Social platforms are successfully driving online purchasing, especially in the United Arab Emirates, according to RetailX’s latest research into the region.

The newly published RetailX Middle East Ecommerce Region 2023 report highlights that the majority of internet users in the Middle East use social media to some extent. In Qatar, almost 98% of the population uses at least one social media platform. The number of people viewing TikTok has risen in recent years, while Instagram and Facebook have seen their potential reach for advertisers declining, although the two platforms still have the highest number of users.

In Kuwait, adverts on TikTok can reach almost 75% of the population, while in Turkey, in early 2023, Facebook had 32.8mn users, equivalent to just under half the number of internet users, according to creative agency We Are Social.

However, Facebook’s advertising reach decreased by 4.7% between 2022 and 2023, while TikTok’s increased by 12.4%, reaching 42% of internet users in the country. Out of the average of 7.5 hours a day using the internet, consumers in Turkey spend almost three hours on social media.

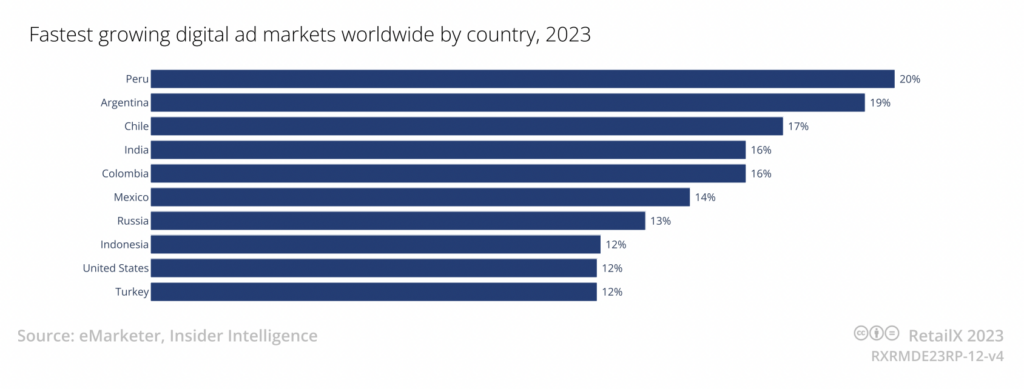

A third of consumers say they use social media to find products to buy or to be inspired, while 35% follow their favourite brands or ones they are thinking of buying from. It is no surprise then that Turkey has one of the fastest growing digital advertising markets in the world.

According to TikTok, 41% of users in the GCC region have bought something via the platform.

Consumers in the UAE are particularly keen on social media as the country has a high number of social media accounts compared to the population size. In fact, consumers in the country are among the highest users of platforms including WhatsApp and Facebook. These two platforms are the most popular in the country, followed by Instagram and TikTok.

Consumers here spend a large proportion of their time on social platforms – spending two hours and 50 minutes on them each day. The majority of people (79%) say they use social media to research brands or things to buy and they can be swayed by the content they are viewing into making a purchase. This can be content in the form of brand advertising, influencers or recommendations from friends or family. Just 23% of consumers actively follow brands they regularly buy from or ones they are considering purchasing from.

However, consumers in the UAE are among the most likely globally to embrace social commerce. When asked if they had purchased through a social media site in the previous 12 months, 59% of consumers said they had, according to a survey conducted by RetailX Consumer Observatory. This is above the 54% global average but a long way behind the 82% of Chinese consumers who are the most eager to shop in this way.

Across the region, 41% of shoppers who buy luxury fashion use social media as an information source. This is slightly higher than the global average but again behind the level of social influence in China.

A growing market

Social commerce is likely to increase as the overall level of ecommerce in the region rises since most online transactions are completed on mobile phones, devices which are also extremely popular for viewing social content. Joining the two is a natural progression for retailers and brands, particularly those who are actively trying to attract GenZ and Millennial shoppers.

Forecasters expect the social commerce market to grow by 35% in 2023, compared to how much was spent by consumers on such platforms in 2022. This will result in products to the value of $1,338mn being sold on social media platforms during the year in Saudi Arabia alone. By 2028, this is expected to have increased to $4,351.2mn, a compound annual growth rate of 21.7%.

Technology companies and new players are keen to get into this market as it grows resulting in a number of live streaming platforms launching in the region in recent years. All are trying to attract retailers, brands, content creators and shoppers. Shopper On launched at the end of 2021 while the Hoods live shopping and entertainment app launched a year later.

To use Hoods, consumers first have to download the app. They are then able to watch live and recorded videos from a number of content creators and chat in real time about the products being shown. Consumers can then click through to buy items directly within the app as well and be rewarded later for becoming a content creator and recording a product review.

The process is made easy for content creators who can tag products from the local and international brands that have already signed up with the platform and create content around them. By tagging the products, they will appear as shoppable links within the video. Content creators are paid commission for any sales their video generates.

Traditional ecommerce experiences are missing what is clearly becoming a growing expectation from younger generations for the type of entertainment and interaction that social platforms offer, believes Hoods founder Mostafa Hanafi. At the same time, these platforms are not built for ecommerce, he explained at the time of the app’s launch.

“We’ve built a platform that uniquely fuses shopping and entertainment in a compelling experience that combines the convenience of robust ecommerce with the excitement of live entertainment. And we make sure that products are delivered to the customers’ door stop with speed and minimum hassle,” he said.

Customer services

Social is being used by brands and retailers for customer services as well to give customers an easy way to contact them as well as enabling technology to take some of the load off personnel. Lulu Hypermarket uses an AI-powered chatbot and the WhatsApp platform to handle enquiries from customers. Within four weeks of going live, Salem, as Lulu Hypermarket calls its chatbot, had successfully handled queries from more than three million customers.

This feature was authored by Emma Herrod, and originally appears in the RetailX Middle East Ecommerce Region 2023. Download it in full to discover:

- In-depth research of six countries featuring their leading retailers and web traffic

- What makes Turkey the largest of the six ecommerce markets?

- Separate sections on consumer payment preferences and sustainability

- Five company profiles feature Getir, LuLu Hypermarket, Noon, Shufersal and Trendyol