Skai just released the fourth edition of its “The State of Retail Media” to help brands navigate Retail Media. It is 78 pages long, full of charts, data and insights gathered from a survey of marketers as well as insights from a separate survey of retailers operating within this space to provide a fuller picture the retail media landscape.

What are the top 10 takeouts that really stood out in my opinion? The themes around Retail Media performance, budget allocation, investment, retail media network proliferation, CTV, full funnel and incrementality.

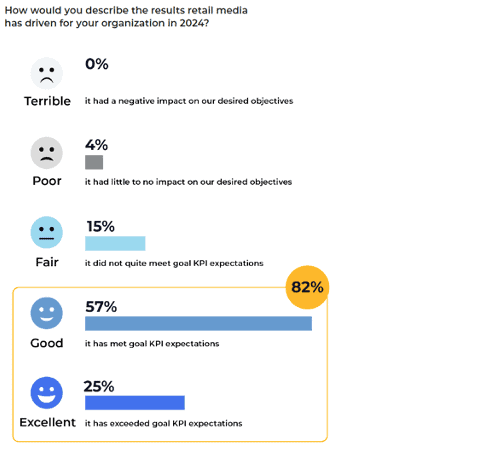

#1 Is retail media driving performance?

Of 109 respondents to the questions “How would you describe the results retail media has driven for your organisation in 2024?”, more than four-in-five consumer goods organisations say retail media has met or exceeded their KPI goals for the year. What I find interesting is the lack of ‘fair’ and ‘poor’ is far more revealing.

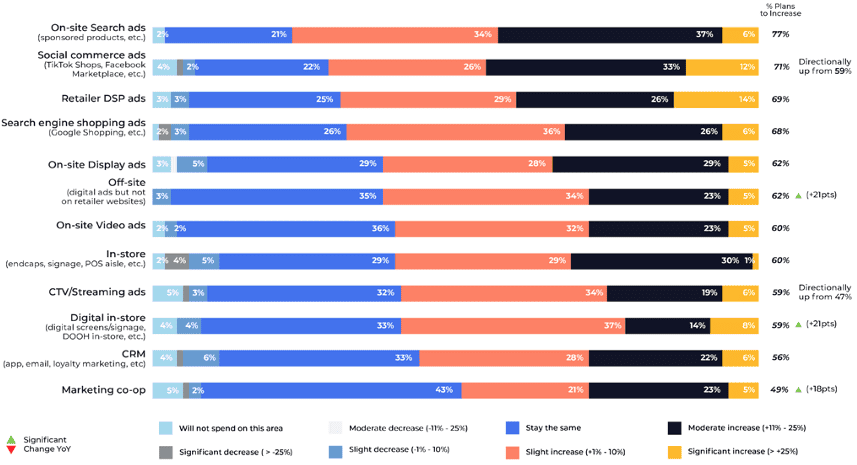

#2 – What is the 2025 budget prioritisation in Retail Media?

There is an expectation to increase budgets for on-site search, social commerce, retailer DSP, and search engine shopping. Compared to results seen in 2023, consumer goods brands are more likely to invest more in in-store, CRM. This should not be a surprise as the data is US centric, and retailer DSPs from the likes of Walmart are a part of the landscape and instore in the US is not as well developed.

