Is the idea of customer-focused retail actually just a buzz concept? Martin Shaw finds evidence in the numbers to suggest it’s not.

The idea of building offerings around the individual customer is now central to retail. Yet there’s a risk this can be a platitude, a great idea much talked about rather than a day-to-day reality. In truth, building services and offerings around the customer shouldn’t be a matter of grand statements, but of day-by-day work based on a clear strategy to improve shoppers’ experiences.

To achieve this in one country is tough. Factor in the complications of working across multiple territories and this becomes even more difficult. Nevertheless, as InternetRetailing research clearly shows, leading retailers are already facing the challenges and setting industry benchmarks.

In addition to website speed, we set out to assess retailers on the basis of the customer service levels they provided across different territories. We looked in detail at such areas as localisation via language and currency, the terms on which retailers offer refunds, search relevance and the effectiveness of communications.

While retailers have subtly different approaches in this area of retailcraft, the research was all designed to discover which retailers genuinely help customers to buy in ways that suit them as consumers, rather

than the retailer.

What leading retailers do

It perhaps shouldn’t be too surprising that Interflora is one of the strongest-performing European retailers in The Customer Dimension. This is a business where things simply can’t be allowed to go wrong because flowers must be delivered on the big day rather than the day after that birthday or landmark anniversary.

In particular, the retailer stands out for the integration of product reviews, for the number of channels it supports and for its promptness in dealing with refunds.

Another retailer that did well in our research was The Body Shop . The beauty products retailer doesn’t trade on being timely, but it’s a business where a reputation for ethical standards is crucial to the offering. It needs not just to be open to interrogation, to customers asking questions about whether it hits these standards but to be seen to be open. The Body Shop also scores highly on offering consumers the chance to leave product reviews and for the number of customer service channels it supports, as well as for having a site that’s easy to navigate.

The strengths these companies share are revealing in that, within many metrics in The Customer Dimension, leading retailers outperform competitors by a wide margin. Admittedly, that’s partly because some metrics are binary – retailers either enable customers to leave product reviews or don’t – which suggests a more absolute distinction than is the reality, with different levels of product information and consumer feedback supported by most retailers.

Nevertheless, many retailers that perform well in these metrics also perform well when it comes to processing refunds promptly or communicating across different channels. This might suggest that retailers that have

got website performance and the cross-channel basics right are then able to move

on to add extra functionality, further increasing performance.

What different sectors do

Looking at performance that beats the market from a different angle, we also considered how different sectors performed against the market as a whole. One of our ideas here was that retailers operating in a particular sector may have to work up to the level of the best in order to compete. Would we be able to discern patterns in areas of best performance that support this idea?

While the correlation is not exact – and some pieces of research used subtly different classifications of retailers from other pieces – there’s enough crossover to suggest that, to compete in certain sectors, retailers need to be more sophisticated than in others. Take apparel and fashion. Powered by a combination of, among other factors, new online merchandising techniques making it easier for customers to visualise clothes and retailers making it easy to return clothes, this is a sector where there’s enormous competition within multichannel retail.

This is reflected when you look across the metrics. Retailers in the apparel sector communicate effectively via more channels than the average IREU 500 retailer and provide more effective service through these channels than the average IREU 500 retailer (subtly different metrics). Their sites are not only fast, they’re also simple to navigate, which helps with retailers’ merchandising efforts. Overall, retailers in this sector outperform the IREU Top500, with companies in different sub-sectors and geographies performing strongly, including French mass market retailer La Redoute , Spanish fast fashion retailer Zara and the British high-end brand Burberry .

“Returns can’t ever become an irritation or point of friction”

In contrast, the grocery sector, while performing well in other Dimensions, isn’t so strong here. Seen against this backdrop, we will be interested to see over the coming years whether Amazon’s entry to this sector, which seems to be gathering pace with its purchase of Whole Foods , improves overall performance as existing players look for a point of difference in overall customer service levels. Alternatively, it may be that grocery shopping will always be a functional exercise, with improvements coming instead within Operations & Logistics.

Return to sender

Returns might, at first glance, seem to be the province of logistics experts, but we also looked at them within the context of The Customer because how companies deal with returns says much about the levels of service they provide. In an era when customers routinely buy more goods than they need and return items they don’t want, returns can’t ever become an irritation or point of friction.

In part, retailers can guard against this with clear product descriptions on the website. If people understand, for instance, sizing, they are less likely to buy two items on the grounds that one of them will fit. Nevertheless, there will come times when items will be returned.

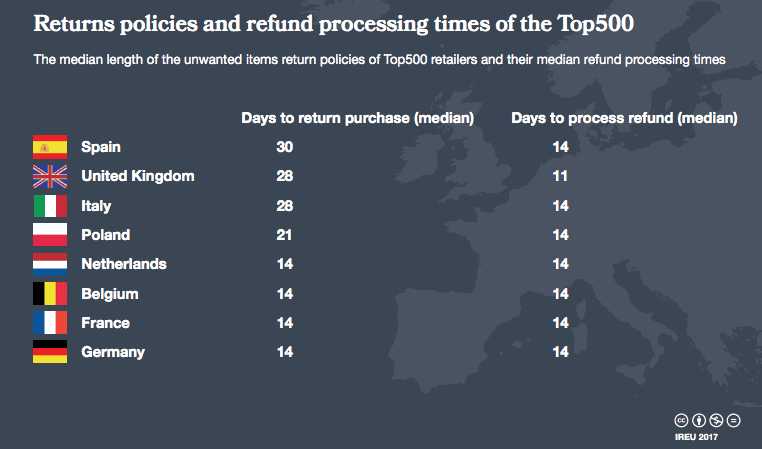

Here, the performance of retailers across Europe proves to be very different. As detailed in our graphic, Spanish retailers typically allow customers up to 30 days to return items. In the UK, the equivalent figure is 28 days. In Germany, despite it being one of the most sophisticated multichannel retail markets in Europe, the figure is just 14 days.

How to explain this? One reason may lie in Germany’s retail culture, where goods are often ordered on approval and customers only pay once they are sure they want to keep items. From a retailer’s perspective, there are enough inherent difficulties within such a system (non-payment, logging items back in, etc) without final payment taking more than a month to be resolved.

As to the time it takes to process a refund, this is remarkably consistent across different European territories, at 14 days. The UK is the outlier here, with retailers typically processing refunds within 11 days. Again, this may be partly attributable to retail culture. In contrast to careful German shoppers paying by bank transfer once they’re satisfied with the goods, British shoppers use credit cards. This makes processing returns relatively easy and means shoppers expect refunds to be made promptly.

Finally, it’s worth noting that we expect to be looking carefully at our metrics within The Customer Dimension over the coming years. The idea of building offerings around the customer is only going to become more deeply embedded within retail with, for example, new kinds of subscription-based services emerging. Our metrics will evolve to reflect these new trends.