RetailX’s latest look at the Europe Homeware Sector in a brand new report highlights that as younger customers become homemakers, speedy delivery, ethical sourcing, sustainable production and delivery are becoming key drivers of this once thought of “staid” sector.

One of the overarching advantages of buying homeware online – particularly larger items – is having it delivered to the home. Indeed, having goods delivered is the most important aspect for homeware buying, trumping even buying instore then having it delivered to the home.

55% of homeware shoppers across Europe choose to order online and have delivery to the home, a figure that rises to almost 80% when looking at those who do it all the time and those who often choose it.

This compares with 34% of instore shoppers who regard instore ordering and home delivery as a must or frequent choice. This is lower even than those who choose to order online and collect instore (41%) and those who have ordered online and collected from a distribution point (48%). This points to online gaining considerable traction among consumers who view delivery or collection from a location of their choosing to be an important consideration when selecting who to buy from.

This decision process is driven not only by convenience but also by speed. More than half (53.2%) of Europe’s online homeware consumers see next-day delivery as an important factor when choosing all of their homeware purchases (18.7%) or most of them (34.5%). Just 14% see it as unimportant.

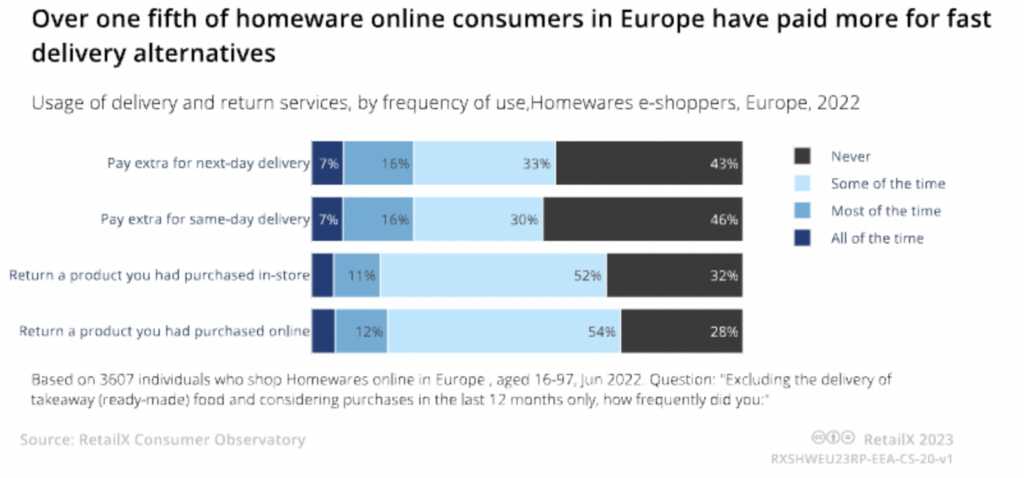

Such is the importance of this speed and convenience for homeware shopper that almost a quarter of them (23.6%) pay extra for same-day delivery, while (23.8%) pay extra all or most of the time for next-day delivery. This demand for instant gratification makes fast delivery a significant factor in consumers’ choice of homeware. This is further evidence of homeware becoming more aligned with fashion shopping, with shoppers looking to receive their homeware purchases rapidly to their homes, much as they do with clothing and footwear.

This also points to how the homeware sector is slowly but surely becoming the preserve of Millennials and Gen Z, who, as they get on the property ladder, set up their own homes and have families, are migrating the online habits they have picked up in other sectors to the furnishings market.

ETHICS AND SUSTAINABILITY

The shift to a younger consumer base is impacting how homeware companies must act in the world. 73.5% of homeware consumers surveyed across Europe by RetailX say that the retailers they choose must be ecologically sustainable. Yet the homeware sector has a poor record with sustainability, with its manufacturing processes being energy and raw material intensive.

As homeware become more of a fashion item, it also contributes a disproportionate amount of waste to landfill, with a study pointing to some 25% of landfill waste coming from the sector[1]. As the sector adopts a more fashion-driven mindset, there could be a drift towards more rapidly made, cheaper to buy and more readily replaced homeware items that is exacerbating the problem of waste. With consumers torn between wanting to live more sustainably and having to survive on less disposable income, the problem remains. This also impacts delivery, with 60.2% wanting to see their homeware goods being transported – both to market and to their front door – in more sustainable ways, Many are even prepared to pay a premium to do so.

Environmentally friendly production and distribution aren’t the only ethical questions posed to homeware sellers by consumers. Alongside wanting to see lower environmental impact, many are also concerned about the working conditions and welfare of those tied up in supplying the sector with materials and in the manufacture of the items themselves. 38.9% strongly agree with wanting to see staff and their communities being treated properly, a figure that rises to a colossal 94.4% when you look at those who agree as well.

As a result, many ethical and sustainably sourced homeware and furniture brands are springing up across Europe, including companies such as Swyft, Wearth, Nkuku, Natural Collection and Sostrene Green. All of these are looking at using sustainable materials, sustainably powered manufacturing processes and culturally sensitive worldwide work practices to produce their products. They all also sell at a premium, although there are still enough consumers willing to pay to make this viable.

Testament to this is Ikea, the biggest player in the homeware space, now being listed among the more sustainably minded vendors in the sector. While not a sustainable brand per se, it has a growing number of ‘green’ initiatives underway, which marks how even mainstream retailers in this space recognise that their methods of production, the materials they use and their overall ethos need to be become more environmentally and ethically focussed in order to secure the custom of the new breed of homeware shoppers across Europe.

This feature was authored by Paul Skeldon and originally featured in the Europe Homeware Sector report 2023