Websites, apps and cross-channel services that meet the demands of smartphonewielding customers offer a more joined-up shopping experience

FORWARD-THINKING RETAIL BOARDS are recognising the popularity of the smartphone among customers, not only as a buying and browsing device but also as a way to bridge the gap between online and offline. Well-specified mobile apps, fast-loading mobile websites and slick multichannel services characterise the retailers that stand out in this Mobile & Cross-channel Performance Dimension.

What the Top500 do

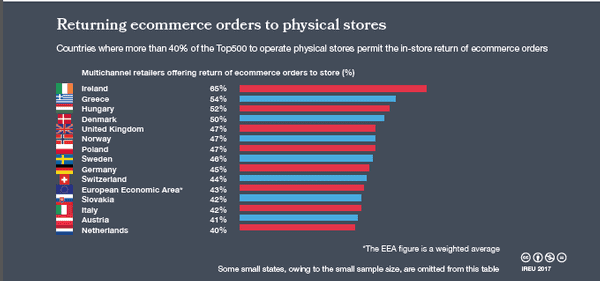

Leading European retailers are developing cross-channel services that satisfy customer demands for convenient shopping. A majority of the IREU Top500 (64%) now enable online shoppers to pick up their online orders in store. But less than half (43%) allow shoppers to return items ordered online to the store. Mobile websites download at an average 8.6 seconds, becoming visually complete in 7.1 seconds. Mobile apps are relatively commonplace, with 369 of the Top500 retailers having a mobile app, of which 63% are Android and 66% iOS. Researchers looked in detail at features available on the 324 iOS apps and found that making the sale was a priority, with 67% now transactional. A third (34%) enable the transaction to take place within the app, through a native shopping environment. Almost two-thirds (60%) support push notifications, while 28% offer daily deals. Showing products off to good effect is a priority for the 44% that have a choice of images and the 43% that enable zoom.

Almost half (49%) enable mobile users to find their nearest store from the app, while 21% enable them to check if an item is in stock at that store. A minority of retailers (6%) offer additional stock checker features.

Sharing on social is a relatively popular feature, with 40% enabling this. Although only 13% of mobile apps show social media Likes, 44% of apps feature wishlist functionality, 27% feature product star ratings and 25% written product reviews. More than three-quarters of apps (76%) were bug-free at the time of testing.

What the leaders do

UK toy retailer Smyths uses its app to share useful product information, from social media Likes to store stock checker, star ratings and reviews. UK prep fashion retailer Jack Wills’ mobile app stands out for some relatively uncommon features, including a barcode scanner, the ability to share an item on social media, product image zoom and being able to shop within the app, using native shopping.

Online UK grocer Ocado illustrates products in its app using written reviews and star ratings. It offers a daily deal and enables shoppers to scan items via a barcode scanner.

Shoppers can zoom in on images from the product page on UK fashion retailer Very’s mobile app, while those items are promoted through reviews, ratings and daily deals.

No frills Polish supermarket Biedronka stands out, enabling native shopping and the ability to share an item on social media, to zoom in on images and to find stores. Albert Heijn has a barcode scanner and scores well on personalisation as well as offering a choice of product images and a wishlist.

How markets vary

Click and collect is found most widely in the UK, where 67% of Top500 retailers offer the service. That’s followed by Belgium (62%) and The Netherlands and Norway (60%). Retailers in Portugal (28%), Hungary (24%) and Bulgaria (12%) are least likely to offer the service.

Returning an item ordered online to a store seems easiest in Ireland, where 65% of Top500 retailers are set up to deal with this. Close behind are Bulgarian (58%) and Greek (54%) traders. Lagging behind are retailers in Czech Republic and Belgium (both 36%).

Irish and Polish retailers are among the most likely to have an Android app, at 93% of Top500 retailers in these markets. Practically all Italian (99%), French, Portuguese and Polish (98%) retailers listed had an iOS app, as did, at the bottom end, 58% of the 240 UK retailers listed.

Some 72% of Swiss retailers had transactional apps, while a native shopping approach was most common in Portugal (45%). Swedish retailers were most likely to offer a range of images and to enable shoppers to zoom in on them.