Sports goods shoppers are embracing online and mobile retail with a growing penchant for social commerce and subscriptions, the newly published RetailX Global Sports Goods 2024 report highlights.

More sports consumers shop online in some way, shape or form than don’t and, compared to other retail sectors, the proportion of online shopping in sports goods is relatively high.

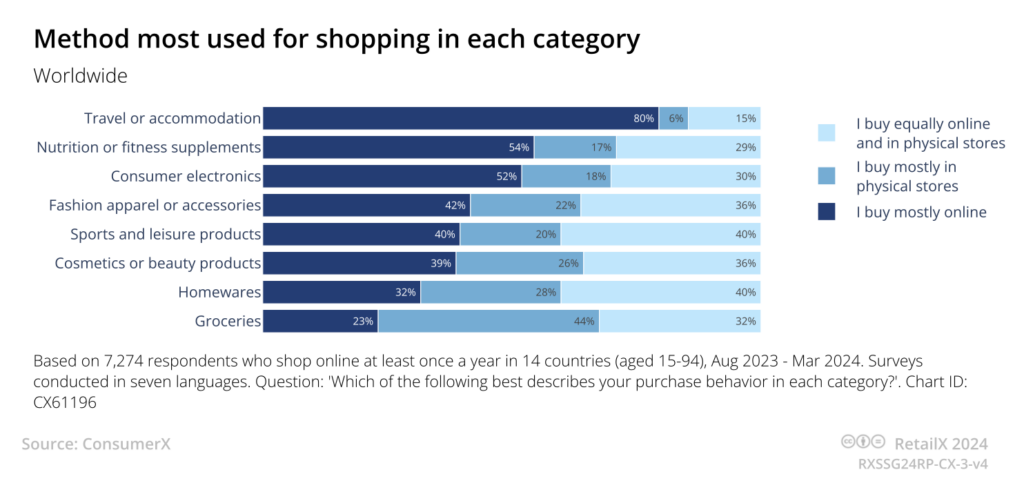

When those that buy both online and offline are factored in, sports has one of the highest levels of hybrid retail of any sector. At around 80% of consumers buying sports online mostly or sometimes, it sits with nutrition and fitness supplements (85%) and consumer electronics (82%), and above fashion (78%), cosmetics and beauty (75%) and homewares (72%).

This hybridisation is a result of sports goods and equipment being a ‘try-before-you-buy’ industry that sees consumers sticking with specific brands. Take running shoes as an example. To pound the pavements or to do ultra-marathons, one’s footwear has to be a perfect fit, which is why many keen runners have a brand and style with which they stick. While initial purchases may be made instore, like-for- like replacements are then often repeated online.

Conversely, since new running tops may need to be tried on, the consumer heads instore. The same applies to sports accessories, equipment and technology, which need to be handled before they are bought. Of course, many will be trying instore then buying online – as is seen in other retail sectors such as fashion – and so the channels used are increasingly hybridised.

However, the picture varies from country to country. The hybrid model where shoppers are buying equally instore and online is strongest in the US, Australia, UAE, Egypt, China and the UK – although it is also relatively strong in several other markets. In many of these, there is also a very strong use of stores for buying sports, with Canada interestingly enough showing a good degree of hybrid and instore-only retail and relatively low online-only shopping.

India stands out due to its heavy online-only sports shopping cohort (57%), significantly ahead of all other markets. This is likely down to the country’s burgeoning young middle-class who want to be fit and healthy but who are very much mobile-first when it comes to shopping. Similar demographic- driven statistics are seen in South Korea and China, where sports markets are the preserve of a young, relatively wealthy mobile-first generation.

This is a global trend, which sees 70% of sports shoppers around the world using smartphones to buy sports goods some or all of the time at rates behind only fashion (72%) and cosmetics (79%). This is seen in how online sports retail is predominantly carried out on mobile devices globally, accounting for 65% of total online sports goods spend.

Social sports commerce

Part of the push into shopping on mobile, especially among younger consumers, comes from a growing proportion of it happening on social media.

Research shows that 41% of global consumers have purchased sports goods through social media in the past year, ahead of fashion, homewares and groceries. Of these, 29% have used TikTok to buy sports goods, while a surprising 22% have shopped via YouTube.

This rise of social commerce in sports retail is part of a wider trend in retail to sell through these sites. Many consumers – especially as they become mobile-first – are spending more of their time on social media.

As with fashion, social media is the ideal place to showcase sporting triumphs, tips and hacks, as well as being a perfect venue for influencer content around sports kit, which is naturally photogenic.

The natural next step is to turn that promotional content into something shoppable and, with TikTok’s user base growing globally, it’s no surprise that many consumers are now using it as a platform for purchase.

Similarly, YouTube’s success in sports goods social commerce relies on its global ubiquity, its popularity and that it is often a place where consumers who are into a specific sport or hobby turn to for tricks, hacks, highlights and comment, making it an ideal platform for both sports advertising and commerce.

Subscriptions score big with sports goods shoppers

According to ConsumerX data, 18% of sports goods shoppers buy their sporting materials through subscriptions – a figure comparable to the level of subs seen in fashion and cosmetics, and only 11% behind groceries, where subscriptions have long been a natural fit.

The reasons behind sports subscriptions services are myriad but coalesce around two main themes. Firstly, as said, sports shoppers often buy the same products on repeat, be that running shoes, tennis balls or water bottles, with regular replacements as their exercise or sports regime dictates.

Secondly, they are driven by cheap, free and fast delivery. As we have already discussed, a relatively large proportion of sports shoppers want the items they buy online delivered the same or next day, which drives them towards subscription services. Indeed, 59% of global sports shoppers receive free delivery through their subscription services, with 18% of shoppers saying it’s why they subscribe.

These numbers lag behind other retail sectors where subscriptions are more entrenched but they do point to how the sports sector is one that may well be ripe for expansion of clever subscription services in the future.

This excerpt from the RetailX Global Sports Goods 2024 report was authored by Paul Skeldon.

Download the full report for more on how sports shoppers are buying differently, as well as the main factors driving this change. It also looks at what we might expect in the future and how retailers and brands can plan for that.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.