Alex Sword’s insight into changes in the delivery market.

LOGISTICAL SAVINGS WITH AI

The retail industry could save $41.36bn (£32.5bn) a year by introducing AI into its logistics operations, according to a new study.

Titled ‘Building the Retail Superstar’, the Capgemini report claimed that retailers could save 6.9% of their logistics costs by using AI to optimise several core functions in logistics. An additional $123.63bn (£97.14bn) could be saved through a 7.5% cost savings in returns brought on by AI.

In terms of specific areas where retailers could invest, the report cited predictive logistics network management, visual-aided picking and inspection of warehouse assets, reverse supply chain and returns management and route optimisation. Other areas included reducing distribution pilferage, improving back office functions and optimising categories.

The report highlighted Ocado as a company making use of automation in its picking and packing processes. The company’s CEO recently attributed its rising revenues in Q4 to its new customer fulfilment centres.

It also discussed how Tesco is using AI to more efficiently route vans and schedule drivers, including for the in-store staff which pick up online orders.

Meanwhile, Walmart in the US uses the technology to analyse whether a temperature rise on a truck is damaging a product and can reroute it to a closer destination if needed.

The survey found that the proportion of retailers deploying AI had risen rapidly over the last two years, increasing from 4% in 2016 to 28% this year. However, it found that only 1% of projects had reached multi-site or full-scale deployment.

In order to succeed with AI, the report said retailers should focus on quick wins which are easy to implement, despite the lower benefit projections. It also said they should ensure their data practices are mature, which means integrating datasets across the organisation to provide a single view of data and use a variety of different types of data.

The report surveyed 400 retail executives in total.

VOLUMES UP AT DODDLE

Click and collect provider Doddle saw a 115% uplift in parcel volumes on Black Friday. Volumes on Saturday 24 and Sunday 25 November were up 216% on the week before as a result of the Black Friday effect, compared to 101% last year.

Volumes from the Monday before Black Friday to the Sunday immediately following it were up 76% on the week before, said Doddle. In 2017, volumes from the Monday before Black Friday to the Sunday immediately after increased by 50% and in 2016 by 42% (significantly less than the 76% this year).

Tim Robinson, CEO of Doddle said: “Impressive year on year parcel volume growth shows that price conscious consumers have responded well to the prolonged Black Friday shopping trend overall. But retailers will have a harder time than ever in future years capturing shoppers’ imagination and sustaining it through such a prolonged sales season. The shift will have to move from price only to price plus experience to create true differentiation”.

In an exclusive interview with eDelivery at the end of last year, Robinson discussed how Doddle had dramatically changed its business model to focus on offering its service at check-out rather than offering it as a subscription service to consumers.

The company has also expanded its service to the US.

ROBOT COURIER UNVEILED

An Estonian start-up has unveiled a prototype for a robot courier which aims to fully automate the last mile. The self-driving robot will be able to ferry a package from a local distribution centre and place it in a personal parcel locker at a customer’s home. This will then trigger a notification for the customer to tell them that they can collect their parcel from the locker whenever they wish.

Cleveron, which counts Walmart and Inditex as clients, plans to begin pilots of the courier in Estonia in 2020.

“The goal behind the creation of the robot courier is the same as for all other Cleveron’s products – to save time for everyone,” the company said in a statement. “Cleveron’s future robot courier enables ecommerce or logistics companies to automate their last mile delivery processes, helping to lower the costs. It also offers the chance to provide a delivery service with utmost convenience for their customers since they do not have to spend time waiting for the courier.”

The company’s personal parcel lockers, which will form an integral part of the robot delivery network, are currently being piloted in Estonia. It has also run trials of drone delivery, which Amazon has been experimenting with, in Belgium.

Its flagship solution, the Cleveron 401, allows customers to both collect and return parcels. In 2018 it launched a pilot with UK retailer Asda in Manchester.

PEAK DELIVERY TIMES RISE

Average delivery times during the peak period have increased year-on-year, according to a new study by Kurt Salmon, part of Accenture Strategy.

Retailers now take an average of five days to deliver compared to 3.6 days last year, according to an audit of 57 retailer. The researchers placed 92 orders on the sites on Cyber Monday, with 57 using standard delivery and 35 click and collect.

The study also found that 25% of the retailers examined experienced technical issues during the period. Problems included the inability to place orders and online baskets being wiped before checkout, with some websites becoming more difficult to navigate due to promotional banners and poor search options.

Customers also had to spend 5% more to qualify for free delivery than last year. In addition, one in three retailers were slower than the maximum delivery time.

