There is everything to play for this Christmas and trying to get on-trend with how shoppers are going to shop could be a life or death decisions. So here are some insights.

Whether consumers spent $100 or $1,000 holiday shopping last year, 67% expect to spend a similar amount this holiday season, and 18% expect to spend more. Consumers offer many reasons for the shift – having a bigger budget (35.6%), purchasing for more people (45%), and purchasing higher quality gifts (19%).

But retailers and brands are better off focusing on when, where, how and why consumers plan to make those purchases.

So says Shopkick, a leading shopping rewards app, as it seeks to predict the trends that retailers and brands are going to see this Christmas in the US – and elsewhere.

The “2019 Consumer Insights: 6 Trends Dominating This Year’s Holiday Shopping Season” white suggests that the things retailers need to be looking out for this year are:

- Make the Most of a Shortened Holiday Calendar – With only 26 days between Thanksgiving and Christmas this year (compared to 32 last year), retailers need to promote early and often, focusing on experiential things that connect people in your community.

- Pop-ups Pouncing on Consumer Fear of Missing Out– FOMO isn’t just a social media stereotype. In fact, it can be a real driver behind shopping behavior. Retailers can translate FOMO in their holiday strategies, including the use of pop-ups to tap into consumer desire for short-term, experiential shopping experiences.

- Thanksgiving Day Remains a “Grey” Shopping Holiday – Retailers that want to approach Grey Thursday strategically should consider whether their customer demographics align with the profile of a person who wants to shop on Thanksgiving.

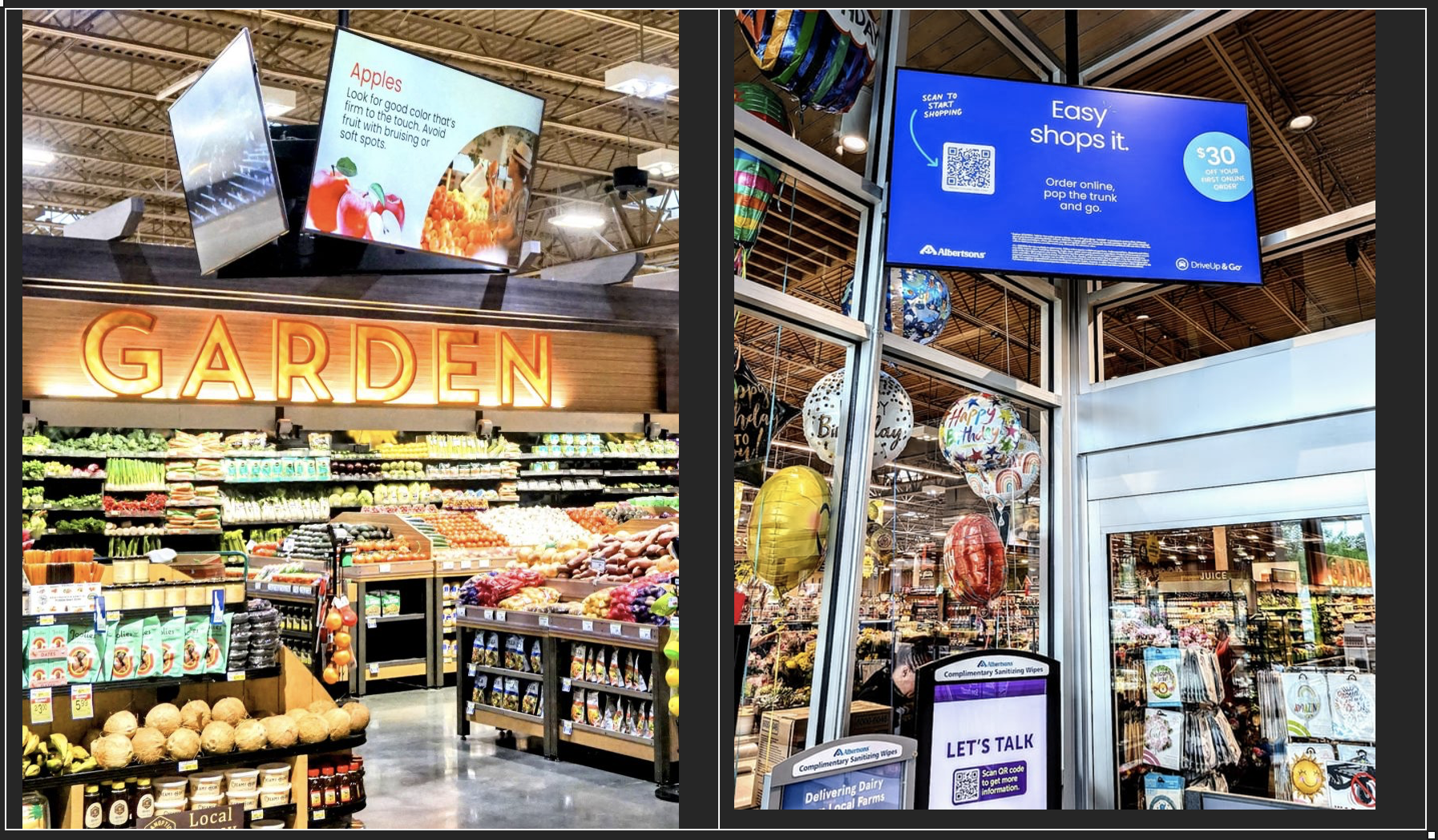

- Amazon and Other Online Marketplaces Win With Convenience, Pricing, and Options – Amazon continues its reign as a marketplace leader. For physical retail to compete, they need to bring in the online incentives that consumers are so attracted to (easy returns, rewards programs).

- BOPIS Blends Options and Convenience – Buy Online, Pick-Up In Store (BOPIS) has captured consumer interest by combining the ease of online shopping with the convenience of picking up packages on your schedule. While the number of retailers offering BOPIS is small, it’s growing. Those that want to implement the incentive – and drive the incremental sales that come with it – should advertise the benefits, offer parking specifically for the BOPIS shopper, train up customer service, and identify value add-ons and promotions like free gift wrapping.