Most leading retailers adapted successfully to the onset of Covid-19 thanks to changes in strategy and operations, new analysis suggests.

GlobalData analysis of the top 25 stockmarket listed global retailers found that more than half of them reported revenue growth of more than 5% during the year – even though it was one of the most difficult that many retailers have gone through. Almost a third reported revenues growing by at least double digits. Some 70% reported growth in earnings – and more than half reported double digit growth in net income, with seven reporting earnings growth of more than 50%.

Online shopping had an in-built advantage in a year marked by Covid-19 lockdown measures and by rising demand for contactless delivery services, says GlobalData business fundamentals analyst Keshav Kumar Jha, adding, “The major ecommerce firms, including Amazon, Alibaba, and JD.com, reported a significant increase in the number of active customers annually on their retail marketplaces, which enabled them to register growth, with each company reporting over 25% year-on-year (YOY) revenue growth.”

The only non-pureplay to see its revenue rise by more than 20% was Lowe’s, which saw its like-for-like sales rise by 14% and average order value by 12%. But Seven & I was the only retailers to report a double-digit fall in its YOY revenue.

Online retailers and marketplaces also benefited from lower Covid-19 costs since they did not have stores to make safe. Despite this French supermarket Carrefour was among the retailers reported operating profits up by more than 40%. Jha says: “Amazon, JD.com and Carrefour reported over 40% growth in operating profit. Impressive growth in revenue was offset by the impact of the increase in operating expenses on the profitability of Amazon and JD.com, while Carrefour’s cost-containment measures resulted in a 4% decline in its operating expenses.”

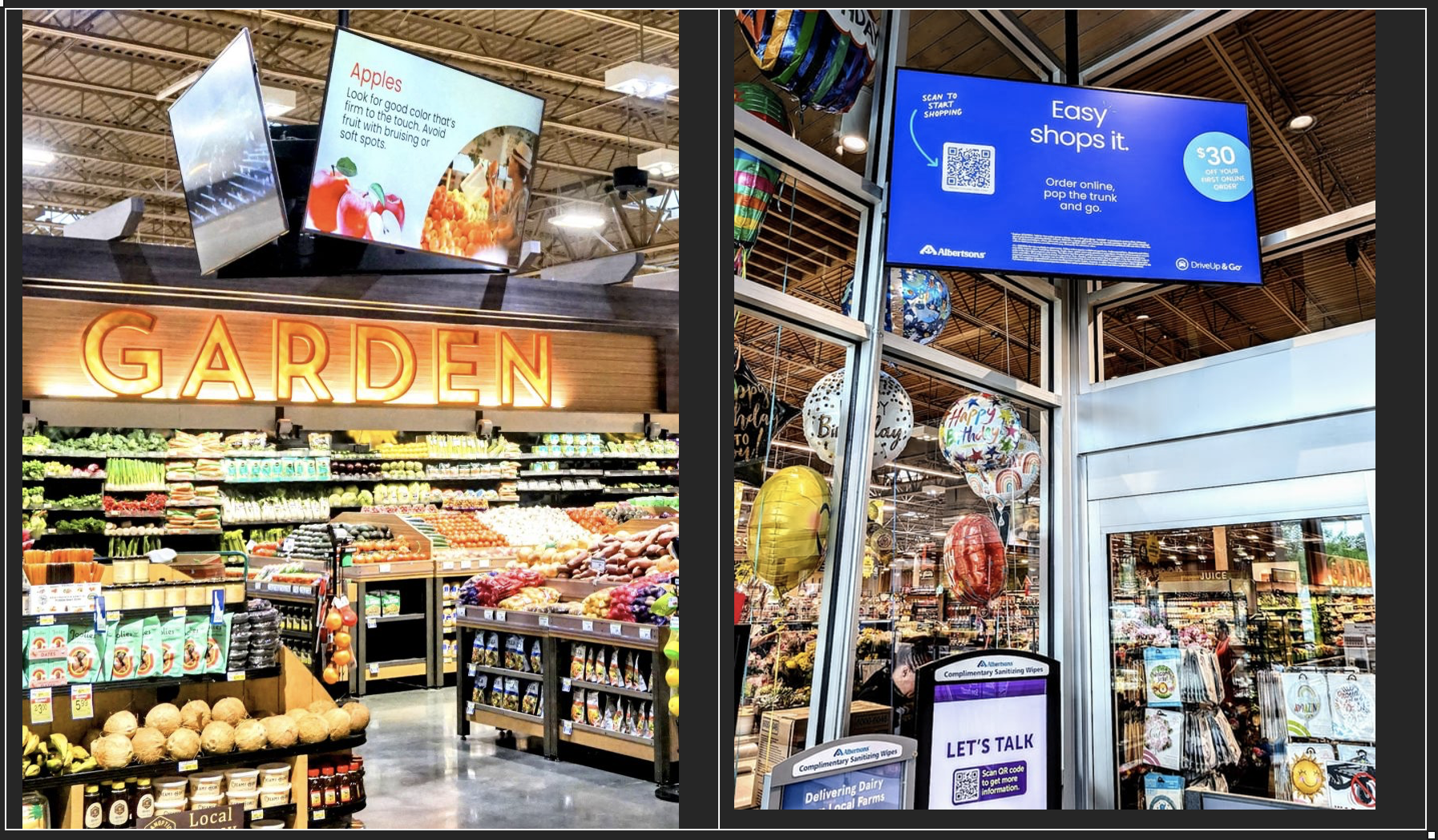

Harder hit were Boots owner the Walgreens Boots Alliance and AEON, with operating and net profit were both more than 50% lower than the previous year. “Higher revenues, improved operational performance and increases in other income – alongside reduction in expenses – led to an increase in the net earnings of Amazon, Kroger, JD.com and Albertsons,” says Jha. “The cost-optimisation initiatives of Tesco and George Weston helped improve their net earnings.”