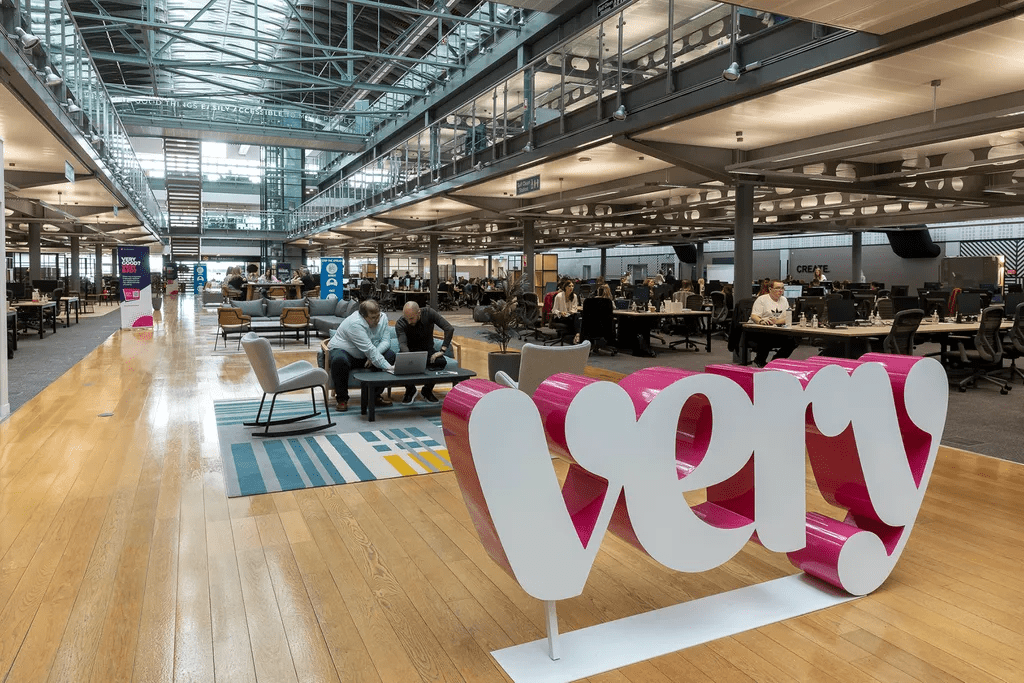

The top performers for fast delivery were B&Q, Argos, Next, Amazon, Very and Aldi, which delivered parcels within one day of the order being placed. H&M, Very and Marks & Spencer were the best performers for click and collect orders.

Siobhan Gehin, Managing Director, Kurt Salmon said: “While many retailers delivered an excellent customer experience, a surprising number of retailers struggled to deliver a strong ordering and delivery experience across channels.”

She added: “Certain UK names are consistently strong while others need to re-focus investment to enhance their competitive agility and ensure they’re equipped to deal with promotional peaks. As brands face fierce competition and wavering customer loyalty, poor performance during these crucial calendar events can leave a lasting impression.”

According to the Capgemini IMRG eRetail Sales Index, online sales grew only 3.6% in December 2018, the slowest growth rate in the year. Online spending fell 15% month-on-month from November to December.

RETAILER NEWS

Danish electronics company Bang & Olufsen has blamed problems in its logistics network for a decline in its revenues. The company saw revenues fall 9% year-on-year in the second quarter, which it attributed to a range of problems in its logistics operations. It claimed that it had seen a time-lag effect from a combination of its sales and distribution network.

It said it had changed to a more direct distribution model, which had particularly impacted sales in the EMEA and Americas regions, as well as a change of distributor in Oceania which had hit Asian sales.

Problems onboarding a new logistics partner had created delays in fulfilling orders.

Meanwhile, footwear brand Skechers is expanding its use of automation in its distribution centre in Liège, Belgium. Looking to accommodate rapid turnover growth, the brand introduced 3.5km of new conveyor technology, as well as a new sorting machine and other equipment.

Skechers expects to make use of the new capacity by November 2019.

Sophie Houtmeyers, VP Distribution Operations said: “Skechers Europe, but also worldwide, anticipates further growth in the coming years and that is why we opted for an expansion of the automation in the EDC. Our satisfaction with the current systems encourages us to address the same partners.”

The facility serves the three channels of direct-to-consumer sales, Skecher stores and wholesale customers.

AMAZON AIR EXPANDS

Amazon is leasing an additional 10 aircraft as it looks to support demand for Prime delivery.

The company expanded its partnership with Air Transport Services Group to add the new Boeing 767-300 aircraft, increasing its fleet to 50. Amazon said the new planes would join its air cargo operation over the next two years.

Dave Clark, SVP of worldwide operations at Amazon, said: “Our customers love massive selection and fast delivery, and the Amazon Air capacity we are building enables Prime delivery speeds for customers from Seattle, Washington to Miami, Florida.

“By expanding the Amazon Air network through our partnership with ATSG we’re able to ensure we have the capacity to quickly and efficiently deliver packages to customers for years to come.”

Amazon launched its air freight division in 2016. It now operates out of 21 air gateways.

A story earlier this month saw Morgan Stanley analyst Ravi Shanker claim that Amazon’s air freight business could sap revenue from FedEx and UPS, which currently handle up to 50% of Amazon’s package volumes. In an investor note, Shanker claimed Amazon Air could mean 2% of lost revenue for UPS and FedEx in 2018, rising to 10% in 2025.

However, FedEx CEO Fred Smith has since claimed that the idea that Amazon could disrupt the company was “fantastical”.