Retail Media presents a unique opportunity for new product launches– the chance to communicate with customers at key moments across the shopping journey. Quick Commerce (Q-Com) is the perfect channel for new product development (NPD).

Traditionally, new product development and launch often started with ideation based largely on a combination of purchasing data with anecdotal evidence from surveys and focus groups. But with this approach, so much new product development (NPD) still fails for a number of reasons:

- Lack of understanding of the target market and customer needs

- Poor or incomplete data, research and testing

- Lack of differentiation

Retail Media gives NPD Brands a unique opportunity to test with real customers at lower risk and at lower cost – and faster.

For Quick Commerce platforms, the options are even more interesting – and faster for NPD. Quick commerce delivery companies are changing shopping behaviour as well as how brands – even huge brands like Unilever bring products to market.

But before we talk about the case study from Unilever using Retail Media for NPD, let’s first understand why launching new consumer products online or in apps is hard.

Launching new products online is difficult

Launching new products online is NOT like selling through a retail supermarket. NPD requires its own unique set of capabilities and economics to make it work. Why? Because of how people shop online and in-apps.

Shoppers are increasingly discovering and deciding upon their product choices based on what they find on shopping apps, whether they are retailers or quick-delivery apps for shopping.

As a result, getting a new product discovered – and bought – requires a different ‘lens’ on how to be successful. There are different considerations for seven key reasons:

- Shoppers cannot pick up products up and reading a label online. They are searching for and reading product descriptions or scrolling through images and videos on their mobile phone

- The larger numbers of SKU’s and product ranges can make the choice over-whelming to customer

- The customers shop very quickly – shopping time is miniscule compared to shopping in person

- Customers can easily get lost online – not only because of the product range, but also due to lack of familiarity with online store layout, how to search and how to find products.

- Customers rely on favourites, shopping lists and repeat purchases

- There is a lack of sensory cues to tempt a customer into a purchase

- The opportunity for ‘discovery’ – finding out about new or interesting product by chance is limited.

The quick commerce market

Quick commerce providers have been surprisingly quick to prove that their business model can serve more than just impulse purchases. As a result, they have become a serious competitor to supermarkets in the markets they serve – and the perfect place for NPD.

According to research from consultancy, Oliver Wyman 44% of Q-Com customers in Europe order two to four times a month. The number of heavy users is high. About 8% use the fast delivery service at least five times a month, while around a third of users estimate Q-Com spending accounts for 20%-39% of their total grocery budget.

Many Q-commerce customers have noticeably changed their shopping behaviour. Half of those surveyed by Oliver Wyman even have fast-delivery services regularly bring them their entire weekly shopping. This shift has come at the expense of bricks and mortar supermarkets.

Q-Com and NPD in GCC

Q-Com delivery companies like Noon are changing shopping behaviour in The Gulf Cooperation Council (GCC) countries, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE. The Q-Com delivery market in the GCC is predicted to skyrocket to $15 billion over the next five years from the estimated $4 billion currently. The leading players such as Noon, Careem, Talabat are aiming to increase wallet shares, moving from the earlier consumer acquisition phase.

Unilever recently launched its biggest innovation in the laundry category for decades in the United Arab Emirates. The product is called Wonderwash and it was created for consumers who use short cycles to do their laundry. Regular detergents aren’t optimised to perform for the quick cycle setting on in washing machines.

Wonderwash is the first liquid detergent specifically designed for use in just 15 minutes. Unilever chose to launch this new NPD in using the q-com operator, Noon, who are rapidly scaling their ultra-fast delivery model in the region called Noon Minutes.

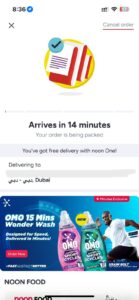

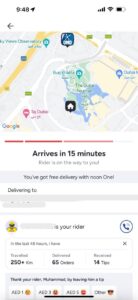

Noon Minutes offers customers over 5000+ products across groceries, electronics, essential products, toys & more with. delivery in just 15 minutes. The promise to shoppers is unlimited FREE delivery on all orders above 25 AED and the claim is to “get everything from fresh produce and household essentials to tech and baby products as fast as 15 minutes.”

Unilever worked with Noon to co-launch Wonderwash in just 3 months! The campaign to launch the product included outdoor advertising, influencers and co-branded delivery riders racing across Dubai in branded merchandise and bags. From a Retail Media perspective, Wonderwash did a full takeover on app with even the rider pin changing for every single delivery.

Wonderwash NPD Launch Retail Media in Action on Noon Minutes

Q-Com and Retail Media expert adviser, Viv Craske commented on the Wonderwash launch: “I’m a huge believer of using Q-com businesses to test new products, just as I used to advise people use Amazon to test new products. You can do stuff and get more data so much faster than working with most established omnichannel retailers.”

Crask believes that q-com businesses are a brilliant place to test product launches and campaigns at speed. Why? Because companies like Noon can:

- Think at tech scaleup speed, not retailer speed.

- Is hungry for a differentiated proposition and range.

- Has a fast and flexible retail media team.

- Is helpful with data and campaign results.

This is the key insight for FMCG brands who are unsure what to do with Q-Com delivery business. Here are some strategies to think through if you are thinking of using Q-Com platforms for NPD:

- Campaign Planning with Q-Com Platforms is different: Planning campaigns with rapid delivery platforms often looks different from working with traditional retailers. They may come with operational quirks and there would be few previous case studies or precedence. Be proactive creatively and approach planning as a joint effort. Agreeing early on what good looks like to help set expectations and supports future media decisions.

- See Q-Commerce as Full-Funnel Tool: Quick commerce plays a distinct role and shouldn’t be treated as just a lower-funnel channel. Think about all the opportunities to target shoppers during urgent or convenience-driven moments and steer them toward conversion within the app.

- ROI Might Not Be Immediate: Expecting immediate returns from the start isn’t always realistic. Q-com campaigns may initially be better suited to achieving goals such as product trial, awareness, or targeting specific audiences. Despite lower impression volumes, strong first-party targeting and contextual relevance can help build brand equity.

- Tap into Shopper Missions: Q-commerce offers a chance to align with specific need states. Consider “Netflix” or “Big Match” need states when consumers are at home and don’t want to leave. This creates a perfect opportunity for brands to team up with platforms to deliver snacks, drinks, or essentials exactly when they’re needed, offering shoppers a timely and seamless solution.

For more on retail media check out our Retail Media: Onsite 2025 report.

The new report takes a look at what onsite retail media is, the models underpinning its operation, the measures of success and steps to create an onsite retail media strategy, drawing on extensive sector research and analysis.

Retail media will also be discussed in person this May as Retail MediaX uncovers the opportunities for scaling RMNs, powered by retailers, brands and agencies across three compelling content tracks.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.