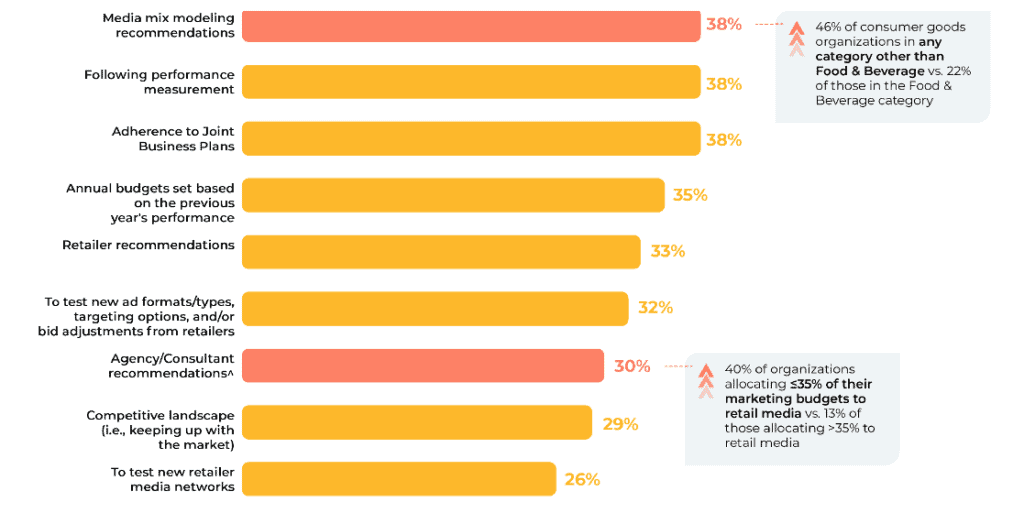

#3 What factors are the most important in budget allocation decisions for retail media?

Media mix modelling recommendations are just as important as adhering to what has been agreed in JBPs and how Retail Media is performing. Given that ‘annual budgets placed on previous year’s importance’ is also rated highly, it is clear that there is no one overall agreed method for budget allocation in Retail Media. Brands allocating less of their budgets to retail media are more likely to say they are leveraging agency/consultant recommendations when making retail media budget allocation decisions.

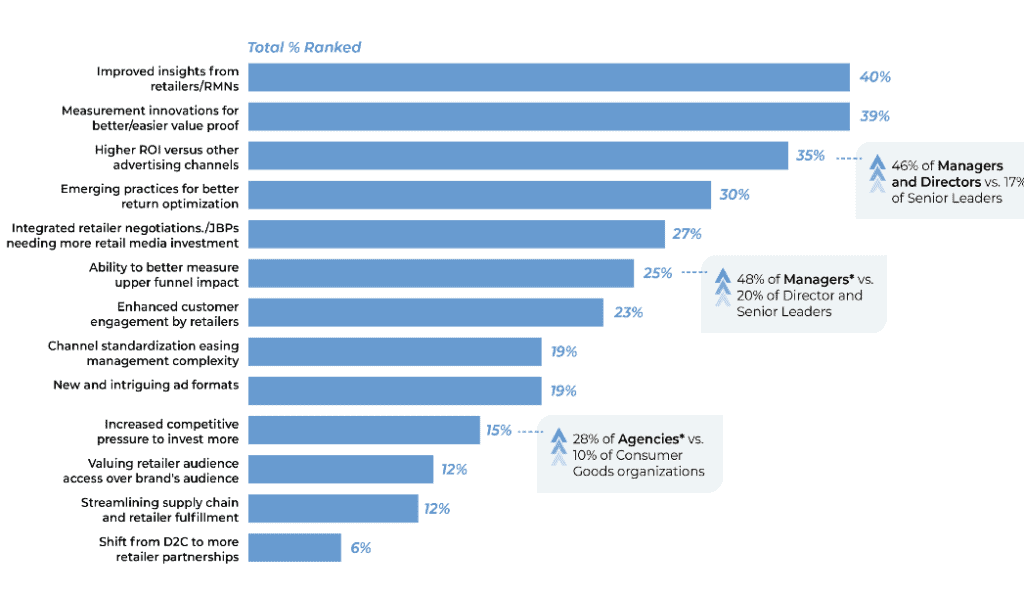

#4 What would accelerate investment in retail media in the future?

How can retailers get more budget from brands? Simple: demonstrating a higher ROI than other channels is more likely to drive action among Managers and Directors. Marketing Managers and Directors are also more inclined to invest when they can better measure upper-funnel impact. Meanwhile, agency leaders see competitive pressure as a key factor that could push CPG clients to increase their retail media spending.

