Unlike with many sectors, the Covid-19 pandemic didn’t boost online sales in the European luxury sector it took until 2022 for the sector to claw its way back to revenues close to its 2019 high.

However, since then, as physical travel and retail have picked up again, Europe’s luxury sector has done sterling work in combining its new-found technology with its traditional retail model.

The resulting model has placed the European luxury industry at the forefront of the hybrid, multichannel, omnichannel retail world, driving forwards not only its own business but becoming the outlier for new retail platforms such as the metaverse.

InternetRetailing summarises some of the findings reported in the 2023 RetailX Europe Luxury Sector report.

The role of physical retail

According to the report, the European Luxury Sector has been highly reliant on physical retail, with as much as 80% of sales last year taking place in-store.

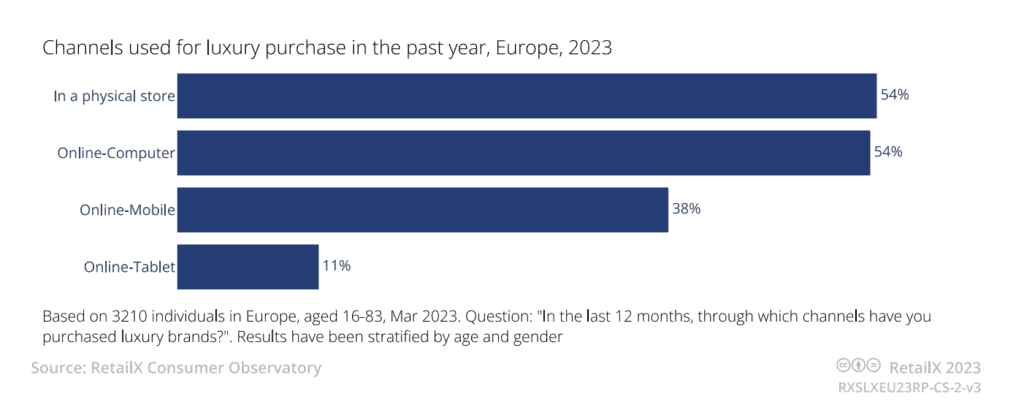

Notably, the findings added that customers are equally shopping online and in-store (53.96% and 54.47% respectively), with 38.26% shopping on mobile devices and 11% using tablets.

“This belies some more subtle changes that have occurred post-pandemic,” the report said.

“While there is still a propensity to shop online, digital channels have become part of a complex path to purchase that takes in online research, visits to stores, social media and, as we shall see overleaf, even the metaverse.”

“This has been driven by customer behaviour in the first instance but has been accelerated by the luxury brands and retailers themselves, many of which invested heavily in digital during the pandemic.”

Inflation’s impact on the luxury landscape

As the fashion sector tries to rebound from the challenges posed by the Covid-19 pandemic, it now faces high inflation rates, which have notably impacted both domestic and international luxury sales.

This has particularly been felt in Europe influencing the behaviour of domestic customers and reverberating across key markets like China and the United States.

Research by RetailX found that 55.8% of Europe’s shoppers see discounts and reduced prices as very important when shopping luxury online.

Additionally, the European region has been hit harder by inflation and cost-of-living price rises.

Willingness to invest in sustainability

Alongside the interest in sustainability, shoppers are also willing to invest in sustainable luxury.

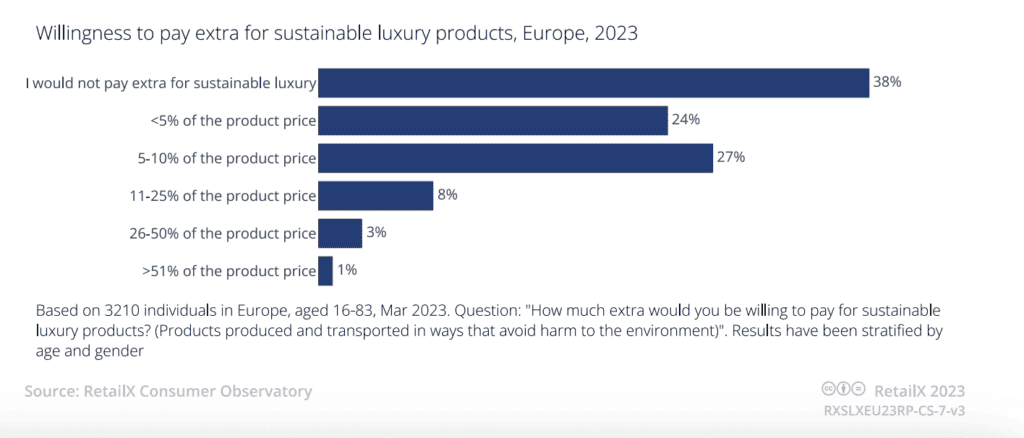

Around 77% of European shoppers in Europe have revealed they are interested in buying sustainable luxury products, with 51% of them even willing to pay up to 10% extra for items sustainabilily made or shipped, new research has revealed.

Some customers (8%) added that they would even be willing to pay up to 25% extra.

The data also revealed that 54% are interested in purchasing second-hand luxury items, with 47.6% of these shoppers already seeing as much as half of their luxury purchases in 2022 being ‘pre-loved’.

The move of paying a premium for sustainability and shopping second-hand reflects a shift in mindset that places value on long-term impact over short-term gratification.

Fashion and accessories: A prime attraction

When it comes to what these shoppers are buying, the bulk of European luxury ecommerce customers are shopping for fashion apparel and accessories, with 62% of them buying one or multiple items.

Cosmetics and beauty bought by 51% of consumers, with flowers and gifts attracting 52%.

The report concluded: “While luxury cosmetics and beauty have always been a strong segment of both the luxury sector and the fashion market, the rise of luxury apparel is further evidence that consumers are looking to luxury and affordable luxury as a replacement for, or even an antidote to, fast fashion.“

Click here to view:

Click here to download the report, which features 38 pages of market-leading research into the European Luxury Sector, 39 illustrative RetailX figures, charts and graphs and nine company profiles including: Fendi, Louis Vuitton, Ray-Ban, Pandora and Vivienne Westwood.