The Search Visibility Index, an InternetRetailing UK Top500 research project in collaboration with OneHydra, tracks retailers’ search visibility, search reach, and the number of keywords they enjoy – all measured using UK Google search. Starting in 2016 the index will monitor search trends for individual retailers and volume across the industry in general, over the full annual cycle.

Update 1, June 2016: Do retailers stand a chance to be seen in Google search?

The InternetRetailing Search Visibility Index, researched in partnership with OneHydra , measures the Top500 retailers’ search reach and visibility, and the share of search each receives for its relevant keywords. Visibility in organic search is one of the most important ways for a retailer to solicit new customers – but, as the index reveals, it’s far from a level playing field. The largest retailers, especially department stores and marketplaces with their large volumes of keywords, are consistently the most visible, appearing more often on the first results page than their competitors. However, volume isn’t the whole story. The Search Visibility Index also reveals the retailers that enjoy good visibility for a narrower set of keywords; they may not have the raw volume of the search titans but they arguably have done just as well at optimising search.

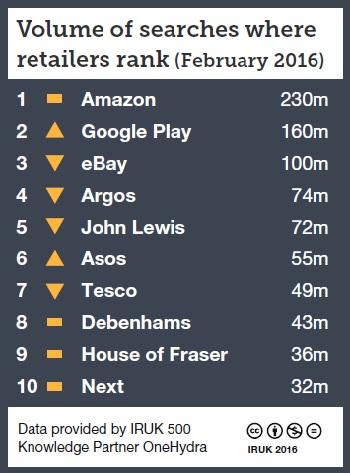

In December, Amazon was visible in UK search results 310 million times – the highest of all Top500 retailers. In the most recent data, from February, Amazon is still in the first position, though with a smaller absolute reach – presumably a seasonal variation from the Christmas period that was visible at other retailers. Overall customer reach declined between December and February for almost all retailers, including the most-visible 10 (‘Top10’). Debenhams and House of Fraser also retained their visibility relative to other retailers, even as their absolute visibility declined over the same period. They ranked 8 and 9, with an average of 55m and 45m search views per month, respectively. Other retailers saw more movement as the top 10 tables below illustrate.

Volume of searches: December, 2015

Volume of searches: February, 2016

Google Play , the multimedia and app store, moved from being fifth to being second in the ranking table with a search reach of just over 160m per month, overtaking eBay. However eBay’s average monthly decline between December and February amounted to 12%, revealing the smallest drop in search volume compared to other Top10 retailers. Had Google Play been visible for all searches of all relevant keywords, it would have a search reach of 208m, rivalling Amazon. And this is a common story for all retailers throughout the full Top500, not just the search giants.

In ecommerce, with its breakneck pace of technological change, SEO seems a geriatric technique, but its benefits are far from realised. It’s also a zero-sum game; almost all of a retailer’s keywords are shared with competitors and it stands to reason that any ecommerce player that ceases to develop SEO will see the gap between searches they want to be seen in, and searches they are seen in, widen.

Over the last few months, the Top10 retailers’ search visibility has decreased by 20% to 50%. Apart from Google Play, which managed to improve search visibility by 45%. It may be that some product lines are less cyclical; while others are counter-cyclical. The grocery and general merchandise sectors display the most traditional seasonality, with the highest observed web search volumes over Christmas. Yet, search volume for digital goods’ retailers soared, once holidays were out of the way.

The Search Visibility Index will next be updated in August – when we’ll review the impact of Spring sales.

Read the Top500 report