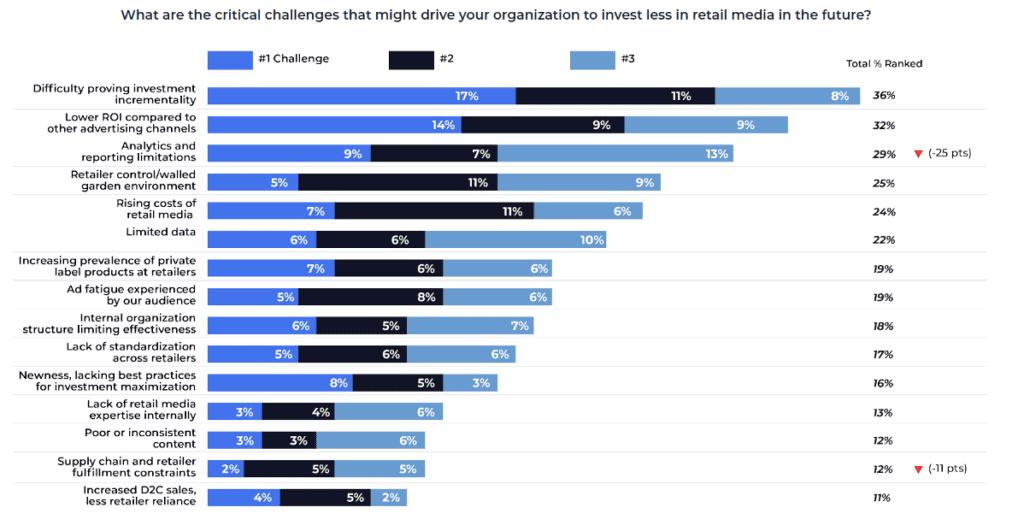

#5 What would cause brands to invest less in retail media in the future?

When asked the question about what would cause a reduction in spend on Retail Media, there should be no surprises that that ‘difficulty proving investment incrementality’, ‘lower ROI compared to other channels’, and ‘analytical limitations’ are the biggest challenges. This is the familiar lament from Retail Media conferences the world over – how can ROI be proven correctly and how can the tools show these results.

Interestingly, the increasing prevalence of private label is a challenge that might drive brands to invest less in retail media in the future.

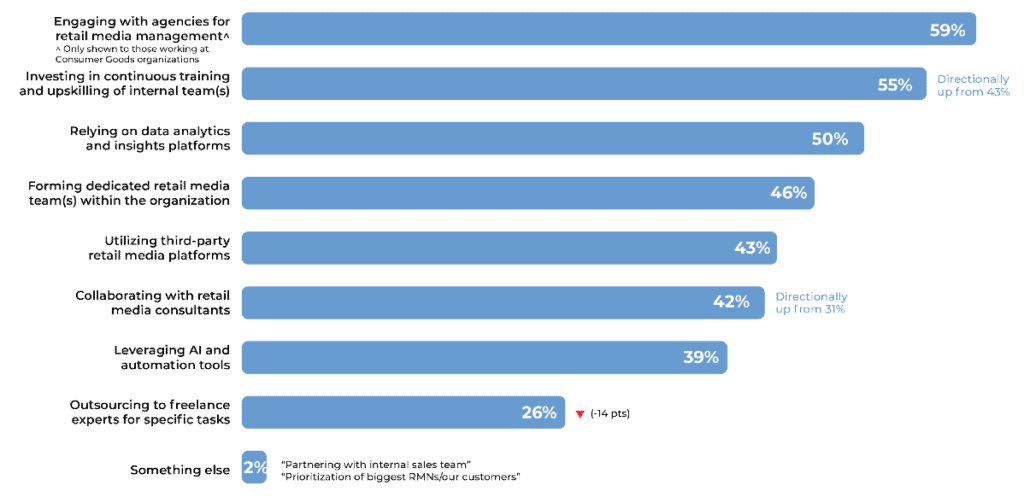

#6 How are advertisers keeping up with the continued proliferation of retail media networks?

The answer to keep up with the rapid developments in retail media, marketers are looking to external agencies for support and investing in training and leveraging analytics platforms.

