Leading retailers are responding to consumers’ interest in shopping across European borders, writes Chloe Rigby

The growing willingness of European consumers to shop across borders means that the most successful retailers in this IREU Brand Engagement Performance Dimension Rare finding new ways to communicate with expanding audiences.

Shoppers from across the European Economic Area (EEA), plus Switzerland, are buying from retailers from Ikea to H&M, and from Tesco to Zara , as these companies trade from fast-growing networks of local stores and websites.

Consumers are choosing from a pan-European range of goods that are now more easily available to access, thanks in part to improved delivery options. It’s also key that leading retailers across Europe now present goods on websites that shoppers from across the EEA can engage with. These are websites shoppers can more easily navigate thanks to the use of local languages, local currencies and familiar options.

There’s a real appetite for cross-border shopping from European consumers: Ecommerce Europe’s European Ecommerce 2017 report suggests that 33% of European online shoppers bought across borders in 2016, rising to more than 60% in some markets, including Luxembourg, Russia and Switzerland.

That comes within the context of a steadily growing online market: the report also found that European ecommerce turnover reached €530bn in 2016, up by 15% on the previous year, with 33% of those transactions taking place in the UK. It forecasts continuing growth to €602bn (+14%) in 2017. The fast growth in buying online seen in central and eastern European markets (Romania +38%, Slovakia and Estonia + 35%) seems set to continue.

Perhaps ironically, the vote for the UK to leave the EU so far appears to have increased the proportion of EEA shoppers visiting UK websites, since the most obvious effect of that decision has been the weakening pound making goods, in the short term at least, more attractive to euro-spending shoppers. The IMRG MetaPack UK Delivery Index found 29.6% of all ecommerce orders shipped from the UK were heading abroad in July 2017 – up from 24.4% in July 2015, and 26.6% in July 2016, shortly after the Brexit vote. Of parcels bound for an overseas address, the proportion going to EU destinations hit 62.7% – up from 55.3% in July 2016.

At the time, Chris Hoskin, head of marketing at MetaPack , pointed to a consistent rise in cross-border orders. “Whilst we could assume this is to do with sterling and the beneficial prices that overseas consumers are enjoying, we also believe it is part of a wider trend. As long as UK retailers can offer quality products with great delivery options at good prices, overseas customers are happy to make their purchases and we have every reason to believe this will continue even once the UK is out of the EU.”

Talking the same language

Retailers at the forefront of the Brand Engagement Dimension offer websites in a wide variety of languages. These include Netherlands-based homeware giant Ikea , founded in Denmark, and Swedish fashion retailer H&M , each communicating with customers across the continent in 30 languages or more. Exceptionally, Ikea’s websites not only reflect the main languages spoken in different countries, but also minority languages. In Spain, for example, the Ikea website is available in Catalan and Basque, as well as Spanish. Swedish fashion retailer H&M offers German, Italian and French to its Swiss customers, and Swedish and Suomi for those in Finland.

In catering for the full language needs of existing and potential customers, these retailers are performing well ahead of the average. On average, IREU Top500 retailers support an average of two or three languages, a reflection, perhaps, that they trade in two or three countries in the region.

One trend now visible is that retailers at the forefront of this Dimension are moving to engage with customers in new markets in the same way they have in their domestic markets. The Body Shop , for example, has improved the range of payment options it offers in smaller as well as larger European territories with the rollout of its mobile-first website, and it also tailors its content to individual markets.

Speaking to InternetRetailing for the recent IREU Top500 The Customer Performance Dimension Report, Harriet Williams, head of digital at the ethical beauty trader, said payments options, currencies, delivery options and languages were the main variables across its different markets. But, she said, another innovation in the Body Shop mobile-first website was also very relevant to brand engagement. “Local teams can tailor promotions and product merchandising to different events,” she said. “Mother’s Day is at different times across Europe, but this means we can promote Mother’s Day on the home page relevant to that event. Also, if certain products or flavours in a range perform really well in certain markets, we can promote those products so the merchandising is relevant to the local customer.”

