Each year, InternetRetailing has an in-depth focus on the peak trading period. In part, that’s because it is the most important time of the financial year for many UK retailers. It’s also because shopping takes place at a higher rate in the run up to Christmas, meaning that any changes in customer behaviour are seen sooner and more clearly.

Black Friday – which falls today – has historically been the biggest online spending day in the run up to Christmas, closely followed by Cyber Monday. But retailers started discounting well before Black Friday last year and look to have started still earlier this year – a factor that could yet change the shape of peak trading in 2022. Predictions have been tricky and today we’re leaving them behind as we turn our attention to regular updates, as we get them, during the course of the day, on how retailers and brands are selling and how customers are buying.

Black Friday payments 3.2% up on last year: Barclaycard

Barclaycard Payments, which processes £1 in every £3 spent in the UK, says that as of 5pm it has seen a 3.2% increase in the volume of payments compared to the same period on Black Friday 2021.

Marc Pettican, head of Barclaycard Payments, says: “We’re now able to look at the majority of Black Friday sales data, and we can see that the number of transactions has increased when compared to last year.

“Sales volumes have also continued to rise since lunchtime, confirming that Black Friday is still an important milestone in the retail calendar. This is encouraging news for retailers who will have been unsure about the outcome of today, given the rising cost-of-living. It will have been helped along by the World Cup coinciding with Black Friday for the first time, providing a welcome boost as football fans head out to socialise and watch the match.

“Retailers will hope the increase in transactions online and in-store will continue into the weekend and Cyber Monday.”

Strong start for John Lewis

John Lewis says its Black Friday has got off to a strong start. It says that customers have ordered online at a rate of 5.5 products a second, choosing from among 5,000 Black Friday offers. At the same time footfall has built its shops through the morning. Top selling items include Apple AirPods, iPads, gaming, TVs and Hotel Chocolat advent calendars. This year the retailer started its Black Friday earlier than ever – on November 4 – and it says momentum is now building ahead of Christmas. Deals range from 15% off Charlotte Tilbury to 40% off Denby tableware. Sales of Christmas crackers are up by 154%, compared to the same time last year, while pre-lit tree sales are up by 39%, and wreaths and garlands are up by 48% on last year. Shoppers have later than usual – until January 28 – to return unwanted products.

Payments update: afternoon

Barclaycard Payments says it’s seen an all-time record broken for transactions-per-second between 12-1pm today. That, it says shows shoppers making the most of their lunch break to bag a bargain. Transactions for the hour were 4.9% higher than the same hour on Black Friday 2019. However, there was only a “marginal increase” of 0.7% in the volume of transactions, compared to the same period on Black Friday 2021.

Marc Pettican, head of Barclaycard Payments, says: “Despite the rising cost-of-living, it’s clear there is still appetite to bag a Black Friday bargain. While shoppers may be tightening their belts overall, it looks like some have been holding back on purchases to wait for the sales to start and others are likely on the hunt for deals for Christmas gifts. Many more will also be heading to the pub early to secure a seat for England’s World Cup match against the US. Sales volumes holding up against last year will come as welcome news for retailers against the challenging economic backdrop.”

Footfall up on last year: Springboard

Offline, business intelligence specialist Springboard says more people headed to shops this Black Friday than at the same time last year. Diane Wehrle, insights director at Springboard, says: “The results for the period up to 12pm today show that footfall across all UK retail destinations is +7.3% higher than last Friday, but the winners so far are shopping centres where footfall is +13.9% higher than last week. Footfall is higher than last year too: +4.6% above Black Friday 2021 across all destinations but +8% higher in high streets despite the increase in footfall from last week of +4.2% not being has great as that in shopping centres. Shoppers are heading to large city centres rather than smaller high streets, with footfall in Central London +11.1% higher than last week and +7.7% higher in city centres across the UK compared with a drop in footfall from last week of -3.2% in market towns.

