RetailX’s latest look at the world’s ecommerce and multichannel retail markets has highlighted that globally consumers understand how ecommerce works, although it still pays to understand localised consumer behaviour.

The newly published RetailX Global ecommerce 2023 report asks is a global retail culture developing?

It can sometimes seem this way, certainly when you are talking about the luxury end of the market. For example, British luxury fashion house Burberry’s current strategy is to grow to become a £5bn ($6.1bn) revenue brand delivering a profit margin of more than 20%. That this seems ambitious yet credible is in part down to the way the company has built a reputation as a distinctive brand, contemporary yet timeless for the way the Burberry name conjures up ideas of traditional workmanship and quality. It helps too that Burberry has its own signature products – its trench coats along with items using its Burberry check.

Yet high standards and distinctive products are not in themselves enough to guarantee global reach – or indeed reach the right customers – as hooligans adopted its check. In subsequent years, Burberry has been noticeably careful about those it tries to reach, to the point of being criticised on environmental grounds when it was reported the company had destroyed unsold goods rather than risk the items being stolen or sold cheaply. Better, it would seem, to sell to a highly mobile and wealthy clientele online and via carefully sited stores – 13 in London alone – than risk reputational damage by having the ‘wrong’ people purchase goods.

Burberry’s target customers, then, are the epitome of global consumers. It is able to define who these customers are because of its reach, reputation and, thanks to the advent of ecommerce and digital technologies, granular information about the purchase patterns of individual customers. Within this overall picture, the company’s digital offering pays particularly close attention. One reason this has worked so well is because it has occurred as consumers around the world have collectively reached an understanding of how ecommerce works. Our behaviour has converged and if, like Burberry, your business can offer a superb digital experience internationally, this can acts to the advantage of the retailer or brand.

All of which could sound like an argument against localism, which it certainly is not. This is because no matter how much consumer behaviour converges, there will always be points of divergence in behaviour across different countries and regions. A more useful lesson to take is to realise that, in a global market, understanding the nuances of consumer behaviour allows companies to make subtle adjustments in order to drive sales.

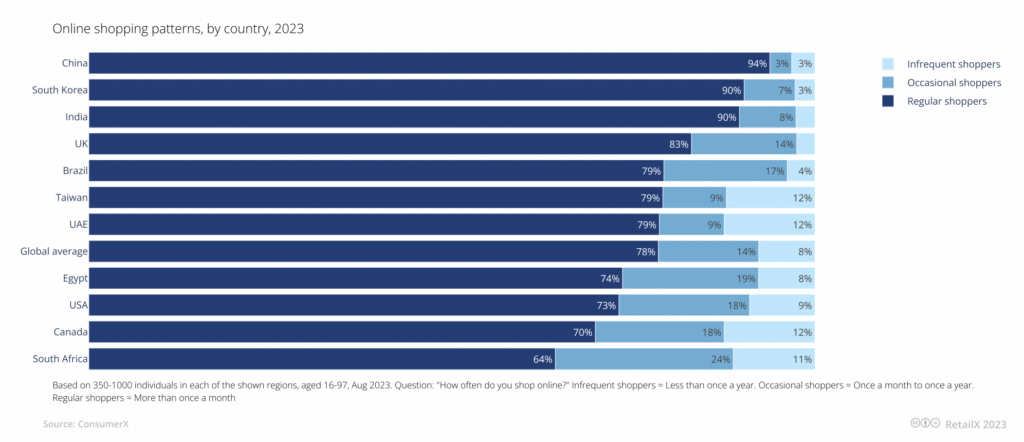

As this graphic, generated from RetailX Consumer Observatory research, demonstrates, there are significant differences in consumer behaviour across different countries and regions. Globally, 78.4% of respondents describe themselves as regular online shoppers. In China and South Korea, that figure rises to 93.8% and 90.3% respectively. In South Africa, the figure is 64.3%. Perhaps surprisingly, in the USA and Canada, the respective figures are 73% and 69.8%.

Yet the percentage who shop online does not correlate to how much consumers spend. In Taiwan, for instance, 46.6% of respondents say they spend more than $1.3k per month online. The equivalent global figure is 12%, while UK shoppers likely spend less but more often, so that just 5% spend more than $1.3k per month.

Globally, consumers are keen on subscription services, with 60% of those surveyed saying they had signed up for such services. China, at 80.4%, leads the way here, but even in South Africa the equivalent figure is 42.3%. We need to do more research to drill into the details behind these figures. Surely, not everyone can be signing up for Prime.

China also leads the way in social commerce, where 81.6% says they have used social commerce. In contrast, the equivalent figures for unsociable consumers in the UK and Canada are, respectively, 25.4% and 24%. It will be intriguing in the years ahead to see if the growth in techniques such as livestreaming shifts these numbers.

Finally, It’s intriguing to look at attitudes towards delivery. In China and India respectively, 37.2% and 36.7% of consumers say the availability of next-day delivery was an important factor in all purchases. In the UK, where free delivery is often offered, the equivalent figure is 8.5%. To summarise, for all the growth of a kind of global ecommerce culture, regional and territorial differences still matter. Those businesses that succeed internationally will likely be the ones keeping a constant eye on the smallest of details.

This feature was authored by Jonathan Wright and originally appears in the RetailX Global ecommerce 2023 report. Download it in full to discover:

- A global overview of online shopping behavior around the world illustrated with concise easy-to-read graphics

- What advantages does Africa gain having gone straight to mobile?

- The technological advancements that Europe’s mature ecommerce markets have made :- Web 3.0, NFT’S and Cryptos

- Category Analysis of each region’s Largest 100

- Global issues – how conflict, climate change and market volatility effect how we all do business

- Were we correct in the issues we highlighted for 2023? What’s likely to be important to the retail sector in 2024?