One of the most vexing questions in retail right now is mobile payments. It has been hovering around like a bad smell for some time, and the launch of Apple Pay this autumn and the announcement that Zapp now has most major UK retailers on board only seeks to stoke things up further. Paul Skeldon investigates the latest developments.

The reality is that we are no nearer mobile payments in any real sense in retail than we were this time last year – I still can’t go into a shop and whip out my mobile to pay for stuff.

The hoopla surrounding Apple Pay however has focussed people’s minds on mobile payment in retail and, while we won’t be seeing it in action in the UK or Europe for quite some time, it could well be the spark that lights the fire. Apple has form with doing that.

“Consumers and leading retailers will adopt Apple’s unique combo of per-transaction security and fingerprint ID”, Forrester Research analyst Denee Carrington writes in a recent report on Apple Pay. “For now, 90% of point-of-sale terminals and 59% of smartphone owners can’t use Apple Pay. However, Apple Pay will reshape the market and merchants should plan for growth as Apple’s competitors respond.”

The key thing about mobile payments is whether anyone wants them. The consumer hunger appears to be there. A McKinsey study into mobile payments carried out in late 2013 found that 37% of consumers it surveyed thought it highly likely that they would be using mobile to pay for stuff in store by 2018; 35% thought it likely.

More recently, a Deloitte study found that 72% of people have used a mobile in store and that 50% of those would use it to pay. And PayPal research finds that 32% of people would rather lose their wallet than their phone. Whether this proves they want to use mobile to pay is a moot point: but it does show that the mobile is now considered to be the device of choice for getting through your day.

“For us mobile as a payment tool is already a reality,” says Rob Harper, Director and Head of Retail Services for PayPal UK and Ireland. “A fifth of our transactions are already on mobile. Consumers use mobile payments already.”

RETAILER BUY-IN

What of retailer buy in to mobile payments? The agreement between Zapp and a host of major UK retailers to start using the nascent mobile payment technology shows how retailers are keen to embrace mobile as a payment tool, because it is what their customers want.

“We know that the way that our customers shop is changing and we’re always looking at new and innovative ways to improve the experience,” says Jon Rudoe, Digital and Technology Director at Sainsbury’s . We’re one of the first retailers to sign up to Zapp to give our customers a quick, secure and convenient option to pay – both online and at the till.”

This is echoed by Paul Fielding, Group Treasurer of Asda , who says: “Our customers want to have choice, not only of what they buy but how they buy it, and Zapp will represent a fantastic addition to our payment options.”

And Shop Direct’s Group E-commerce Director Jonathan Wall expresses similar sentiments when he says “Shop Direct are excited to be working with Zapp to make it easy for our customers to pay their accounts online and shop with our brands. Mobile payments are a key area of innovation for us and Zapp are definitely one of the winners in this area”.

So, with retailer and consumer buy-in in place we should start to see a raft of mobile payments tools start to arrive across retail. Apple in the US will no doubt offer some insight into uptake in the run up to Christmas, and then through 2015 we will see a plethora of mobile payment tools burst through into mainstream use.

However, this could well be the problem: the plethora of payment tools. There are so many proposed payment tools out there, using everything from NFC to Bluetooth, to PayPal, to the web, to text, to stored value cards, to wallets that no-one can really see how this is going to play out.

Consumers will start to gravitate towards the technologies that suit what they do and that are easiest to use, but retailers can’t afford to sit and wait for that to happen. Retailers need to take a punt on the technologies they think are going to be the chosen ones. Get it right and all is well. Get it wrong and you are in a bit of a pickle.

The key is taking the friction out of the whole shopping process

Perhaps the payments aren’t the real issue here: perhaps it is not so much about the type of mobile payment technology that you offer, but what you do with it.

“We believe it’s not just about mobile payments,” says PayPal’s Harper. “You have to look at the additional benefits that you can add into the payment process that makes it compelling to use. You have to understand user preferences, loyalty and what people are doing to add real value.”

Harper also believes that this is really driving m-payments: “it is about adding time benefits to consumers,” he says. “The key is taking the friction out of the whole shopping process, not just about making payments easy.”

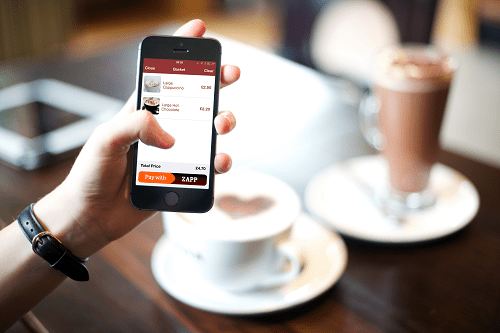

This is something that Zapp too has been keen to acknowledge. It styles itself as not only making it easy to pay online or in store using mobile, but it also helps consumers manage their finances, as it shows them balances, let’s them chose the account from which the payment is made and so on. Already it is trying to claim to be more than just about payments.

This is how m-payments is likely to evolve. The early adopters will revel in tapping to pay or using Zapp or even carrier billing, but it will be the combination of payments, loyalty and a rethink of how shops are designed that will really swing it. When this happens, however, is anyone’s guess.

Hanging on the telephone

Charging for things on the mobile phone bill used to be the preserve of dodgy chat lines, horoscopes and tarot readings and, latterly, voting on TV ‘talent’ shows. But this is all set to change thanks to the pioneering work of payments company Boku, which has managed to create the ability to charge for real world goods straight to the mobile phone bill using nothing more complicated than a text message.

This ‘carrier billing’ offering is revolutionary as it starts to make micropayments – things under £30 – quick and easy to do and could see a new tier emerge in how people pay for, say, their daily paper or a pint of milk. Instead of Apple Pay being the arbiter of all things m-payments, this could mark the start of the m-payments revolution.

So how does it work? Prior to this initiative, carrier billing in Europe has operated under an exemption to the European Union’s Payment Services Directive (PSD), which was originally designed to facilitate the purchase of mobile wallpapers and ringtones and limited carrier billing purchases to digital content.

By combining e-Money with the convenience of charging purchases to your phone bill, Boku is revolutionizing the carrier billing industry by launching a fully regulated payment product that provides a carrier billing solution that can be used for the purchase of all types of goods and services, including all sectors of ecommerce (subject to compliance with the local regulatory framework). It also offers a clear regulatory framework offering superior levels of protection to consumers and merchants.

Boku is partnering with O2 , EE, and Vodafone in the UK, with plans to extend the solution to other major MNOs. Partners selling magazines and bus tickets have already signed up to use the Boku e-Money solution and the programme will soon be extended to a range of real world goods and services.

This isn’t all that is happening in the carrier billing space. For many years there has been a payment technology called Payforit that uses the mobile phone bill to charge for things. Now in its fifth iteration, Payforit has a simple user journey and some clear branding. It has started to find its way into games apps for in-app purchases and is being used for quasi-physical purchases such as wifi time on Virgin Trains and could soon be used to pay for car parking.

The move by Boku to bring about the use of carrier billing for physical goods is likely to make the case for Payforit even stronger. With other companies in the space looking to add carrier payments technology to Twitter, and with O2 customers already using it to pay for iTunes in the UK and Amazon purchases in Germany, carrier billing’s time may have come. This could well be one to watch for the savvy retailer.