“The footfall data demonstrates that whilst trading conditions are challenging Black Friday is certainly not a disaster. We are also expecting footfall to strengthen this afternoon as those consumers who are working from home go shopping after lunch. The dry and sunny weather will also help drive up activity, as will the UK vs USA World Cup match this evening as shoppers may well head into towns and cities and do some shopping and then watch the match from bars in town centres.”

How leading RXUK Top500 retailers and brands are selling this Black Friday

By Monday, IMRG had already seen more retailers running Black Friday campaigns than it saw running them throughout last year’s November discount period. We take a look at how leading RetailX Top500 brands are approaching Black Friday today.

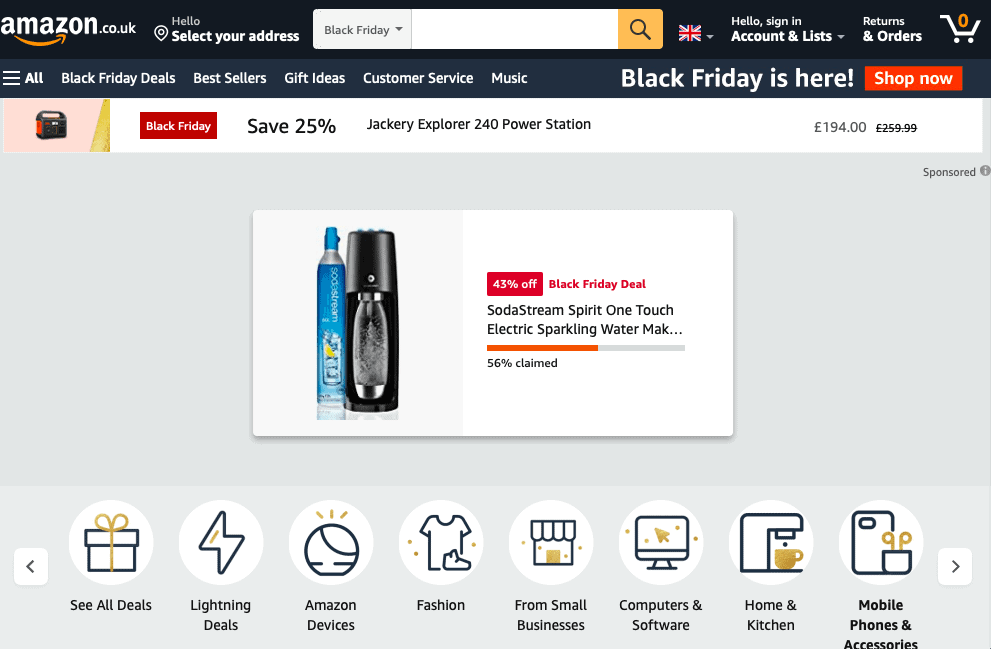

Black Friday is very firmly here for RXUK Elite retailer Amazon, which can expect to see high numbers of Black Friday visitors today. It features deals across its home page and its Black Friday category pages. This year it’s featuring deals with an easy view of both how much the discount is, as a percentage, and what proportion of the available products have already been sold. The level of discount varies by product, ranging from between about 15% and 65% off. The retailer is this year offering cut price National Express coach tickets for students to get home for Christmas, selling off used and returned items with a further discount, and supporting Comic Relief with donation options throughout the website. It says that so far this year, toys, electronics, beauty and home products have proved some of the most popular categories.