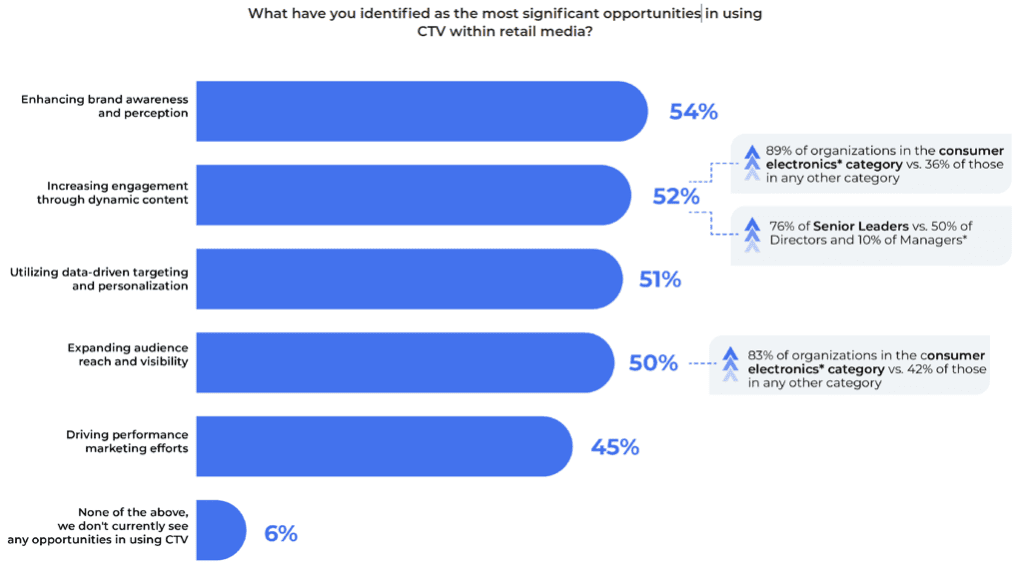

#7 What are advertisers using CTV for?

CTV is being used for what it is great at: driving brand awareness and perception, with targeting and personalisation close behind but performance marketing marked a bit lower. Given that CTV is often sold as the answer to wastage through data driven personalisation and targeting, this is an opportunity for CTV offerings. What is stopping CTV? The answers – later in the report – are budget limitations and measurement challenges and difficulties with technical integrations.

Interestingly, those in organizations allocating more budget to retail media are more likely to say they haven’t faced any challenges with incorporating CTV. More money, less problems!

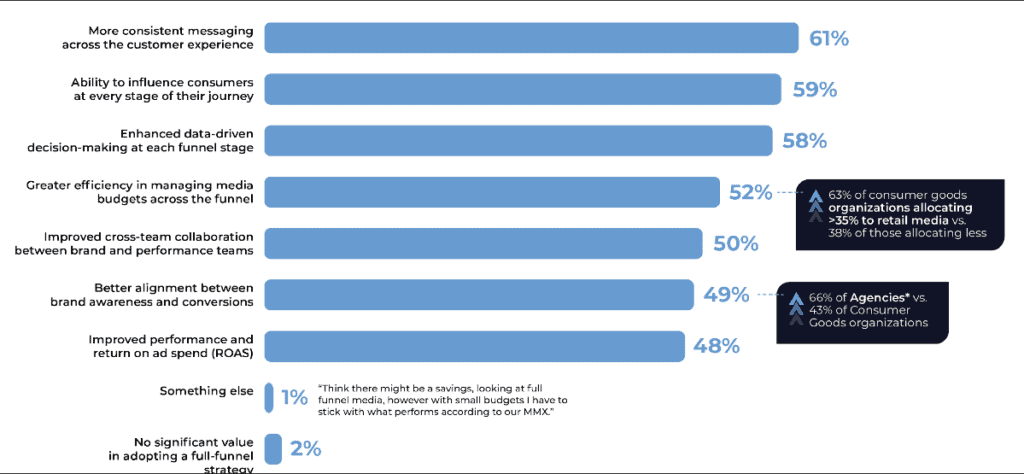

#8 What do you believe is the value of adopting a full-funnel retail media strategy?

