Simple changes to the way retailers use networks can help companies make more of social media, says Martin Shaw

HOW DO LEADING retailers use social media? In conjunction with Knowledge Partner Brandwatch , we set out to look at what sets apart retailers that performed strongly in the Brand and Engagement Dimension. We did this by monitoring the Twitter and Facebook accounts run by 29 Elite and Leading UK retailers – the Elite and Leading clusters of the overall IRUK 500 and the Brand and Engagement Dimension – for two weeks over Christmas 2014.

In doing so, we unearthed new insights into the way retailers and customers use social media. Exclusive API access, filtered for UK-based web users, showed us, for the first time, Facebook statistics that are usually unavailable to third parties. Posts, likes, re-posts, comments and replies, complete with time stamps, were gathered to form a valuable dataset.

OUR FINDINGS

Facebook: merchants included in the survey, says Phillip Agnew , community manager at Brandwatch, manage “remarkably well-run accounts which catalyse a host of conversation and engagement on Facebook”. He adds, “In one week alone, these 29 accounts generated 227,076 new content likes, and 50,651 comments in seven days and from just 420 posts.” Nine of the ten best-performing posts came from the major supermarket brands, Asda , Tesco , M&S and Waitrose . Of those ten posts, nine contained an image. The best-performing post, with almost 10,000 likes and more than 5,000 comments, was one that featured a competition.

Twitter: the Twitter accounts operated by the 29 retailers we studied created a wealth of conversation and engagement. In just a week, they generated 45,947 retweets and 30,236 replies from 13,233 posts. “On average,” says Agnew, “these retailers publish 65 new tweets per day of which 57 are replies meaning that brands typically post eight timeline tweets per day. These posts are retweeted, on average, 226 times a day.” In contrast to Facebook, seven of the best performing posts came from clothing retailers, including New Look and Urban Outfitters , suggesting the apparel sector stands to gain more from Twitter than others.

ROOM FOR IMPROVEMENT

The companies whose Facebook and Twitter feeds we analysed lead their peers in the IRUK 500 Index. But our findings show that even these Elite and Leading retailers could improve performance through a few easy changes.

Scheduled posts: it stands to reason that consumers mostly browse their social feeds outside office hours, when many marketing teams are off duty. Our research identified the days and the times that retailers should consider posting in order to gain most views and retweets. It pays to schedule Twitter posts for early in the morning – whenever users check their feeds, they will see posts in chronological order.

Posts made at 8am are 800% more likely to be retweeted than those made between 10am and midday. Facebook, on the other hand, uses algorithms to filter what users see in their feed, favouring new content, so it pays to post when the audience is most active. Retailers should schedule Facebook posts for 9pm, when likes per post are 320% higher than 10am, the time slot at which retailers most often post. Saturday is the best day for retweets, though retailers post the fewest tweets on that day.

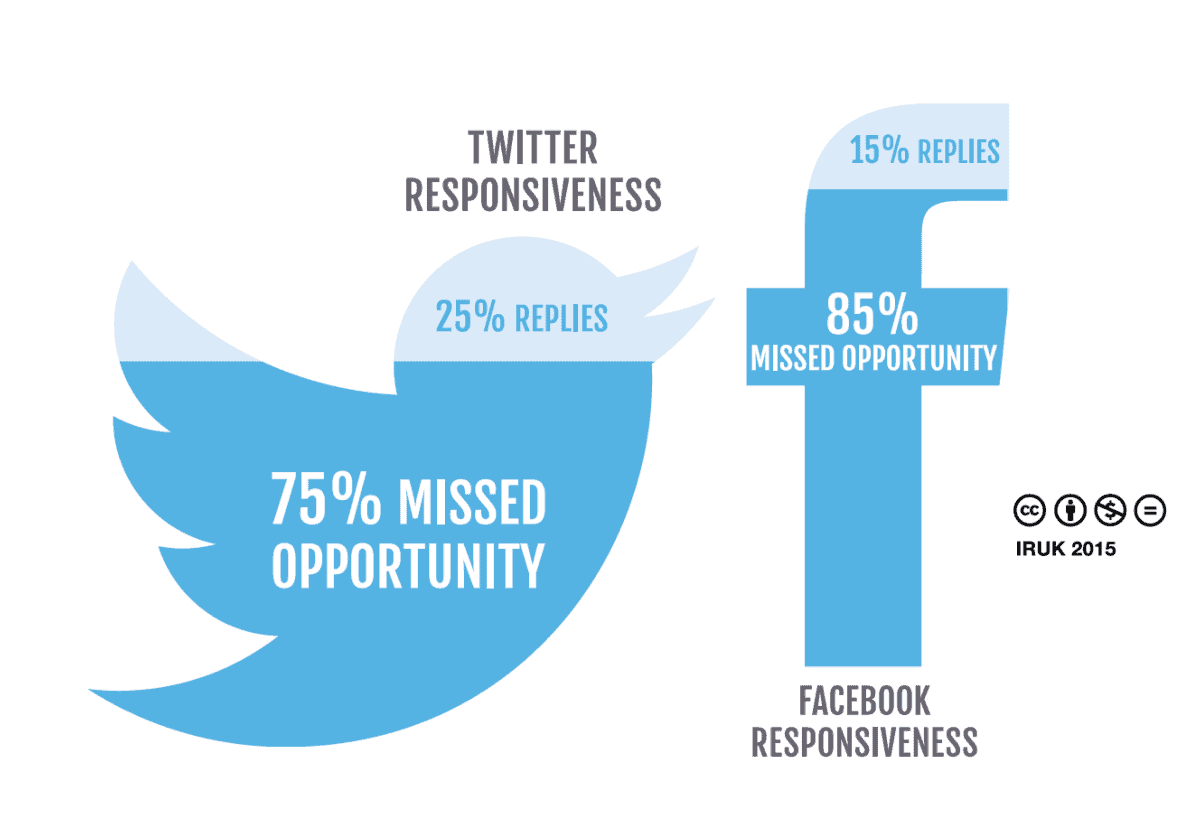

One-way conversation: during the course of our research we found that audiences tweeted about the 29 brands’ posts an average of 226 times a day. They responded to consumers’ comments only 57 times a day, on average, meaning that almost 75% fell on deaf ears. On Facebook, more than 85% of 249 comments a day went unanswered. It’s difficult to quantify the value to a retailer but it’s easy to imagine that answering queries or comments with a referral to a product might well boost sales.

One-way conversation: retailers in our study failed to respond to 75% of Twitter mentions and 85% of Facebook comments – a missed opportunity to engage with potential customers. Data researched in partnership with BrandwatchThe practical business advice here is straightforward. Firstly, retailers need to time social communications for times when they will be most effective. Just as importantly, retailers need to monitor social activity and respond where appropriate, especially over key selling periods such as the run-up to Christmas. We suspect there are plenty of nuances here that will become clearer in the years ahead and we’ll keep monitoring what retailers do, with a view to seeing which social strategies increase retailers’ reach, growth and effectiveness.