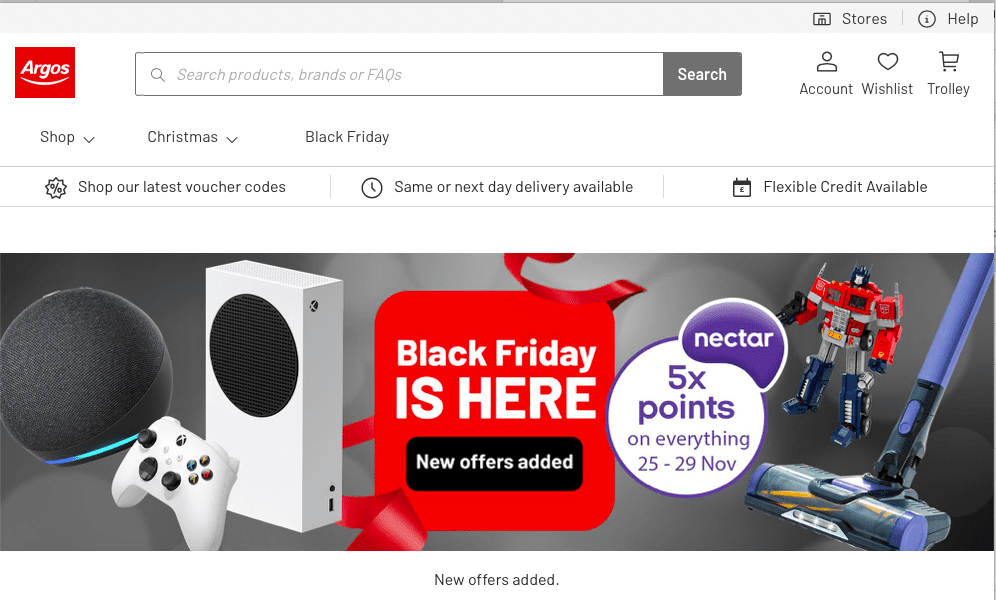

Fellow Elite retailer Argos, meanwhile, is offering five times as many Nectar points as usual on its Black Friday deals today and is flagging up same-day and next-day delivery from its home page. Levels of discount are shown in a variety of ways, from 20% to a third off, or buy one get 50% off a second, to ‘our lowest price ever’ to ‘o ‘great new price’.

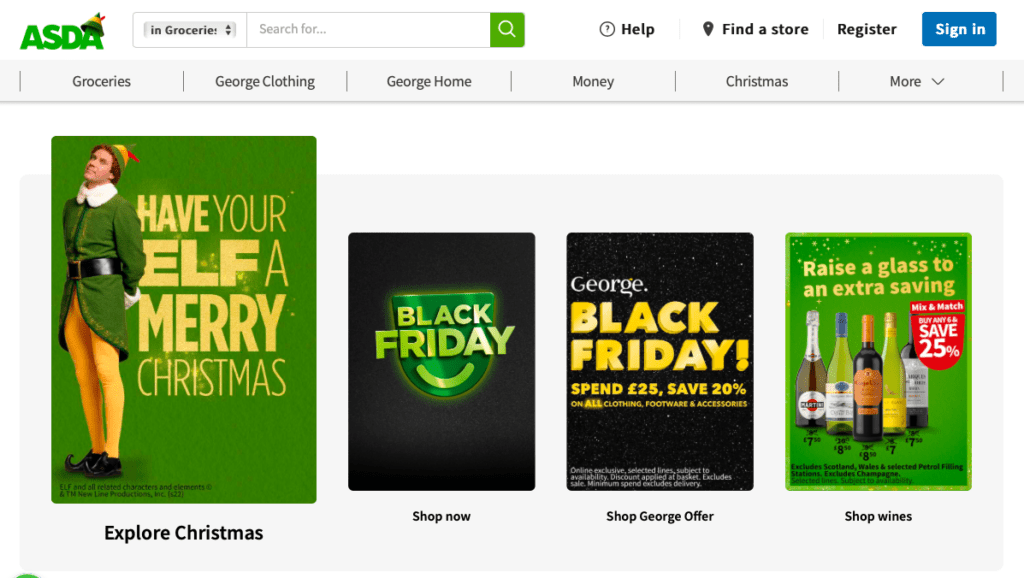

RXUK Elite retailer Asda also features Black Friday on its home page, where it flags up 20% discounts on its George range of clothing, homewares and footwear, when shoppers spend at least £25, and discounts of up to 50% elsewhere, including on Lego toys and Tefal cookware. A 25% saving is also available on wine.

