H&M today shows the effect of Russia’s invasion of Ukraine on sales over its latest financial year – with signs of recovery from the initial impact of closing its 185 Russian stores in the final, peak trading, quarter of its year.

H&M’s early figures suggest net sales came in at SEK 223.6bn (£17.6bn) in the year to November 30, the retailer says in a trading update today. That’s 12% up on last year when calculated in Swedish krona – or a rise of 6% in local currencies. When H&M’s business in Russia, Belarus and Ukraine is excluded, sales were 15% up in SEK and 8% in local currencies.

In the fourth quarter of the year alone, net sales were 10% ahead of last year, at SEK 62.4bn (£4.9bn) – and flat in local currencies. When sales in Russia, Belarus, and Ukraine are excluded, sales were 11% ahead in SEK and 2% in local currencies. H&M closed its business in Russia and Belarus during the quarter, selling off its final stock before shutting the last stores on November 30. The retailer was also affected by temporary closures at between 25 and 50 shops in China, as a result of new Covid-19 outbreaks.

Effect of war

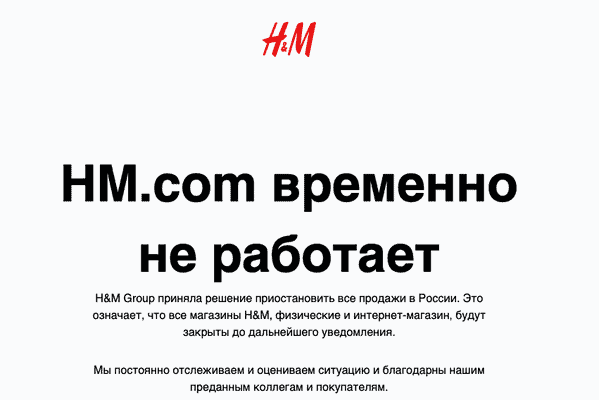

The fashion retailer took the decision to suspend trading in Russia – and its ally Belarus – shortly after Russia invaded Ukraine in late February. Since then it has permanently closed down its stores in both markets – with the final stores closing during the final quarter of the year, with the stock from those stores sold off, while those in Ukraine were temporarily closed for the safety of staff and customers. In Russia that meant the closure of 185 stores.

In today’s end-of-year trading update, the fashion retailer shows the extent to which the invasion has held back sales growth during the year. Swedish currency sales are three percentage points lower over the full year than when the effect of the Russia, Ukraine and Belarus closures is taken into account, recovering to one percentage point lower in the final quarter. That may suggest a stronger recovery in its other markets around peak trading, although there may also be some positive effect from selling off stock from Russian stores.

In the first quarter of its financial year, H&M had reported a strong recovery from pandemic closures before the effects of the Russian invasion of Ukraine somewhat muted growth.

Peak recovery

Commenting on the figures, Melissa Minkow, director, retail strategy at digital transformation consultancy CI&T, says: “This is a challenging time for retail across the board, but consumers have demonstrated an appreciation for holiday promotions. H&M’s positive sales numbers are reflective of the best-case scenario during a worst-case scenario moment. The key for H&M going forward will be matching production efficiently to demand so that prices can consistently align with market positioning for the brand and raising the bar on its experiences across channels.

“While H&M sits more in the fast fashion space, in these tough financial times, its price point leans closer to mid-range for shoppers. The product quality and elevated price point for trend-driven apparel make the case for highly engaging channels.”

Samantha Merkle, head of strategy experience and commerce at customer experience transformation business Merkle UK, says: “Despite a 10% increase in year-on-year sales for H&M, the retail stalwart struggled to keep up with competitors. 2022 has made its dent in the retail industry, with unforgiving rising inflation laying waste across the sector. Ahead of 2023, it’s time to rethink strategies.

“Customer loyalty will undoubtedly dominate the industry and dictate the success of companies. Brands must differentiate themselves through solid customer-centric strategies that optimise their journeys and interactions across checkpoints – especially in the online world.

“The future is digital and scaled personalisation is critical to any digital business. Companies must utilise data to understand their audiences and build strategies that meet their expectations. Through enhanced personalised experiences, informed by key data and based on trust, honesty, and transparency, retailers can stand out from the crowd and come out winning.”

H&M is a Top50 retailer in RXUK Top500 research, while its Cos, Monki, Weekday brands are ranked Top350.