetRetailing research shows, approaches to merchandising vary across different markets and regions. That’s likely to mean that consumer expectations of websites and how they sell will vary as well. That’s a challenge for online traders that are looking to sell widely across the continent.

Those retailers that InternetRetailing research judges to have performed strongly in this Dimension are those that use key merchandising approaches to enable shoppers to find the products that are most relevant to them. That’s important in a retail environment where ranges often stretch to tens of thousands of items – and occasionally to millions. Visitors need help if they are to find the goods they want to buy, and that’s even more important from a website that they aren’t used to using. This means enabling potential customers to search for the products they want to buy. Effective search tools are important for those that know what they’re looking for. Those users who don’t have a specific goal in mind can instead browse for inspiration using effective and often highly comprehensive navigation.

In-depth product information, alongside high-quality, zoomable images that can inform as well as inspire, help shoppers to be sure that the item they’ve found will meet their needs. That’s important since if shoppers don’t trust what they see, they will click away to a rival site. InternetRetailing research shows that European retailers are adopting technologies that make it easier for shoppers to see and understand products. It found that most (95%) IREU Top500 retailers offered at least one navigational filter – most popularly filtering by product (69%) – while 75% offered dropdown search suggestions.

Raising the game

Leading European retailers are not only meeting the measures put to the test in InternetRetailing research, but are improving on them as well. They do this by developing new strategies that work for the devices that customers use to shop. Some retailers, for example, are bringing ‘gamification’ into merchandising as they look to make it easier for customers using smartphones to find products, often from a vast range of items.

By doing so they find new ways to engage on-the-go shoppers as these customers explore increasingly wide online ranges, despite the restrictions of a small screen.

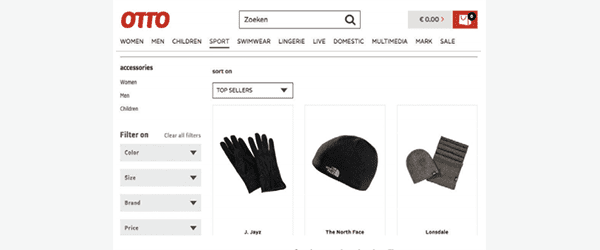

German general retailer Otto, for example, has introduced a Swipe Advisor that lets shoppers leaf through different living room looks. Shoppers swipe right when they see a look they like, and left to discard an idea. The technology learns from the individual’s choices to provide a list of furniture and accessories that match their tastes and preferences.

“Our goal,” says Francesco Ferreri, senior project leader in the Otto ecommerce competence centre, “is to make it easier and more fun for mobile shoppers to discover and explore interesting items on the go.” He says the result is a “more engaging” mobile experience.

The technology comes from SmartAssistant, which says it has learned from trends in consumer behaviour, in order to develop decision-making solutions.

A similar effect is found at UK-based fast fashion retailer Missguided. The company’s iOS app enables users to favour or discard fashions by swiping left or right, Tinder-style, on images of clothing. Speaking on a recent InternetRetailing webinar, Michael Langguth, co-founder of app developer Poq, said: “Missguided has used this ‘Tinder for fashion’ to create a very exciting experience for consumers. From the retailer’s point of view it is a very good tool to learn about your customer. Missguided has seen customer swiping hundreds of products, telling them which ones they love and which they hate.” That means, says Langguth, that the retailer can see very early on which products will be most popular, while machine learning can make the experience more personal to the individual user.

He adds: “Generally an app should be incredibly convenient and highly engaging. Those are the two things to think about when you decide to make an app for your business: is this making the experience of the customer more convenient, and does it make it more engaging? Do they get something fun or interesting from downloading this app that they wouldn’t get from the website?” That’s also something to remember when it comes to developing merchandising that stands out from the crowd.

Socially speaking

Many European retailers recognise the important role that other people’s opinions inevitably play when shoppers make buying decisions. They’re enabling visitors to read reviews and see how previous buyers rated the products under consideration. By offering social media sharing, they’re enabling shoppers to endorse their products via the channels on which customers speak to their family and friends.

But InternetRetailing research found the use of these tools varied by country and by region within Europe. Product reviews were more popular in the UK, where they were used by 53% of traders that sold in the market. Social media sharing was more popular among retailers trading in Ireland (67%) and, in southern European countries such as Italy (60%) and Spain (57%).

Sally Express, for example, a leading retailer in this Dimension, displays product reviews and ratings clearly from its product listings. But while it enables shoppers to follow the brand via social media, it does not have social sharing from individual product details.

Meanwhile, American Golf, which sells in Ireland as well as the UK, enables shoppers to share products through Facebook, Google+ and Twitter. It also enables speedy one-click checkout through a Facebook sign-in.

Checking out

Helping shoppers to buy quickly is an important part of merchandising. Speedy checkouts make it more likely that shoppers who have found the products they want to buy will go on to complete their purchases.

When UK fashion retailer New Look, for example, focused on improving its mobile checkout some time back, it removed any factors that might slow up the final payment – from data capture through to enabling a single checkout to work across desktop and mobile. Its conversion rate improved across both devices as a result.

Missguided has also cut down on its checkout in its iOS mobile app, reducing the payment process to a three-second, one-click checkout that uses fingerprint identification to confirm the transaction. “It’s incredibly convenient,” says Poq’s Michael Langguth. “It makes people want to come back to that app and makes people want to buy more.” In the first four months of having the app, Missguided saw revenue through that specific channel reach £30m.

Looking to the future

While, as we’ve already noted, leading retailers are moving beyond the performance tested by InternetRetailing research metrics, there’s room for improvement amongst the IREU Top500 as a group. Most retailers, as we’ve already seen, offer at least one navigational filter (95%) and dropdown search suggestions (75%).

Nonetheless, almost one third still (31%) don’t enable shoppers to search by type of product. While some leading retailers offer one-click checkout, the average checkout takes almost four (3.67) pages. And while 51% offer social sharing, 49% still don’t. Just as speedy checkout increased conversion for New Look, so these are all features that could make incremental improvements both to sales and at the bottom line.

In the future, merchandising is likely to get ever more personal, as retailers look for new ways to show the right product to the right person at just the right time. At the cutting edge of the industry, merchandisers are constantly improving their understanding of customers and the factors that influence consumers as they move through shopping journeys. Machine learning, as deployed by Poq for Missguided, and artificial intelligence are among the weapons now being brought to bear in the battle for the consumer’s attention and buying power. These are approaches that analyse data at scale to draw important and actionable conclusions about consumer behaviour and aspirations. The aim is to use these insights to show shoppers the most relevant items at the point when they are most likely to buy.

As leading retailers raise the expectations of their customers, it’s likely that those customers will then demand similar service from the other traders with which they shop. Indeed, that effect is also likely to be seen as successful traders take their services further afield across the EEA (plus Switzerland).

As a result, we’d expect to see improvements in the way that traders merchandise their websites across the region. That will come as more retailers develop websites in order to ensure that shoppers can search effectively for the items that they are looking for, and that shoppers can browse with the aid of high-quality images and product information.

Ultimately, what’s expected is a virtuous cycle of continuous improvement that raises standards across the board and delivers on heightening customer expectations.