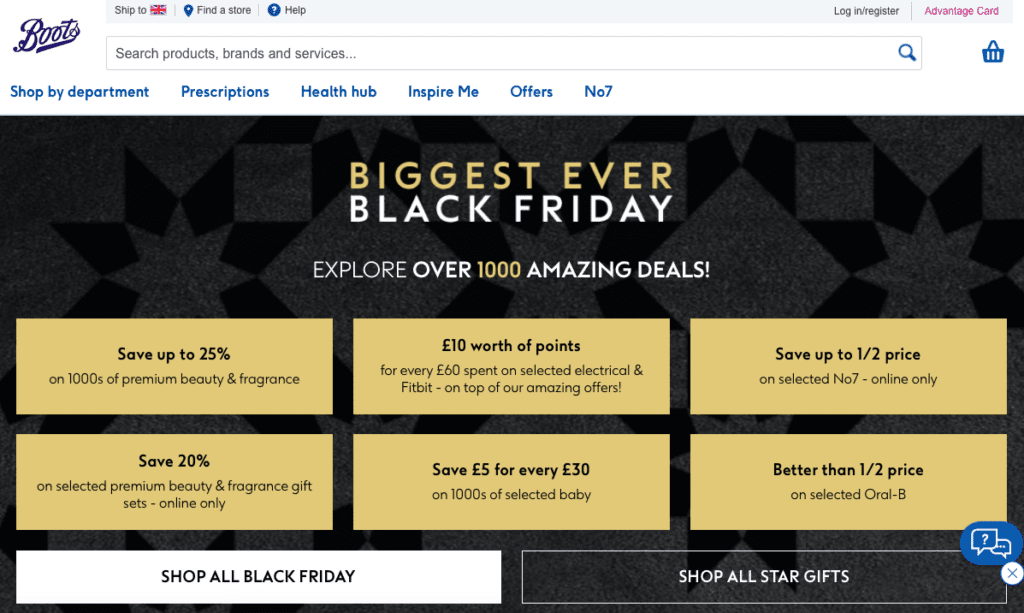

Fellow Elite retailer Boots is offering discounts of between 20% and half-price on a range of categories, including beauty and electricals, with loyalty points also on offer for those buying electricals. The health and beauty retailer labels this its “biggest ever Black Friday” with more than 1,000 deals available. Fulfilment options incluing next-day delivery, fast delivery via Deliveroo, and airport click and collect are also flagged up on its home page.

Elite retailer Sainsbury’s is also flagging up Argos’ Black Friday deals on its group home page this year. When it comes to the supermarket’s grocery site it has Christmas offers rather than Black Friday deals, with deals of up to half-price on Christmas chocolates, alcohol and gifts.

At the final Elite retailer, Tesco, the UK’s largest supermarket, it’s less a Black Friday feeling and more a World Cup event, with offers available on a range of snacks to eat while watching the game. Some Christmas offers are also available further down the home page, including a promotion on Fitbit products that offers the chance to win loyalty points at a rate of three times extra, while Tesco Mobile has the only named of Black Friday some way down the page. The website was generally loading less quickly than others when InternetRetailing visited.

FRIDAY MORNING

Hush uses Black Friday to raise money for homelessness charity Crisis

Hush is marking the launch of its ‘buy one, give one’ initiative this Black Friday. It says the move will support its long-term partner Crisis’ ongoing mission to end homelessness.

Through the campaign, each time a product is purchased online at hush-uk.com during the course of today, Hush will donate an item of clothing to Crisis, to either be distributed directly to its members experiencing homelessness, or to be sold in one of the charity’s UK stores, driving much-needed funds for the months ahead.

Last year hush raised over £50,000 for Crisis on Black Friday by taking the same approach.

Richard Lee, Crisis director of fundraising, says: “Crisis is privileged to be able to count on hush as one of our dedicated supporters. They have supported our work to end homelessness for the past six years through their annual Anti-Black Friday campaign, invaluable stock donations to our warehouse, and staff volunteering their time at Christmas and throughout the year. We’re extremely grateful to them for supporting us once again this Christmas and bringing us closer to ending homelessness for good across Great Britain.”

