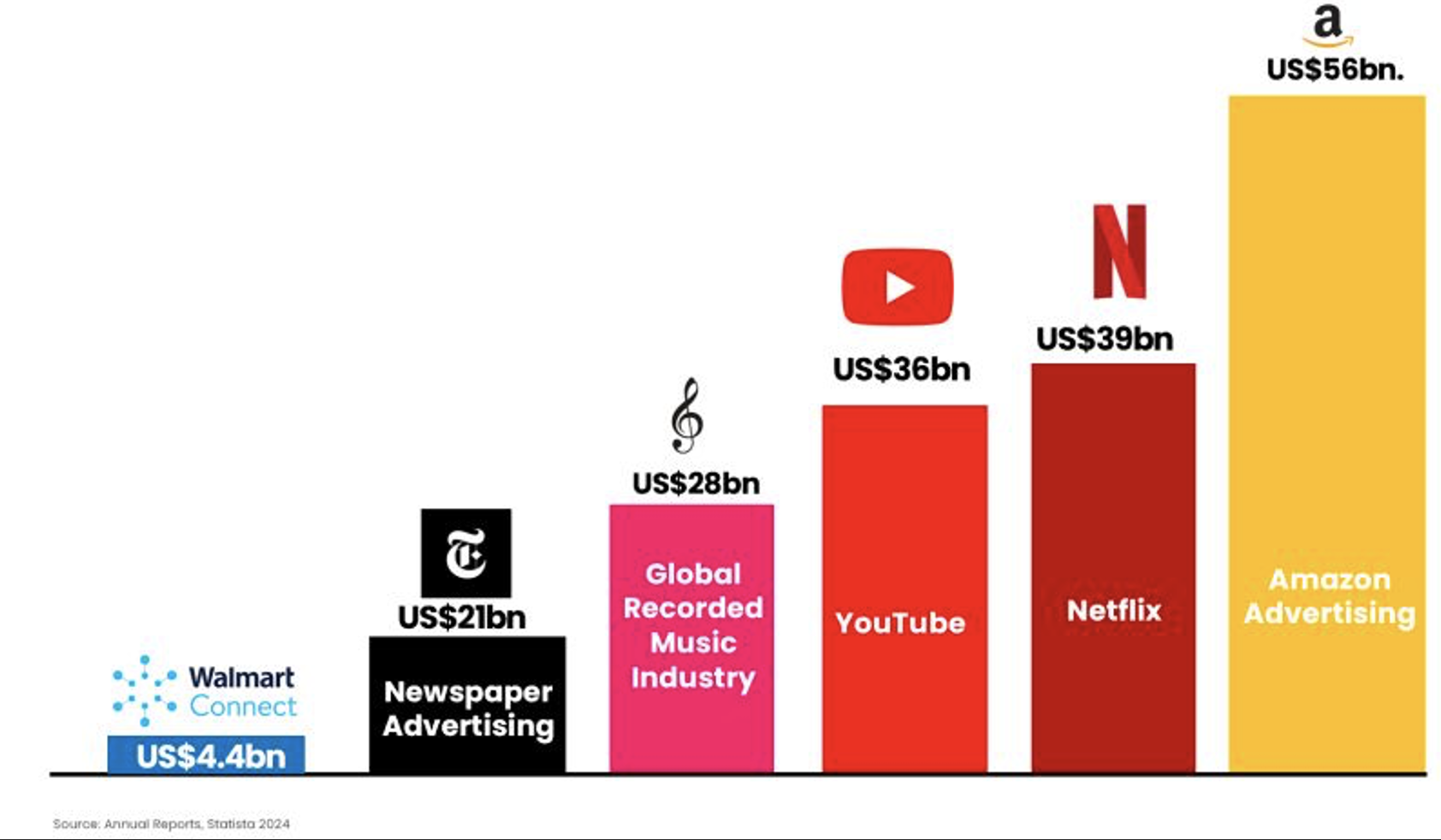

The first item on the agenda when talking about Retail Media is to talk about the sheer scale of Amazon Advertising. Its global ad business reaching $56 billion in 2024 – growing 19.8% Y/Y on it already enormous 2023 revenues.

Amazon Advertising not only dwarfs Walmart Confect’s $4.4 billion revenue, it is also:

- Twice as big as the whole of the global music industry revenues.

