With November having started, the countdown to this year’s Singles Day has officially begun. Singles Day is the biggest online shopping festival of the year. And every year, it breaks last year’s sales records – 2019 was no exception. In 2019, Alibaba hit a new sales record of $38.4 billion in gross merchandise value on its ecommerce platforms Tmall and Taobao. Singles Day also serves as a trend barometer as usually new marketing trends become mainstream. As Alibaba has already kicked off its pre-sale period for Singles Day on October 21st, we saw some changes coming up in this year’s Singles Day. Let’s take a look at three updates for this year’s Singles Day.

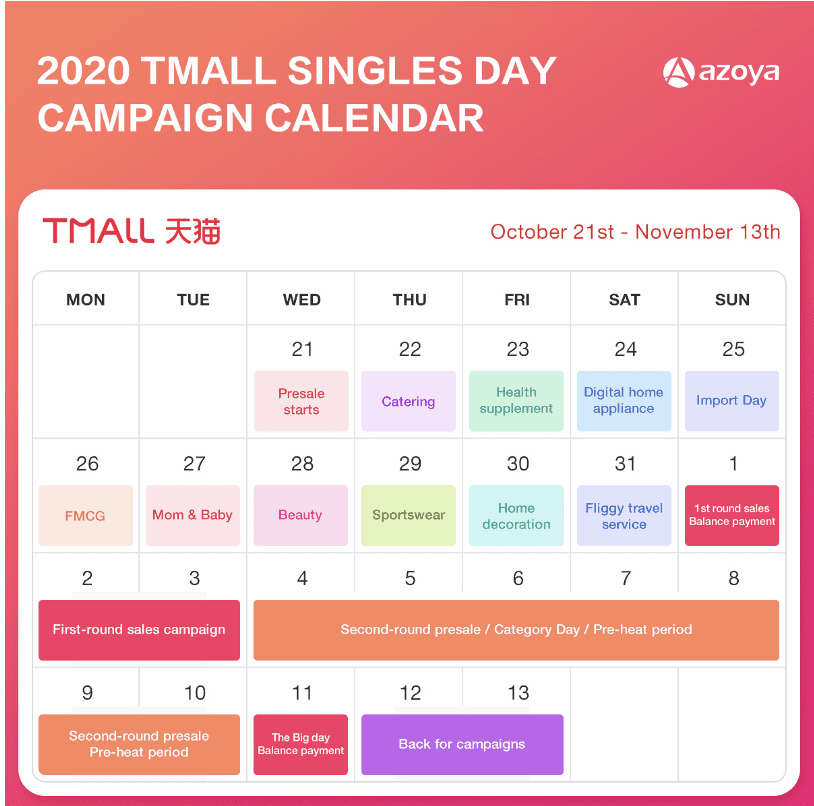

Singles Day 2020 calendar

Singles Day turns into Singles Season with two selling windows

Singles Day’s pre-sale usually started in late October in the past, but customers could only complete the purchase on November 11th. This year is different. Two sales periods with two pre-sale windows have extended this year’s shopping extravaganza.

This new setup is a great way for retailers and brands to increase their sales by leveraging this “double” Singles Day. They cannot only develop respective marketing strategies for these two sales windows toward different product lines, product portfolios, pricing strategies, and promotional items but they can also adjust their strategy for the second sales period based on the first window’s performance from November 1st to 3rd.

Short videos are all the rage in content marketing

Content Marketing is playing a crucial role in the online consumer journey, especially when it comes to discovering new brands or products. Short videos – as well as livestreaming – have proven to be a good method of not only getting consumer’s attention but also make them hit the buy button. No wonder, short videos are all the rage in China.

A report by QuestMobile shows that the monthly active users for short-video products in China have reached an incredible 852 million this summer. Seven out of ten mobile internet users are using short video platforms. To find inspiration and new goods they could purchase.