Payments staying steady with last year

Barclaycard Payments, which processes £1 in every £3 spent in the UK, says that as of 10am today it has seen the volume of payments remain consistent compared to the same period on Black Friday 2021.

Marc Pettican, head of Barclaycard Payments, says: “Our data shows that Black Friday is off to a steady start this year, despite the challenging economic backdrop. When looking at spending on the morning of Black Friday, so far today, transaction volumes are broadly in line with what we saw this time last year.

“We have also seen an increase in transactions in the week leading up to today, with volumes up 3.46 per cent week-on-week* compared to the lead up to Black Friday last year. It’s likely the feel good factor in the run up to the World Cup, with the England and Wales matches on Monday of this week, has given retail and hospitality a boost. We’re also seeing Black Friday discounts starting earlier each year, so while today remains the main event, many retailers started their deals earlier in the month. It will be interesting to watch what happens as we progress throughout the day, especially as we near England’s second group stage match this evening.”

*17.11.22-24.11.22 compared to same weekdays in 2021, 18.11.21-25.11.21

Security concerns rise with increased payments

Just as payments are rising, so too are security concerns, says Matt Aldridge, principal solutions consultant at OpenText Security Solutions. He says: “November is one of the most active months of the year for online scams as a result of the increase of online shopping amid the festive season and the deals offered by retailers for Black Friday and Cyber Monday. In fact, in 2021, we saw 34% of all phishing activity for the year in November alone.

He adds: “Our recommendation is that everyone should remain cautious when exploring all emails and links received, especially during Black Friday, Cyber Monday and the Christmas season. Similarly, businesses and IT leaders should be aware of these risks too and consider analysing companies’ email filtering technologies and multi factor authentication methods (MFA) to ensure they’re fit for purpose. Also, by conducting security awareness training for all staff and investing in real time phishing detection, businesses will be strengthening their frontline defences against potential attacks and building cyber resilience – whilst helping employees to avoid falling victim to common scams.”

Do shoppers like Black Friday?

Womenswear retailer Thought has asked the question, surveying more than 1,000 members of the UK public to find that only 28.3% of the public liked Black Friday, with 32.8% unsure on how they feel about it and almost 38.9% reporting that they actively did not like the sale period.

Question: Do you like Black Friday?

The data suggests Britons are becoming tired of the intense Black Friday messaging and the potentially unsustainable retail impact it can have, says Thought, which is running a ‘Thoughtful Everyday’ campaign to coincide with Black Friday week to try and promote more sustainable and ethical shopping habits over the holidays. All of its profits from today will be donated to food charity Fareshare.

Interest in Black Friday appears to be up this year

Digital marketing agency The Audit Lab has investigated how the cost of living crisis affected search data surrounding the event, and how searches compared to previous years. It expected numbers to be down across the board as people tighten their belts leading up to Christmas, but says it has been surprised by the results.

It says that in 2020, searches for Black Friday dropped by 40%, compared to the previous year, as searches fell from 2.5m to 1.5m. In 2021, they fell a further 6% to 1.49m. But this year its analysis so far, based on historical data, means it expects to see a 5% rise searches for ‘Black Friday’, against an 8% rise for ‘Black Friday deals’.

Megan Boyle, head of content marketing at The Audit Lab, says: “Despite our expectations, it’s easy to understand why we would be seeing an increase in the searches this year, as consumers are trying to find the best deals they can to save the pennies this Christmas. While the numbers are still below pre-pandemic levels, crippled by the two years of drops, this year should present at least some opportunity for growth for many retailers, though the unique circumstances surrounding Black Friday and the looming threat of recession may mean this is not going to be a sustainable increase, and 2023 could once again bring another round of drops in searches.”