The report has an interesting ‘take’ on the value of having a full-funnel Retail Media strategy. It should not be a surprise that marketers see a great deal of value in adopting a full-funnel retail media strategy. ‘More consistent messaging’ and ‘ability to influence right across the customer journey’ take priority. Having said that, ‘greater eifficiency in managing media budgets’ comes up, but I believe that the real benefit of Full Funnel is great EFFECTIVENESS, not efficiency, as effectiveness is what all marketers should be looking for, not efficiency.

#9 How do brands define incrementality in Retail Media?

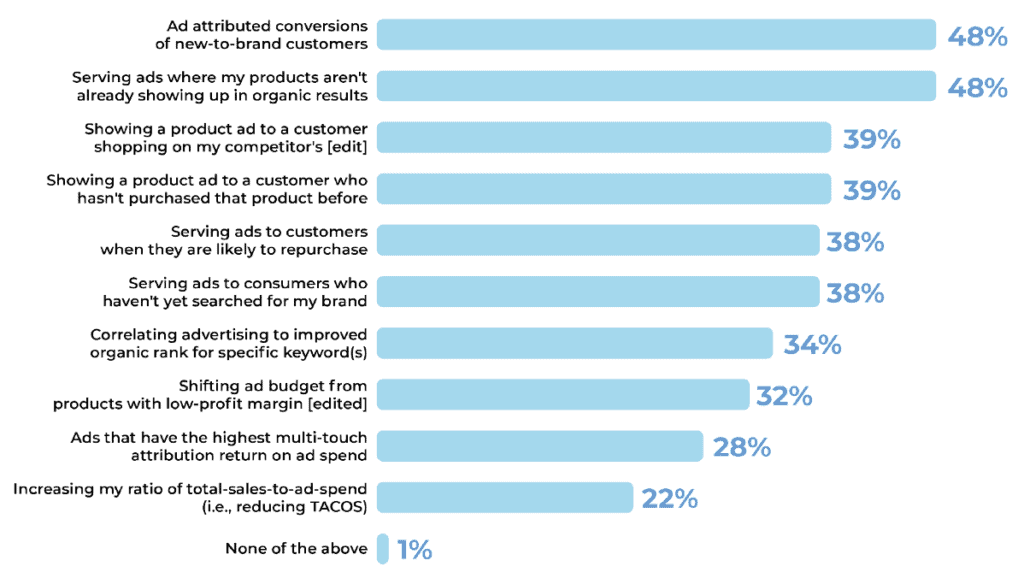

Incrementality continues to be defined in several different ways by marketing leaders. The most common definitions are ad attributed conversions of new-to-brand customers and servings ads where products aren’t already showing in organic results.

However, senior marketers are more likely to define incrementality as serving ads to customers where they are likely to repurchase. Those brands who allocate more of their budgets to retail media say they define incrementality by correlating advertising to improve organic rank for specific keywords.

Over half of organisations say they are proficient in measuring incrementality for retail media, up significantly from the previous year.

What are the challenges? Concerns about accuracy, its extensibility, and limited tools or tech to support it. The good news is that the lack of data has declined considerably as a challenge from the previous year’s survey results. Challenges in aligning internal teams around incrementality metrics is also an issue, and for agencies, a lack of internal expertise is more often a challenge. Those allocating less more often mention the costs and lack of clear methodologies or best practices.

#10 What challenges have retailers and advertiser faced with data clean rooms?

Clean room are one of the hottest technology topics in Retail Media. They offer a way to share aggregated rather than customer-level data with advertisers from Retailers. However, their adoption has been slower that you would think given that data is one of the key topics in Retail Media and collaborating with data in a secure manner that aligns with privacy rules is incredibly important. The challenge of integrating data clean rooms in existing practices and joining data with other sources is the core problem, aside from just technical expertise. New technology does come with hurdles – and data clean rooms are facing the biggest of all – working with existing practices – as this requires change management – not something every brand or retailer has the time and resources to invest in.