Owned media – defined as all channels a company directly controls, such as websites, emails, in-store screens, catalogues, and apps – is set to explode in reach and value in the coming year as marketers look beyond just retail media and explore the full range of digital marketing opportunities available to them.

So finds the latest report into owned media published by independent international media valuation and software business, Sonder. This is Sonder’s third report on the owned media sector includes fresh research from 50 senior marketing leaders across retail, finance, travel, and telecom.

According to Sonder, the value of owned media assets has undergone a major transformation. Retailers, airlines, telecom companies, and financial services have turned their media channels and first-party consumer data into revenue-generating networks.

The report predicts ad expenditure shift away from world’s biggest media platforms Google and Meta and points out that companies in new sectors are seeking to cash in on this fast-growing, multi-billion-dollar market.

The different types of media

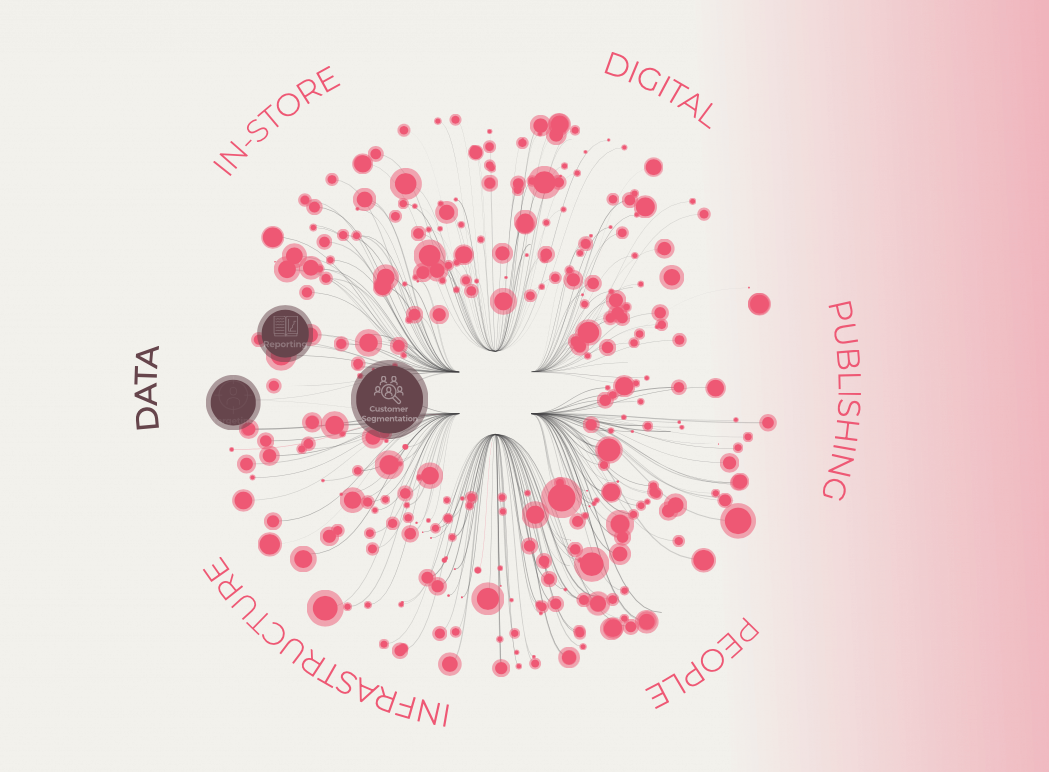

The Sonder Global Market Report makes distinctions between the different types of media. While terms like “owned media,” “retail media,” and “commerce media” are often used, the Sonder report points out that there are unique distinctions:

Owned Media: As said, this encompasses all channels a company directly controls, such as websites, emails, in-store screens, catalogues, and apps. These assets support brand objectives and can also generate revenue when strategically used with brand partners.

Retail Media: Focused on monetisation by retailers who sell media space directly to advertisers. Retail media networks also frequently partner with external media to reach larger audiences.

Commerce Media: Involves monetization by any organization aggregating data from multiple sources and networks to sell advertising space. Examples include United Airlines’ Kinective and fintech platform, Revolut, which use data from various touchpoints for advertising across owned channels.

Market size and growth rate

The report draws together many of the predictions made around the global market growth for Retail Media. Retail media continues to dominate the headlines with a global media spend projected to reach more than $150 billion by the end of 2024, with the sector growing faster than most traditional advertising channels.

The United States continues to lead the way in the market, with Europe seeing rapid expansion and the Asia-Pacific region in the early stages of growth, with a number of high-profile brands beginning to realise the potential through the launch of media networks.

The topline market size and growth are drawn from a variety of sources:

- WARC estimates retail media ad spend will reach $153.3 billion in 2024, an increase of 13.7%.

- Stratably forecasts a 20% growth in retail and commerce media in 2024 and 18% in 2025.

- MAGNA Global projects commerce media will hit $158 billion in 2023, climbing to $220 billion by 2027, over 20% of global ad revenues.

- GroupM anticipates that by 2029, retail media will account for 17.5% of global ad revenue.

The report points out that the United States continues to lead the way in the market, with Europe seeing rapid expansion and the Asia-Pacific region in the early stages of growth.

New sector entrants that are expected to make an impact in the market in 2025 include finance, travel, telco and convenience.

New research findings

To source an accurate picture of the current global market for owned media leverage, Sonder partnered with research and analytics firm Infuse, surveying 50 senior marketing leaders, in 40 companies, across 22 different countries around the world to gain insights into their perceptions of owned media and their current and future approach.

Three of the findings stand out.

One of the most interesting findings from the report is that 37% of senior marketers reporting that they use owned media primarily for brand-building and internal marketing, and 36% of companies are providing owned media value to partners at no cost or not leveraging it all. This points to a significant value gap between owned media’s current use and its strategic potential as a growth engine for a brand.

Two thirds of marketers will increase their owned media leverage in the next 12 months. However, many marketers are operating with one hand tied behind their back as 60% of respondents do not operate with a rate card. A rate card is the key to unlocking and operationalising owned media leverage and revenue.

The future

According to Sonder, as networks continue to proliferate, pressure will build on the major digital media companies including Google, Meta and Amazon with brands seeking cost-effective alternatives for their marketing dollar.

Jonathan Hopkins, founding partner of Sonder, said: “Owned media has long been overlooked in favour of traditional paid advertising channels. In the past few years that has fundamentally changed as we enter a new era where any type of business can leverage their owned media networks both strategically and commercially.

“Retail has embraced the commercial potential of the opportunity and now other sectors are catching on. We expect to see more and more organisations launch owned media networks in 2025.”