Since the lines between e-commerce and content platforms have started to disappear it does not come as a big surprise that Chinas biggest e-commerce platform Taobao is trying to leverage short video’s success for its business. Taobao Mobile has recently revamped its video offerings – just in time for Singles Day. With the updates, brands can produce even more high-quality video content. There are several changes that may seem small but will have an impact on the sales journey. In its previous version, banners showed on the top of the homepage in horizontal, mainly graphic design. After the upgrade, banners were moved down and replaced by the recommendation feed – “Guess You Like” in a vertical version. This new model enables brands and retailers to enrich their content into short videos, livestreaming, and graphic design.

Taobao has officially suggested its merchants to use short videos to cover 70% of product descriptions. Brands and retailers could leverage this new feature to create more high-quality and attractive content to win over Chinese customers.

The livestreaming market is diversifying

Alibaba’s livestreaming unit Taobao Live recorded a sale of RMB 20 billion (GBP 2.3 billion) during Singles Day last year and we see that commerce livestreaming will play an even more significant role this year. Whilst many merchants have noticed the importance of traffic driving and sales impact of Taobao Live, I would also recommend to looking at other platforms, in particular Douyin, Kuaishiou and WeChat Mini Programs.

Douyin

Douyin is the Chinese version of ByteDance’s short-video platform TikTok. The platform has monthly active users (MAU) of 518 million with abundant high-quality content. In the past, brands and retailers used Douyin’s livestreaming channel to drive traffic to their online stores on Taobao or JD.com. As of recently, the links to external e-commerce platforms has been cut. Mostly to fuel their own e-commerce unit.

With the link to external ecommerce players being blocked, sellers need to re-think their strategy for Douyin in this Singles Day. There are different ways to do so, for example by using it as a content marketing channel for branding and promotion or establish a Douyin store to convert traffic into sales.

Kuaishou

Kuaishou is Douyin’s mail rival when it comes to its short video success and its e-commerce has more than 100 million daily active users (DAU). For this year’s Singles Day, Kuaishou will partner with China’s leading television network Jiangsu Broadcasting Corporation (JSBC) to kick off Singles Day 2020 with a large-scale event – “Kuaishou Night” on October 30th. This event is to bring together more than 30 celebrities and several top talents.

In addition to that, Kuaishou will cooperate with 12 top celebrities and KOLs to launch a series of e-commerce livestreaming sessions from October 30th to November 11th. It is expected to drive massive traffic to the platform during Singles Day.

WeChat Mini-Program

WeChat has only launched livestreaming on its mini-programs this year. And while they seem to be late to the party, they are kicking it off right. China’s leading innovative beauty brand Perfect Diary was the first beauty brand to start livestreaming in the WeChat mini-program. In February, 50 makeup artists from Perfect Diary offline stores held 50 mini-program livestreaming simultaneously. During these sessions the purchase conversation rate was over two times higher than on other platforms.

Plus, we saw some international brands, e.g. Sephora, Estee Lauder, and Lancome, launching livestreaming on WeChat’s Mini-program. WeChat may be late to the game but is already showing great potential.

All in all, it’s going to be an exciting Singles Day bound to break some records and showing whether these changes will have a lasting impact to China’s ecommerce market.

Author:

Elena Gatti is managing director of Europe Azoya

You are in: Home » Guest Comment » GUEST COMMENT: Singles Day 2020 – what’s new, what’s different

GUEST COMMENT: Singles Day 2020 – what’s new, what’s different

Elena Gatti

With November having started, the countdown to this year’s Singles Day has officially begun. Singles Day is the biggest online shopping festival of the year. And every year, it breaks last year’s sales records – 2019 was no exception. In 2019, Alibaba hit a new sales record of $38.4 billion in gross merchandise value on its ecommerce platforms Tmall and Taobao. Singles Day also serves as a trend barometer as usually new marketing trends become mainstream. As Alibaba has already kicked off its pre-sale period for Singles Day on October 21st, we saw some changes coming up in this year’s Singles Day. Let’s take a look at three updates for this year’s Singles Day.

Singles Day 2020 calendar

Singles Day turns into Singles Season with two selling windows

Singles Day’s pre-sale usually started in late October in the past, but customers could only complete the purchase on November 11th. This year is different. Two sales periods with two pre-sale windows have extended this year’s shopping extravaganza.

