Less than 92% of online orders are delivered successfully on time. Andrew Starkey, Head of e-Logistics at IMRG, examines the findings of its Valuing Home Delivery report.

Consumers’ expectations are increasingly influenced by their wider experience of a digitally enabled world and in an e-retail sense this means something close to 100% service – to be able to access product information (rich media) 24/7/365, interact with retailers via websites that rarely hang and order exactly what we want, when we want.

Unfortunately, there is one element of the e-retail process that is still heavily reliant on physical capabilities and in respect of e-retail logistics and delivery this is where the problem lies. When using a physical supply chain of trucks, warehouses and people, even with the best of intentions links in this chain will sometimes ‘break’.

The research we carry out at IMRG clearly shows us that collectively the e-retail supply chain currently fails to meet shoppers’ digitally enhanced expectations. The first table, taken from the IMRG MetaPack UK Delivery Index, shows ‘on time’ delivery performance over the past 12 months across a sample of 52 million orders, 220 retailers and all the major carrier services.

The weighted average across the year runs at 91.9% but in addition to this a further 4.2% of orders that are ‘attempted on time’ are not delivered because there is no-one home to accept them meaning that the customer is disappointed at least 12 times in every 100 orders (not including orders that are not dispatched On Time In Full – OTIF). We estimate this to be more than 80 million orders a year.

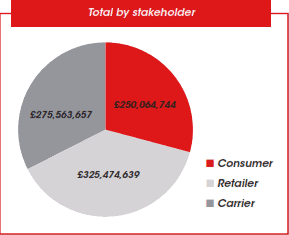

At IMRG, we have just published the latest (the fourth) in our Valuing Home Delivery series of reports. This report is supported by Blackbay and attempts to calculate the avoidable cost of ‘1st time / on time’ delivery failure (across all three stakeholder groups (consumers, carriers and retailers) and the six most likely failure scenarios). This year we put this figure at £851m per annum.

And amongst these stakeholders, it is perhaps not surprising that retailers carry the biggest burden.

For retailers, within the six failure scenarios it is those where the risk of lost goods and lost customers that are the most expensive but even late and re-arranged deliveries carry a heavy cost penalty.

But, it would be wrong to lay all the blame at the feet of the logistics and supply chain people (in company and contracted) because delivery is now part of the wider retail offer.

If the customer is not aware what delivery solutions are available, because the right options are not offered or communicated properly, then the problems start not in the warehouse or on the delivery vehicle but on the website at checkout.

Recent surveys carried out by MICROS , on behalf of MetaPack and Blackbay, demonstrate that:

- 25% of retailers sampled only offered one delivery option and only 19% of retailers offered a nominated day option even though such options are widely available (albeit at a premium) and that consumers rank this as one of the most significant things that would improve their perception of online delivery (IMRG UK Consumer Home Delivery Survey 2012, supported by Blackbay).

- Only 11% of retailers sent a pre-delivery text message to update their customer on the progress of their order and only 64% provided tracking links at the time of order confirmation.

- Despite consumers wanting to be able to give specific delivery instructions and the fact that these can be accepted by most carriers offering tracked services, only 23% of the retailers sampled offered this to the consumer.

So, given the need to maximise customer value, retailers’ wider ecommerce and marketing teams need to consider how best to promote their delivery offer to best effect because more than three quarters of consumers confirm that a good delivery experience will encourage them to shop again with the retailer providing it.

And it’s not just direct experience that drives shoppers’ perceptions. In the past 12 months the impact of social media in this respect has doubled to the point where more than 35% of those surveyed for the IMRG/Blackbay report say that a social network comment about the delivery service provided by a retailer has influenced their decision of whether to shop (or not) with that company.

Clearly Collect and Reserve in Store offers circumvent some of these problems but as long as customers shop online, delivery to home will be a vital part of the service mix so we may as well do what we can to get it right because the costs (avoidable) and the benefit (customer value) surely make it worthwhile.