By offering a range of convenient and flexible delivery, collections and returns options, retailers encourage more shoppers to buy, according to RetailX Europe Top1000 360° report.

RetailX research explores how retailers offer flexible services that match customer demand both directly to shoppers, through home delivery, or using stores to offer multichannel services such as collection or return-to-store.

Speed of delivery

Next-day delivery is available from 24% of retailers selling to Europe, a service that’s most available when selling to the UK (37%), Ireland (23%), Denmark and Italy (both 22%).

Some 5% offer same-day delivery when selling to Europe. This option is only slightly more used in Spain (6%). Saturday delivery is available from 9% of those selling to Europe, most commonly in the UK (20%).

Fewer across Europe (5%) offer Sunday delivery, which sees the highest rates in the UK (11%) and the Netherlands (6%).

How do Top1000 retailers organise collections?

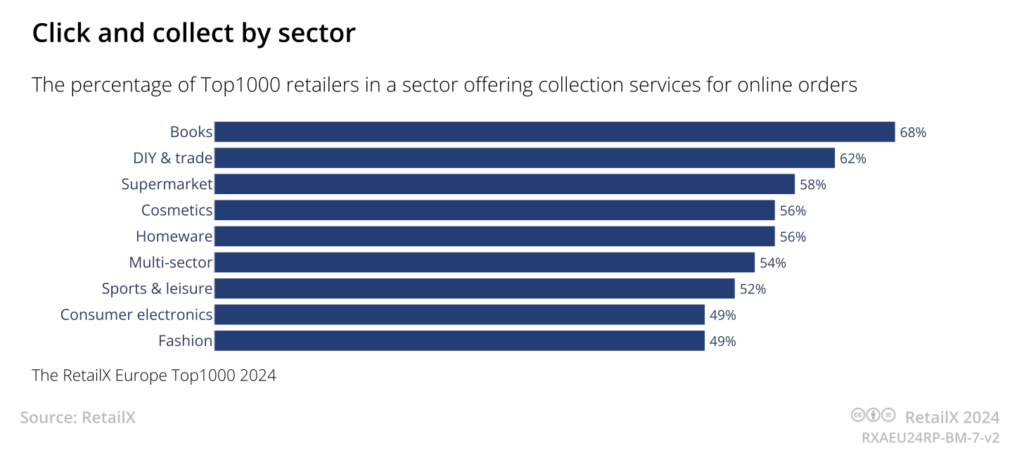

Over half (54%) of retailers selling to Europe offer customers the option of collecting their online order. The service is most available when selling to the UK (58%) and Luxembourg (56%) while few offer it when selling to Liechtenstein (6%) or Malta (17%).

Next-day collection is available from 12% of retailers selling to Europe. The option is most commonly found in the UK (14%), Luxembourg, the Netherlands, Norway, France and Sweden (all 11%) but fewer than 1% offer this service when selling to Slovenia, Malta, Liechtenstein, Croatia or Greece.

Same-day collection is most available from retailers selling to Sweden (12%) and Romania (11%) while fewer than 1% offer the service when selling to Latvia, Liechtenstein, Malta, Croatia or Cyprus. 9% of retailers selling to European markets offer same- day collection.

While, 13% of retailers selling to Europe offer the option of picking up their order from a locker, which are more commonly found when selling to Poland (31%) and Romania (20%).

How do Top1000 retailers manage returns?

Across Europe, shoppers buying online have a minimum of two weeks to return an item they bought online but no longer want. That puts the onus on retailers to do so in the most efficient, cost- effective ways.

The average retailer selling to Europe gives shoppers an average of 57.8 days to return an unwanted item and the median retailer 25.7 days. In many markets, the median retailer offers 30 days for shoppers to return an item, although this is shorter in Italy (25.3 days). In Sweden, the average retailer offers 512 days and in the Netherlands, 361 days.

One relatively popular approach is to offer pre-paid returns, which are used by 45% of those selling to Europe, 64% of those selling to the UK, 58% of those selling to Germany and 56% of those selling to Austria and Ireland. At the lowest end of the scale are Malta 17% and Iceland 18%.

The shipping costs associated with making a return are refunded by 44% of those selling to Europe. This is most common from retailers selling to Hungary (66%), Finland (52%) and Czechia (51%). It’s least seen in Switzerland (17%) and Austria (21%).

A small study looked at whether retailers charged return fees. Where they did, the average retailer selling to a European market charged €9.35 and the median retailer charged €5. In the UK, the average charge was €10.20 and the median €5.63.

Returns channels

Post remains the most popular returns option, used by 64% of those selling to Europe. This is most used when selling to Belgium (84%) and Ireland (83%) but less so to the UK (59%). 47% of retailers selling to Europe enable shoppers to return an item to their own shops. Shoppers are most likely to be able to do this in Ireland (57%), Spain and the UK (both 55%) and less likely in Iceland (16%), Cyprus (18%) and Malta (19%), perhaps because not all retailers have branches in those smaller markets.

This is an excerpt from the first RetailX Europe Top1000 360° report. This report brings together two strands of RetailX research. The first is the Top1000, now in its ninth year of ranking ecommerce and multichannel retailers by performance. The second is the more recent 360° reports, which explore markets in the round, from the economic context for retail to retailer performance and how shoppers buy, or would like to buy.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.