This new setup is a great way for retailers and brands to increase their sales by leveraging this “double” Singles Day. They cannot only develop respective marketing strategies for these two sales windows toward different product lines, product portfolios, pricing strategies, and promotional items but they can also adjust their strategy for the second sales period based on the first window’s performance from November 1st to 3rd.

Short videos are all the rage in content marketing

Content Marketing is playing a crucial role in the online consumer journey, especially when it comes to discovering new brands or products. Short videos – as well as livestreaming – have proven to be a good method of not only getting consumer’s attention but also make them hit the buy button. No wonder, short videos are all the rage in China.

A report by QuestMobile shows that the monthly active users for short-video products in China have reached an incredible 852 million this summer. Seven out of ten mobile internet users are using short video platforms. To find inspiration and new goods they could purchase.

Since the lines between e-commerce and content platforms have started to disappear it does not come as a big surprise that Chinas biggest e-commerce platform Taobao is trying to leverage short video’s success for its business. Taobao Mobile has recently revamped its video offerings – just in time for Singles Day. With the updates, brands can produce even more high-quality video content. There are several changes that may seem small but will have an impact on the sales journey. In its previous version, banners showed on the top of the homepage in horizontal, mainly graphic design. After the upgrade, banners were moved down and replaced by the recommendation feed – “Guess You Like” in a vertical version. This new model enables brands and retailers to enrich their content into short videos, livestreaming, and graphic design.

Taobao has officially suggested its merchants to use short videos to cover 70% of product descriptions. Brands and retailers could leverage this new feature to create more high-quality and attractive content to win over Chinese customers.

The livestreaming market is diversifying

Alibaba’s livestreaming unit Taobao Live recorded a sale of RMB 20 billion (GBP 2.3 billion) during Singles Day last year and we see that commerce livestreaming will play an even more significant role this year. Whilst many merchants have noticed the importance of traffic driving and sales impact of Taobao Live, I would also recommend to looking at other platforms, in particular Douyin, Kuaishiou and WeChat Mini Programs.

Douyin

Douyin is the Chinese version of ByteDance’s short-video platform TikTok. The platform has monthly active users (MAU) of 518 million with abundant high-quality content. In the past, brands and retailers used Douyin’s livestreaming channel to drive traffic to their online stores on Taobao or JD.com. As of recently, the links to external e-commerce platforms has been cut. Mostly to fuel their own e-commerce unit.

With the link to external ecommerce players being blocked, sellers need to re-think their strategy for Douyin in this Singles Day. There are different ways to do so, for example by using it as a content marketing channel for branding and promotion or establish a Douyin store to convert traffic into sales.

Kuaishou

Kuaishou is Douyin’s mail rival when it comes to its short video success and its e-commerce has more than 100 million daily active users (DAU). For this year’s Singles Day, Kuaishou will partner with China’s leading television network Jiangsu Broadcasting Corporation (JSBC) to kick off Singles Day 2020 with a large-scale event – “Kuaishou Night” on October 30th. This event is to bring together more than 30 celebrities and several top talents.

In addition to that, Kuaishou will cooperate with 12 top celebrities and KOLs to launch a series of e-commerce livestreaming sessions from October 30th to November 11th. It is expected to drive massive traffic to the platform during Singles Day.

WeChat Mini-Program

WeChat has only launched livestreaming on its mini-programs this year. And while they seem to be late to the party, they are kicking it off right. China’s leading innovative beauty brand Perfect Diary was the first beauty brand to start livestreaming in the WeChat mini-program. In February, 50 makeup artists from Perfect Diary offline stores held 50 mini-program livestreaming simultaneously. During these sessions the purchase conversation rate was over two times higher than on other platforms.

Plus, we saw some international brands, e.g. Sephora, Estee Lauder, and Lancome, launching livestreaming on WeChat’s Mini-program. WeChat may be late to the game but is already showing great potential.

All in all, it’s going to be an exciting Singles Day bound to break some records and showing whether these changes will have a lasting impact to China’s ecommerce market.

Author:

Elena Gatti is managing director of Europe Azoya

Read More

You may also like

Subscribe to our email community