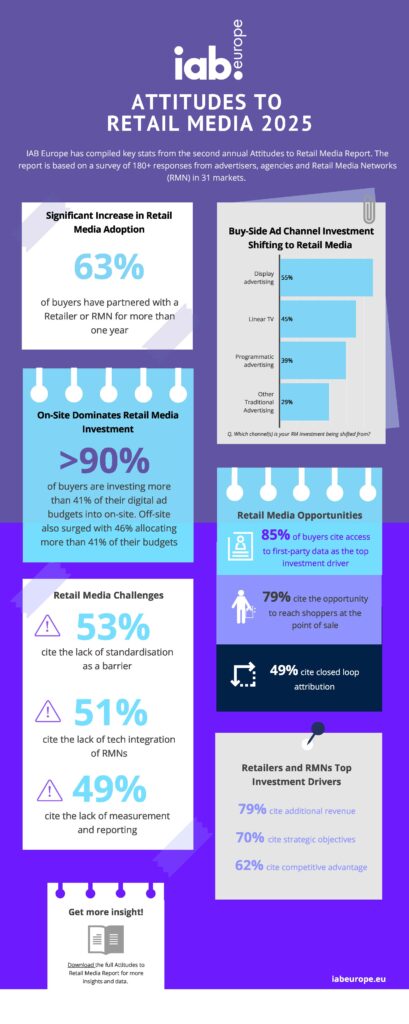

Retail media continues to gain ground with the number of buy-side stakeholders in retailer partnerships that last more than a year up from 50% in 2024 to 63% this year, while the number of brands working with between four and six networks more than doubling from 10% to 24%.

This buy-side growth is being fuelled by first-party data activation, point-of-sale reach and the rise of emerging channels like CTV, Audio and OOH. On the sell-side, motivations such as additional revenue, strategic alignment, and competitive advantage are gaining ground.

So finds the second edition of IAB Europe’s Attitudes to Retail Media Report, published today (15 July 2025), which offers a comprehensive view of how Europe’s retail media landscape is developing. Drawing on insights from buy-side and sell-side stakeholders, the report highlights growing maturity, evolving investment strategies, and a shift towards performance-driven, omnichannel Retail Media.

According to the report, while onsite continues to account for the lion’s share of retail media spend – with 90% of buyers allocating at least 41% of their digital retail media spend to it – off-site investment has jumped from 30% to 46% of buyer budget allocation, driven by growth in display and social formats. Emerging channels, as said are also cutting through. However, despite instore digital screens also garnering interest, they still see limited investment.

The IAB finds that buyers, predictably, prioritise transparency (82%), performance (76%) and measurement options (75%) when evaluating Retail Media partners, with Return on Ad Spend (ROAS) emerging as the most in-demand metric (88%).

However, while concerns around data access and technology have eased, network fragmentation (51%) and lack of standardisation (53%) remain the most significant barriers to retail media growth.

Marie-Clare Puffett, Industry Development & Insights Director at IAB Europe, explains: “This year’s report confirms that retail media is no longer an emerging trend, but a strategic priority. As the ecosystem matures, we’re seeing a real need for shared standards, consistent measurement, and greater collaboration across stakeholders. Through our Retail Media Certification Programme and the work of our committee, we’re committed to providing the guidance and tools the industry needs to grow effectively.”

Jason Wescott, Global Head of Commerce Solutions, WPP Media & Chair of IAB Europe’s Retail & Commerce Media Committee adds: “This report highlights the key drivers powering Retail Media’s momentum, particularly the activation of first-party data and the growing influence of point-of-sale. While challenges like network fragmentation and lack of standardisation remain, it’s promising to see concerns around data access and technology starting to ease. This report is more than a snapshot of market sentiment – it serves as a strategic roadmap. It reinforces the urgent need for industry-wide standards, advanced measurement capabilities, and ongoing upskilling to help realise Retail Media’s full potential across Europe.”

The survey was developed by IAB Europe’s Retail & Commerce Media Committee. It received more than 180 respondents from advertisers, agencies and Retail Media Networks in 31 markets. The majority of respondents (75%+) manage annual advertising budgets of €1m or above, with half (48%) investing more than 41% in digital advertising. Many of the respondents were either Heads of Retail Media, Heads of Commerce, or Media Directors.

The full report can be downloaded from IAB Europe’s website here. You can find all of IAB Europe’s retail media resources and more information on its certification programme on our Retail Media Hub here.