We outline how we measured retail innovation and strategic planning, and place our findings in the context of other recent research

When InternetRetailing’s research team set about analysing our index of leading UK retailers, the IRUK Top500, through the prism of Strategy and Innovation, we wanted to know what approaches the most successful used in this area, and what other retailers could in turn learn. Our initial research aimed to find out how those traders were able to be ‘everywhere’ for the customer, and how they made different sales channels buyable.

We indexed performance in these areas through adoption of click-and-collect services, and through how well traders deployed payment technology across channels. In this follow-up study, we’ve revisited those findings and looked in more detail at how retailers approach payment, and click and collect. We’ve gone on to compare the growing sophistication of traders’ offers with how customers say they want to be served, as detailed in a number of third-party studies.

Click and Collect

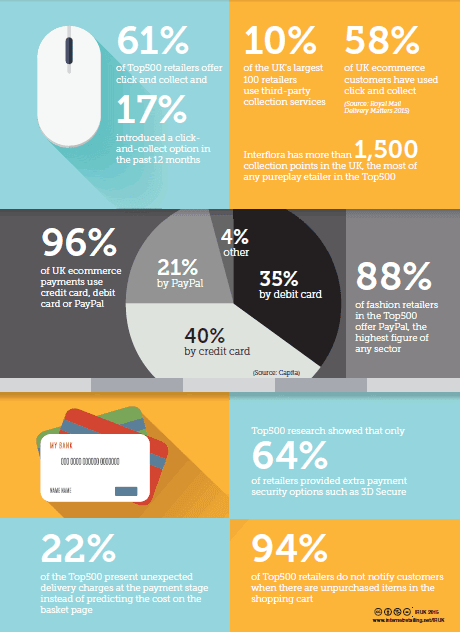

Click and collect has become popular with customers in a relatively short space of time. Shoppers now expect to be able to pick up their online purchases from the branches of most high street retail chains. Royal Mail’s 2015 Delivery Matters report estimates that 58% of UK customers use click and collect, most because it is free. The service, indeed, is on offer at a growing number of leading UK cross-channel and ecommerce retailers. The original IRUK Top500 research found that some 218 of the Top500 retailers offered click and collect, while 282 did not. Our latest findings show that 17.6% of the Top500 retailers have introduced click and collect this year. Now 61% offer the service.

There’s also a growing shopper appetite to pick up online purchases from a point that’s nearer to home or work, or more convenient to them, and the most innovative retailers are finding imaginative ways of satisfying that appetite.

When a shopper is out of the house, home delivery becomes less convenient, while employers have often discouraged delivery to work. Collection options then come into focus. When a shopper doesn’t live, work or pass by a retailer’s local branch – or, in the case of pureplays, where there are no branches – the possibility of collection at a third-party store or site becomes a more important factor when customers order online.

The Elite and Leading retailers in this category are those that successfully extend collection well beyond stores. Amazon UK, for example, has an Index Value of 100% in this dimension, a figure that recognises its wide-ranging use of third-party collection points, which include locker banks in locations from Birmingham Airport to supermarket branches, and newsagents and convenience stores, the latter using the Collect+ network.

Doing this is important or Amazon because studies repeatedly show that collection does matter. Shoppers simply want to collect their shopping from a point that is convenient to them.

The IMRG Collect+ Click & Collect Review of 2015 found that customers wanted to collect their online orders at the time and place that was most convenient for them. Meanwhile, a 2013 Econsultancy Multi

channel Review Survey found 50% of customers had abandoned an online purchase because the delivery options on offer were unsatisfactory.

The original IRUK Top500 research found that 9.78% of the Top500 retailers examined offered customers the option of picking up parcels at stores in the Collect+ network, which also includes petrol stations and shopping centres as well as corner shops.

“This figure,” says Polina Modenova, InternetRetailing researcher, “suggests that delivery customisation is still in its infancy and retailers need to innovate in line with customer expectations.” However, she points out, the proportion of retailers offering Collect+ as a pick-up point was still well ahead of the 2.2% of 2,159 UK adults who last year told researchers for Barclays’ The Last Mile report that they wanted to be offered the option of delivery to a locker or collection point. “Interestingly,” says Modenova, “this study shows that customers anticipate using collection from lockers by 10% more this year compared to 2014, suggesting that customers are slowly realising the convenience of the service.”

Our research also showed that only seven of the Top500 retailers provided collection points in underground and train stations. Of those that did, nearly 60% were grocery retailers. Other retailers stood out because they provided more collection points than they had stores. Three pureplay retailers with no physical stores, for example, provided large number of collection points to customers. The best performer in the group was Interflora, which provided its customers with more than 1,500 collection points.

Payments

Choice matters too when it comes to payment, and strategic retailers offer customers the choices that ease the path to completing a transaction. Our original research analysed the payment and conversion strategy of the Top100 retailers through seven metrics, including whether they offered PayPal, 3D Secure and showed delivery charges from the basket page. Our other criteria included whether a retailer retained products in the basket once a customer had left the website, enabled customers to change or cancel their orders, alerted customers to their basket contents through an email, and offered feedback opportunities, including a review email and a customer survey.

This year we’ve analysed those features where we have found evidence that suggests they make a particular difference in encouraging customers to complete their transaction.

WorldPay figures (Alternative Payments Report, second edition) suggest that 78% of British transactions involve cards, with PayPal the third-most popular option (13% – after e-wallets, 16.5%). Our analysis of the largest 100 retailers suggests that nearly 81% provide PayPal as a payment option. The sector most likely to offer PayPal was general fashion, where 88% of retailers provided this option. That was followed by stationery, books and craft businesses, where 80% of traders did so.

Then we followed customers further through the conversion funnel on the largest 100 retailers’ websites. While 56% of customers suggested, in Statista.com research from 2012, that they would abandon their carts if they came up against unexpected charges in the final stage, 22% of the largest 100 traders created this situation, presenting customers with unexpected delivery charges as they came to check out, rather than showing them on the basket page.

The Statista figures show 10% of consumers say concerns over payment security would make them abandon their shopping baskets. IRUK Top500 2015 research shows that just shy of two-thirds (64%) of retailers provide extra payment security options such as 3D Secure “Retailers,” says Modenova, “should consider upgrading their ecommerce platforms by introducing extra payment security options in order to promote customer retention.”

Conversion rates can be increased by enabling customers to save their baskets for later. Our research showed only 6% of the largest 100 retailers allowed the product to remain in a customer’s basket and also sent an email to notify or remind customers.

Overall, only a third (32%) of the largest 100 retailers score highly in the Top500 2015 research on all basket and payment option attributes. “This suggests,” says Modenova, “that there is still a lot of room to encourage customers to complete purchases and to return to make more purchases.”