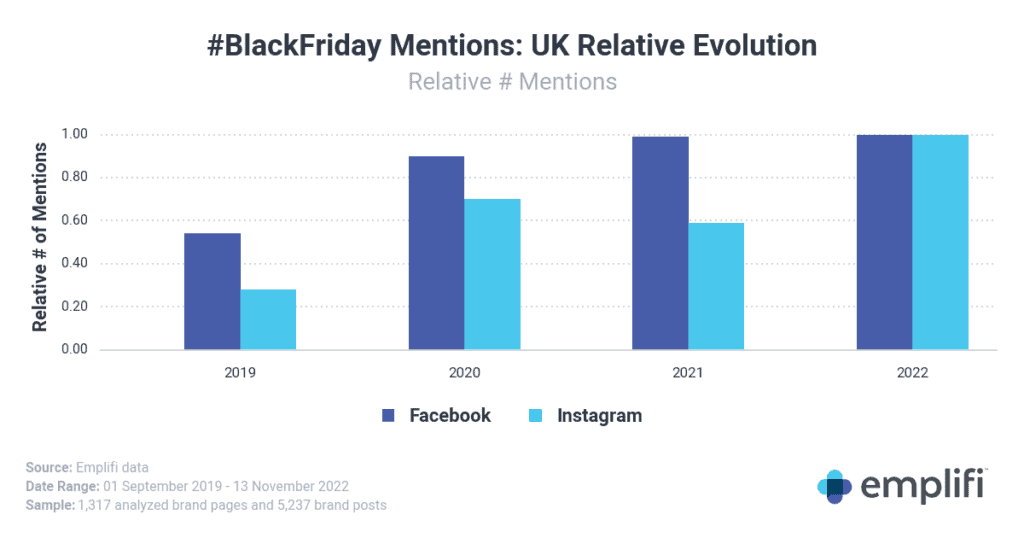

Social media mentions up

Social media mentions for Black Friday have been up this year, compared to previous years, according to data from social media and customer experience platform Emplifi, which is used by retail brands including Pandora.

It says brands are running Black Friday content on social more than any previous year, with a 40% year-on-year jump in UK brands mentioning the event on Instagram. Ecommerce and retail brands are posting more about Black Friday than any other industry, far more than the perceived leaders in this area (4x more than beauty brands and 3x more than fashion)

Brand #BlackFriday content gets most engagement in the form of Instagram Reels – with 143% more interactions on Reels compared to single images.

Why shoppers may be buying today

Jane Edmondson, fund manager for the Global Online Retail UCITS ETF (IBUY), says there are tangible reasons for shoppers to buy this Black Friday – and to do so online.

“We believe investors are underestimating the prospects for online retailers this holiday season, including on Black Friday, which may provide significant upside opportunity,” says Edmondson. “Post-pandemic shopping habits have been permanently transformed both in-store and online. While shoppers may venture to stores to see and handle products, many of those final purchases will occur online.

“Additionally, as inflation causes consumers to be pickier about where and how they spend, shoppers will once again embrace the better selection, price comparisons, and convenience of online shopping this holiday season. Higher fuel costs will also discourage aimless driving around and lead to seeking advice online.”

Last chance for retailers to boost sales this year

This year’s holiday season is the last chance for retailers to win vital sales, says Marcel Hollerbach, chief innovation officer at product data specialist Productsup, which works with retailers and brands from Aldi to Sephora. “The retail landscape is in chaos with missed earnings, store closures, and dramatic sale events dominating headlines,” he says. “Despite these stories, retail sales are still expected to grow 4-6% for the 2022 holiday season – a much smaller rate of growth compared to last year but positive nonetheless if retailers can meet consumer demands.”

Hollerbach says retailers need to change tack in a year when gift deals started as early as October. “This avalanche of offers makes it difficult to stand out from the crowd but there are two key strategies to employ. First, make sure you are where your consumers are spending the most time – social ads and shopping options make it easier for consumers to find and quickly purchase your products. Second, analyse and react quickly to performance across the various commerce channels. If something isn’t selling through one format or platform, change it – fast. We know during recessions, consumers spend less – this could be the last big shopping event of the year for retailers to get a nice revenue boost.”

