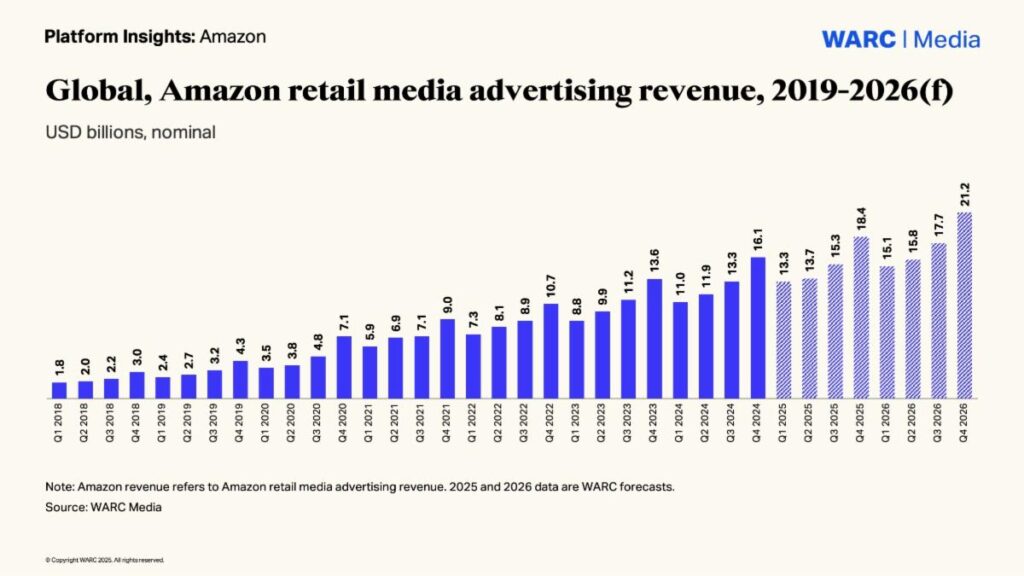

Amazon is set to see retail media ad revenues hit $60bn this year, spurred on by its immense data base from the 2.5 billion monthly visitors it gets and the trust that those consumers put in the ads they see on the marketplace.

Amazon continues to grow its advertising business at a rapid rate. According to the latest WARC Media forecasts, Amazon will earn $60.6bn in retail media ad revenue in 2025 not including spend with Amazon-owned properties such as Prime Video and Twitch – and is forecast to climb to $69.7bn in 2026.

WARC Media data shows that Alphabet, Amazon and Meta together accounted for over half (53.6%) of global ad spend, excluding China, in 2024 (up from 51.9% in 2023 and 49.7% in 2022).

Advertising revenue accounts for just 9.2% of Amazon’s total revenue, yet it continues to post significant double-digit year-on-year growth. It achieved +17.7% ad growth in Q1 2025, outpacing the +16% expansion forecast for the global retail media market, per WARC Media. This ad growth also surpassed its overall sales growth for all revenue (8.6%).

While paid search formats such as Sponsored Products remain the core of Amazon’s advertising offering, the company has achieved incremental growth through upper-funnel ad spend, including via its Prime Video platform. Using indexed growth data from Omdia, by the end of this year, Amazon will have doubled the size of its display ad revenue over the last four years.

At a time of economic uncertainty resulting from cross-border tariffs, advertising has become an “important contributor to profitability” across markets, the company acknowledged in its latest earnings call. According to WARC’s Marketer’s Toolkit 2025 survey, more than half (56%) of global marketing leaders plan to increase ad spend with Amazon, behind only YouTube (64%) and TikTok (79%).

Brands on Amazon, via its programmatically-placed display ads (DSP) system can extend campaigns to social platforms including Meta, Pinterest, and Snap. Amazon is also rapidly expanding its roster of premium publishing partners to boost off-site growth.

Amazon leads depite competition from China

Despite Chinese-based Temu and SHEIN having gained global attention, Amazon still dominates across markets for most visits. The e-commerce giant on average sees 2.5 billion visitors per month, according to data from SimilarWeb.

