Speculation that Walmart may yet open its marketplace in the UK will have many merchants and brands licking their lips – but how likely is it?

The UK market is dominated by Amazon, which takes around 30% of the ecommerce market and, with more shoppers than ever looking to marketplaces for a one-stop-shop approach to, well, shopping, it is likely that this percentage may yet creep higher.

There is a also an increasingly competitive strata of SME retailers, brands and merchants in the UK competing for eyeballs and wallets in a market that is about to become even more price-conscious as the cost of living crisis starts to bite. This too is likely to up the ante in the general and mixed marketplace market and give these retail platforms an edge over D2C brands when it comes to price.

Together, this innate popularity of marketplaces and the race towards bargain basement retail is likely to make the UK market very attractive to Walmart. It has already seen stellar growth in the US, surpassing stalwart number two, eBay, in the US marketplace rankings to take it to the within sniffing distance of Amazon. The same could easily happen in the UK.

Walmart already has a presence here – well, it maintains a voice on the board of Asda, which it once owned – giving it a ‘trusted supermarket’ feel to consumers. It also places it well against the likes of the big four supermarkets in the UK, all of which harbour desires to be quasi-marketplaces sites, leveraging their wide inventory and growing omni-channel presence.

What may put Walmart off, however, is the very fact that the UK market is ripe for more marketplace competition. None of these reasons why the UK looks such as attractive proposition to marketplaces have gone unnoticed by the likes of Alibaba and SHEIN, among others.

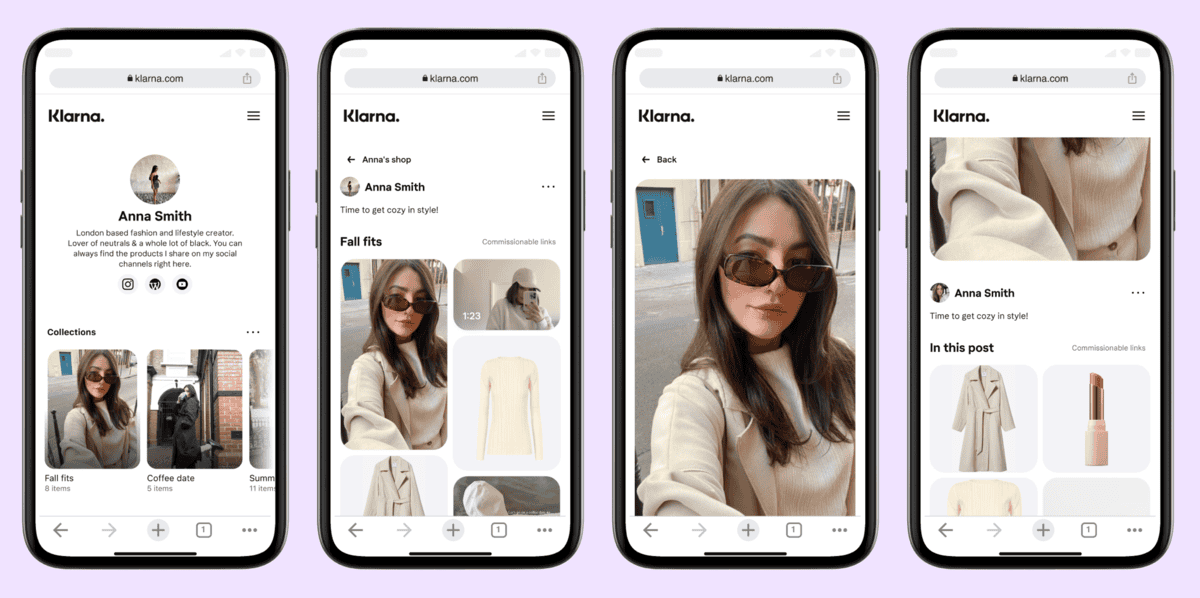

These Chinese uber-marketplaces are already starting to establish themselves in the UK – and everywhere else – with growing sales. They have also already started to pioneer the use of inspirational technologies such as live streaming and the virtual events across successive Singles’ Days.

UK consumers themselves are also increasingly avid cross-border shoppers, making the location of the marketplaces they deal with less significant than it once was and opening up the marketplace sector to yet more competition.

That said, Walmart could still be a shoe-in for the number two spot in the UK and it seems that, with its Meet Walmart event taking place later this month and with the retailer having a UK head of business development, it looks likely that it may yet give it a go.