Black Friday 2022: all about reducing inventory

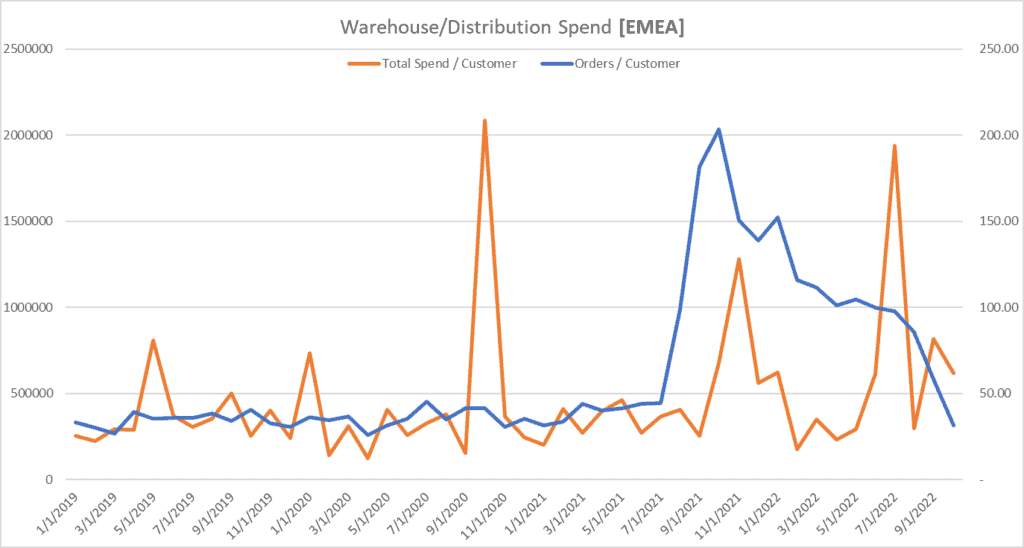

This Black Friday will be all about reducing inventory that has built up in recent years, in the wake of supply chain problems last year, says business spend management company Coupa.

Madhav Durbha, VP supply chain strategy at Coupa, says: “Over the past two years retailers have grown their inventories to relatively high levels, with warehouse and distribution spend rising over 68% (based on Coupa’s Community.ai data). This glut was a short-term solution largely driven by the post-pandemic ‘just in case’ supply chain model, where extra inventory is used as a cushion against another disruption. Yet, this is now creating headaches for some of the world’s biggest retailers who are struggling to draw down from the large inventories they’ve built up in late 2021 and early 2022. No brand wants to keep a significant amount of working capital locked up in its warehouse, so we should expect this Black Friday to be about getting rid of backlogged inventory.”

IMRG forecast

The central prediction from e-tail trade association IMRG – made at the beginning of this month – that shoppers will spend 5% less this Black Friday week than they did last year, given the impact of factors including changing spending habits, the Russian invasion of Ukraine, rising inflation and the World Cup. The forecast covers the eight days to November 28.

The organisation has been tracking 305 retailers in the run-up to Black Friday to see when they launched their campaigns and said on a peak trading webinar yesterday that by this Monday more of those retailers were already running campaigns than took part in Black Friday at any point last year. Already in the first two weeks of this month, participation in Black Friday trading has been an average of 78% higher than at the same time last year, among those the IMRG is tracking.

Now, though, it’s hard to say, says Andy Mulcahy, strategy and insight director at IMRG. “It’s all on the table at the moment,” he said this week. “I think it’s quite possible there could be a little bit of growth in Black Friday week but also quite possible it could be in the 5% decline area.”

Last year, 36% of November online sales took place in Black Friday week, rising quickly from 19% in the first week followed by 22% and 24% in the second and third weeks respectively.

Meanwhile, Bobbie Ttoulis, group marketing director of logistics specialist GFS, which works with more than 400 retailers in the UK, said on yesterday’s IMRG peak trading webinar that early Black Friday campaigns had already led to a 10% week-on-week rise in parcel volumes on weekdays – rising to 20% at weekends – with the biggest growth so far coming from fashion.