French sporting goods retailer Decathlon has social media managers in markets well beyond France as it looks to communicate with new audiences in both the language and through the channels that work best for them. In its home market, for example, stores are a key channel for the retailer, but in the UK, where it has fewer outlets, social media channels such as Twitter are a priority.

On average, according to InternetRetailing research, IREU Top500 retailers offer a choice of seven different communication channels to their customers. For the majority, these include Facebook: 305 of the Top500 retailers are on the platform, and enjoy an average of 5.3m Likes, or a median of 291,585. These figures illustrate an important point. Leading retailers across Europe tend to skew the averages in InternetRetailing research. For while brands such as Nike have 29m followers on Facebook, at the time of writing, many have far fewer, leading to a median, or halfway, figure that’s well below the average.

Make it easy for shoppers to find – and find out

It’s important for retailers to be easily found through search. Research carried out by InternetRetailing Knowledge Partner Hitwise suggests that 20% of new visitors to IREU Top500 websites across the European Union find the site via search, rising to 79% in the UK and 67% in Belgium. That makes it important for retailers and brands to be present, and to raise brand awareness well beyond their websites. Sharing via social media is one way to do this as people spend more time on social media sites.

Figures from Statista suggest that, worldwide, people have steadily spent more time on social media as time has gone on, rising from 90 minutes a day in 2012 to 135 minutes in 2017. Retailers that enable their products to be shared on social media can potentially see them put in front of a highly receptive audience. Fashion brands in particular are sharing their products and their stories on sites such as Instagram. UK retailer TopShop has 9m followers for the stories that it shares from locations such as fashion shoots and backstage at its London Fashion Week event. It encourages shoppers to share their own stories via #TopshopStyle.