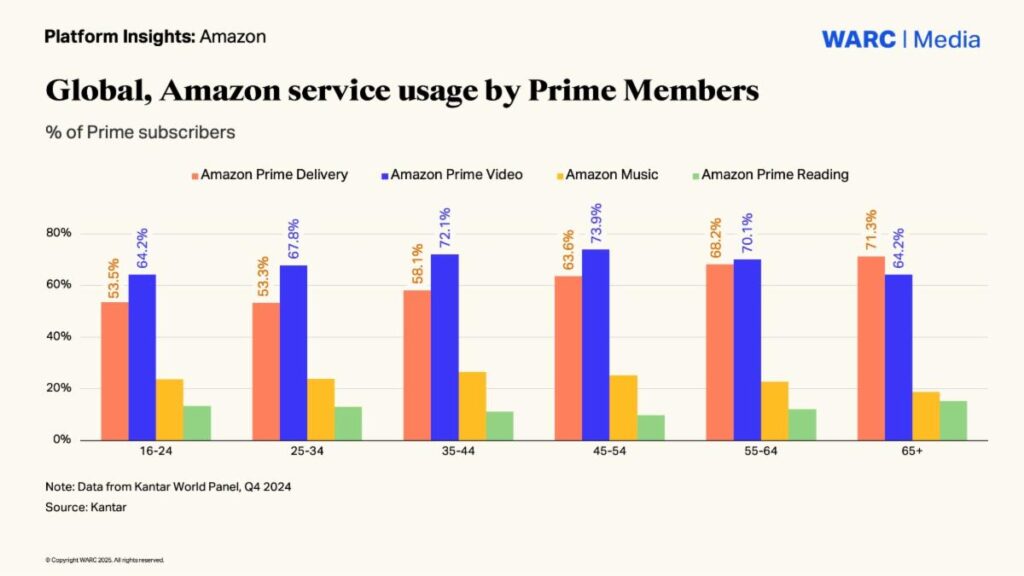

Amazon aims to be among the first video on-demand players to achieve scaled mass reach in advertising audiences. Brands can reach over 200 million shoppers who watch Prime Video. This offers advertisers new formats, reach and vast first-party signals. Prime Video’s share of streaming is the third-largest in the US.

However, Prime Video, like many SVOD platforms, is highly subject to resubscription after cancellation, data from Ampere shows. Advertisers are advised to understand the overlapping users of services to find incremental reach in a saturated market.

Gaming content platform Twitch, acquired by Amazon more than a decade ago, now has over 105 million monthly users, heavily skewed to Gen Z. It offers live engagement and high attention among online communities. Advertisers use the platform to deploy video and display ads, streamer-driven activations and partnerships with creators.

Consumers favour Amazon ads for trust and quality

Amazon ranks joint first with TikTok as consumers’ most-favoured media platform for advertising, according to Kantar’s Media Reactions study. Consumers were also found to prefer Amazon ads over rivals for relevancy and usefulness. Amazon also rated as a platform with the most “trustworthy and innovative” ads. Kantar noted that consumer concerns about over-targeting on Amazon have been declining.

However, global marketers did not rank Amazon among their top-five preferred digital media brands. Amazon will hope to change marketer perceptions through its AI innovation, and more advanced creative tools across display, audio, and video ad formats.

While paid search formats like Sponsored Product remain Amazon’s core offering, Amazon’s brand lift meta analysis found that a multi-channel or multi-format campaign within the Amazon ecosystem drives better brand lift for advertisers on the platform.

Unlike its Big Tech peers, Amazon’s advertising revenue claims only a small share of total company earnings – just 9.2% of its total revenue. Paid search formats remain the core of Amazon’s ad offering, but the company has achieved incremental growth through upper-funnel ad spend and is seeing ad revenue outpace its overall growth, finds WARC.

Alex Brownsell, Head of Content, WARC Media, co-author of the report, says: “Ecommerce giant Amazon offers more than retail media advertising—it’s quickly becoming a leading platform for full-funnel activation, with streaming TV and its own demand-side platform serving advertisers of all sizes. This latest Platform Insights report provides evidence-based insights on the challenges and opportunities Amazon has to offer, and explores its advertising ecosystem, from ad revenue to user trends and marketer and consumer attitudes towards Amazon ads.”

Platform Insights: Amazon is part of a series of reports exclusive to WARC Media subscribers. This latest report follows recent Platform Insights such as TikTok, Spotify and Facebook