- Delivers $20bn more revenue than YouTube.

- Has three time the revenue of the global newspaper industry.

- The same size as three of the major advertising holding companies in terms of revenues, for example, Publicis, Omnicom and Havas.

Arguably, one of the most striking aspects of Amazon’s size is the fact that one product, ‘Sponsored Product’, its search based advertising unit is around 80%+ of all their revenues, meaning one type of advertising is the size of two major holding companies gross revenue, twice the size of the global newspaper advertising revenue and a third of the global TV advertising revenue of $132bn (*).[1]

Of course, Amazon Advertising growth is driven by its massive marketplace, robust shopper data, and analytics tools like Amazon Marketing Cloud (AMC). Amazon also increased ad revenue as a percentage of Gross Transaction Value (GTV) by 6.6% signalling improved monetisation of Amazon sites.

Walmart Ecommerce and Walmart Connect growing Ffster

Digital channels created 68% of Walmart revenue growth in 2024. Walmart Connect – the retail media arm of Walmart grew 27% in the U.S. – faster than Amazon Ads in percentage terms, demonstrating Walmart’s rapid advancement in retail media.

The company’s digital commerce sales increased 21.4%, significantly more than Amazon’s 8.8% and much more than the growth in eCommerce in the US. However, Walmart is competing with Amazon’s entire ecosystem, not just Amazon.com, making direct growth comparisons tricky.

Advertising and membership accounted for 25% of Walmart’s total operating income in the most recent quarter.

Walmart results analysis by Russ Dieringer of Stratably pointed out something Doug McMillon, CEO Walmart said: “If there was one thing he could change it would be consumer awareness of their vast selection and fast delivery speed”. The Walmart marketplace is small compared to Amazon and it has has a marketing problem – shoppers are not aware of Walmart’s vast third-party selection and fast delivery speeds, areas where Amazon holds a significant edge.

As ever, marketplaces and retail media are a B2B and B2C marketing challenge. If you build, that does not mean they will come.

Dieringer also believes that convincing brands of Walmart’s value beyond search ads will be crucial for continued growth.

Instacart Advertising is losing momentum

Instacart had $33 billion in gross transaction value (GTV) in 2024. It outpaced the broader grocery industry, growing 10.4% in 2024, but lagged behind the overall eGrocery channel growth, indicating it is benefiting from macro trends rather than outperforming peers.

Instacart Advertising revenue increased by 10.5% in 2024, trailing both Amazon and Walmart. Despite a 27% growth in active brand advertisers, Instacart’s ability to increase advertiser spending per brand has been limited.

According to Stratably, “Instacart’s ad revenue as a percentage of GTV increased by just four basis points, lagging the increases Amazon (+66 basis points) and Walmart (+22 basis points) experienced.” In other words, Instacart is an established platform within their retail media budgets, but they’re not necessarily growing their spend in it.

Why is this? Stratably believe the following hinders Instacart’s ad growth potential:

- Retailer targeting limitations: Unlike Amazon or Walmart, Instacart cannot deliver detailed performance reporting at the individual retailer level.

- Brand-Retailer issues: Some retailers do not credit brands for Instacart-driven sales, creating friction in ad investment decisions.

- Lack of Retail Media Innovation: Compared to Amazon and Walmart, Instacart has been slower to roll out new ad solutions, limiting its appeal to large brands.

That said, Instacart remains an important channel for brands and is particularly useful for emerging brands looking for a foothold in the competitive grocery sector.

Takeaways for retailers and Retail Media advertisers

Each of these retail media platforms offers unique benefits, but the right allocation of ad spend depends on a brand’s category, objectives, and target consumers:

- Amazon Advertising is still the leader in scale, sophistication, and closed-loop measurement.

- Walmart Connect is growing rapidly, driven by its excellent eCommerce momentum and increased advertising adoption, but it is still just less than 10% of Amazon Advertising revenue. And, all other retail media networks are MUCH smaller than Walmart, showing the scale of the challenge for smaller RMNs to scale.

- Instacart Advertising provides essential reach in the grocery category but lacks the innovation and platform enhancements needed to capture more of marketing budgets

[1] Source: Group M 2024 Global Advertising Forecasts