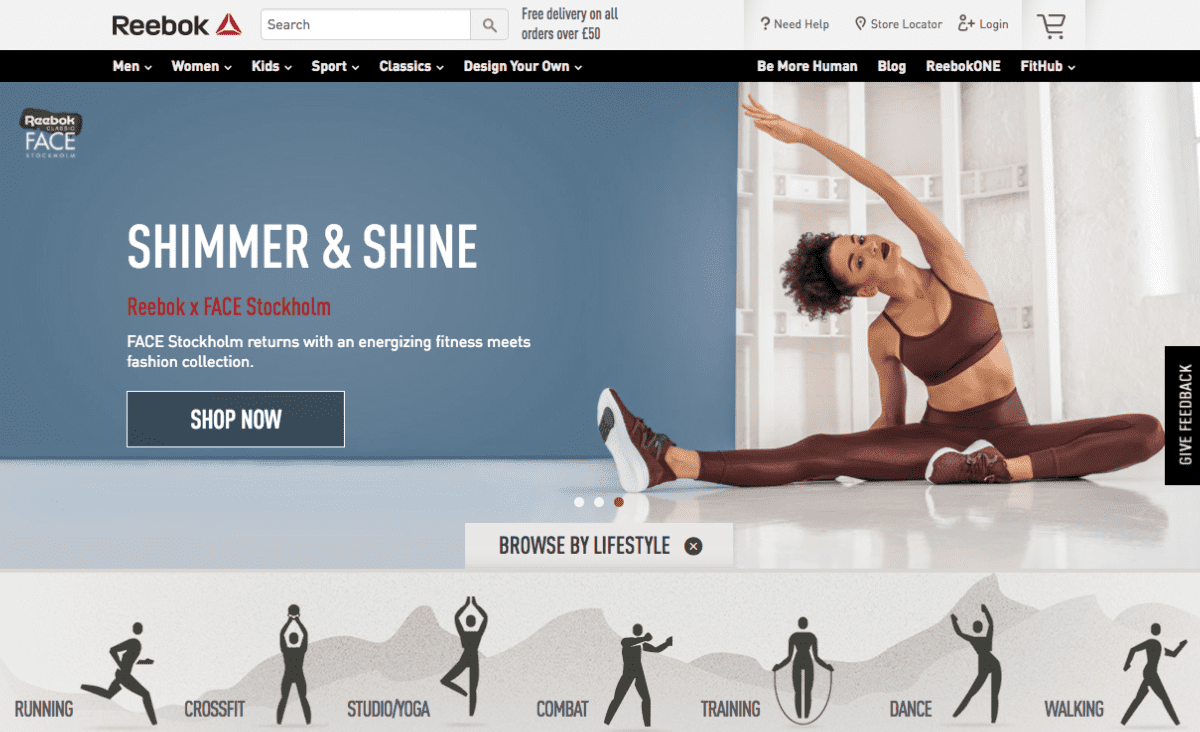

Some brands and retailers are now taking this further by making their Instagram and other social media images shoppable. Reebok , for example, has appointed marketing technology specialist Curalate to enable consumers to click to buy from its posts. Starting with Instagram, consumers who see images and videos that feature athletes using Reebok products on its social channels will be able to learn more about the item and to buy from the post.

“Our brand digital focus is to be relevant to existing and future customers, as a large part of our audience is active on social media,” Mark Allin, senior digital manager at Reebok, has noted. “Reebok’s online content celebrates fitness communities. We’ll feature our products in content captured during genuine workouts rather than simply product shots. This way people are clear as to what our position is in fitness and can then explore options to purchase. This approach provides a clearer and more consistent message to the user, one considered journey.” Analytics will then show how shoppers have responded to the social media feeds.

Reebok also plans to use events to engage with shoppers. It has partnered with Ragnar Relay, a 170-mile team relay race, and will promote footage of the team on its social channels in near-real time posts that will feature shoppable fitness kit and trainers.

Enabling shoppers to find out what other people thought of products through product reviews and ratings is something that around half of European retailers do. IREU Top500 research found that Polish, British and Hungarian retailers were among the most likely to give shoppers a say through written product reviews and star ratings on desktop websites, while those in Switzerland and Greece were among the least likely.

Even in these territories, this may change. The way Amazon shoppers can leave many and detailed reviews about their purchases via the platform has been a factor in its success. The Body Shop, MediaMarkt and Debenhams all stand out in InternetRetailing research for their use of both ratings and reviews on their mobile apps.

The personal touch

Ensuring that brand engagement stays relevant will be an important task in the future. A recent Reinventing Loyalty report from Adobe and Goldsmiths found that 50% of British consumers and 61% of European consumers are loyal to brands that tailor experiences to their needs and preferences. This figure needs to be seen in the context of a retail environment that many European shoppers see as marked by overwhelming choice (46%) and where there’s a growing demand for convenient shopping (59%). Some 62% of 5,000 consumers, surveyed across Europe, said they would return to shop with retailers that stayed consistent, while 53% said they like it when brands know their preferences and cater to them directly.

This underlines the need for personalisation and relevant shopping experiences, to which some retailers are now responding with the use of artificial intelligence. There’s more on artificial intelligence in the emerging practice feature in this Brand Engagement Dimension Report. In addition, we see leading retailers working to improve the relevance with which they engage with shoppers.

In its recent half-year results, to July 2017, UK fashion retailer Next said it had invested in its software with a view to targeting shoppers in a more individual way. As a result of introducing a personalised home page, it says, 40% of customers now saw home pages “tailored to their broad areas of interest”. The retailer added: “The results have been encouraging with those customers viewing personalised home pages increasing their sales by circa 1%.” Intelligent recommendations that flag up products they might find relevant, it said, had also been successful.

Such developments illustrate the way that leading retailers across Europe are working towards relevant brand engagement, making sure that they communicate with their customers in a way that makes sense – and that makes for good business.