The RetailX USA Growth 2000 report, which is available to pre-register for now, highlights the importance of next-day delivery for US consumers and which sectors have been quick to respond.

The report found next-day delivery is a relatively popular option for customers, with 9.7% saying they always pay for it, while 20.4% do so most of the time and 31.2% some of the time. But 38.7% never do so.

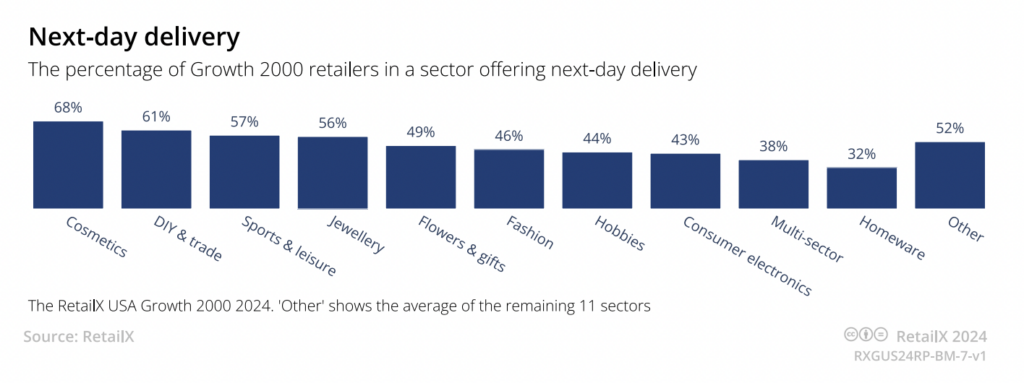

From the retailer side, 49% of 1,547 retailers assessed on this metric offer next-day delivery. RetailX research suggests, with those selling cosmetics (68%) the most likely to do so, followed by DIY & trade retailers (61%).

Homewares (32%) are the products that shoppers are least likely to be able to order for next-day delivery, while 46% of fashion retailers and brands in the index offer next-day delivery.

Same-day delivery is much less common – available from only 3%. As yet, availability of this service lags behind customer expectations.

US Growth 2000 retailers offer standard delivery in a median seven days. The average order value at which retailers offer free delivery is $108.

How do retailers approach collection?

Collection is particularly useful for shoppers who want certainty, whether that’s of knowing the product they want will be at the store when they visit, or of knowing that they won’t miss a delivery.

ConsumerX research suggests that the service is an important one for US shoppers. 52% say that collection from a nearby store or locker is very important (19.8%) or important (32.5%) to them. Most people have used click and collect at least five times in the previous year, with 68.1% doing so fewer than five times, 25.3% doing so between five and 20 times and 6.6% more than 20 times.

RetailX research suggests that collection is widely available, with 68% of 1,675 assessed on this metric offering a pick-up option. Hobby retailers are the most likely to offer this, with 72% doing so. Homewares, consumer electronics and cosmetics retailers (all 70%) are also likely to do so. Retailers and brands selling flowers and gifts are the least likely to offer a pickup option although even here, adoption is relatively high at 64%. Among a smaller subset of 16 retailers assessed, 37% had their own collection lockers.

This is an excerpt from the RetailX USA Growth 2000 report. Register now and have it delivered straight to your inbox upon release.

The USA Growth 2000 2024 explores how these dynamic retailers have grown through elevating customer experience, product offerings and strategic investments. Throughout the report all our data is illustrated through RetailX’s signature graphics and in-depth company profiles.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.