Approaches to Brand Engagement vary significantly between geographies and product sectors.

Brand engagement is generally defined as the creation of some form of attachment between a consumer and a brand. This may be based on previous experience and trust or could involve a simple preference for a brand’s products because they meet a specific need.

Or it might be aspirational – enhancing a consumer’s image or Instagram posts. Whatever the basis of the attachment, brands know that they must work hard to maintain the engagement with appropriate messages, products, and consistency while building a long-term relationship with their most loyal customers by appropriate interactions.

The Top50 brand TopShop, like many leading fashion brands, engages shoppers with an online magazine giving style tips, blogs – featuring anything from celebrity interviews to where to find the best chocolate experiences – and an Instagram link allowing shoppers to upload images of themselves wearing the latest styles.

Hugo Boss, another Top50 brand, attracts its upmarket shoppers with its “Experience programme”, which offers invitations to private sales and events, “exclusive” gifts, personalised style advice, free alterations and a “customer hotline” for service queries.

Responding to customers

Customer preferences and attitudes are, however, rarely set in stone, and successful brands are always alert to any developing trends and changing values affecting their target markets. Thus TopShop is now promoting a range of “vegan shoes” on its website, while Hugo Boss allows is customers to have their T-shirts and sweatshirts printed with any word they choose in “iconic Hugo reversed style”, a way for customers to satisfy a desire for individuality while demonstrating that they buy from a prestigious label.

As well as Instagram posts and loyalty schemes, leading brands encourage their customers to interact by leaving reviews and ratings. More than half (51%) of Top100 brands encourage product ratings compared with an average of 39% for the Top250 as a whole. Similarly, while 42% of the Top250 across the European Economic Area include product reviews, that figure rises to 54% for the Top100.

Reviews are most likely commonly supported by sports-related brands with 70% of equipment brands, 64% of clothing and 60% of sports footwear brands in the Top250 encouraging product ratings.

In contrast, fashion bands are rather less likely to include product reviews with just 36% of footwear, 35% of clothing and accessories and 27% of jewellery brands including them. This could be related to the much shorter product life of many fashion items, which may have little more than six weeks between launch and clearance, while sports buyers are more interested in product performance and advice from fellow enthusiasts.

Among other product sectors, retailers selling appliances (47%) and cosmetics (43%) are slightly more likely than average to include customer-generated ratings, while homewares (32%) and consumer electronic (30%) are unlikely to provide product reviews. Both UK and Danish sites are slightly above the average for the proportion including product reviews at 44% while Slovakian-localised and Greek-localised sites are at the bottom of the list with averages of just 23% and 19%, respectively, allowing shoppers to post reviews.

While the majority of Top250 brands measured in both 2018 and 2019 made no change in their attitudes to reviews, overall some 15% dropped the product review option from their sites and 19% introduced them.

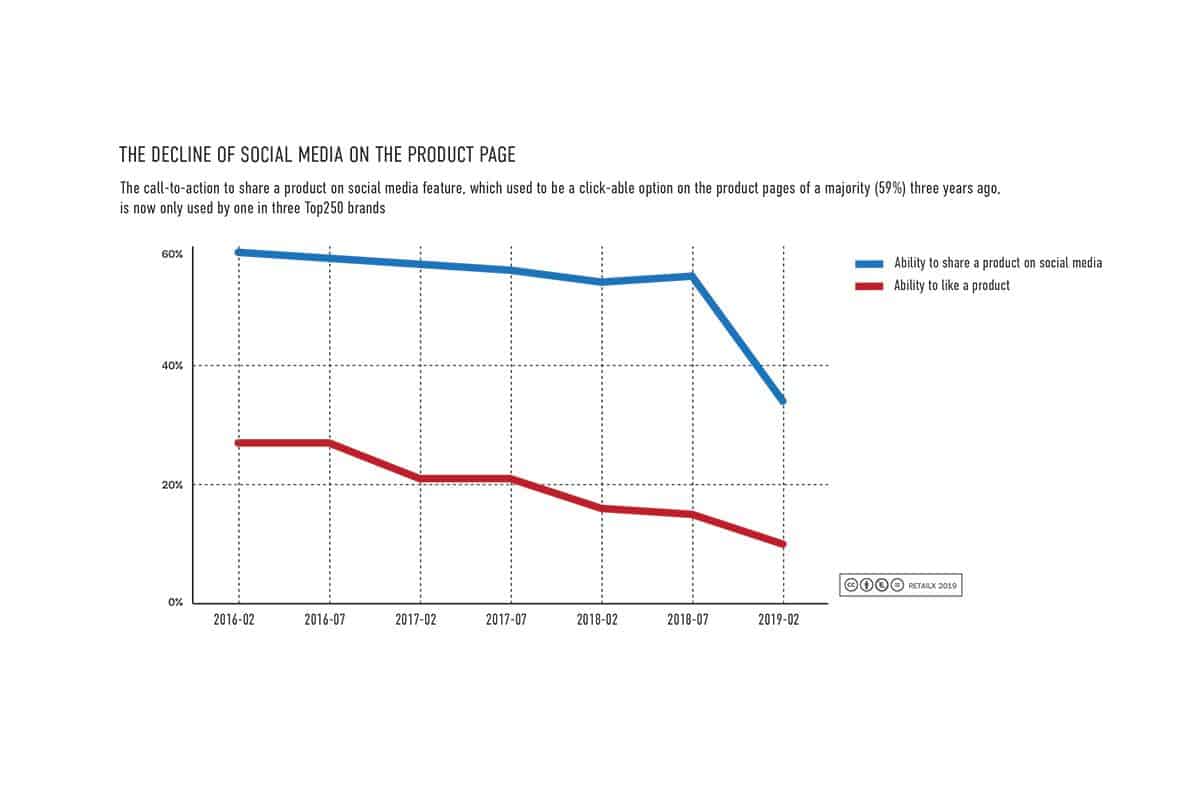

There are marked differences in approaches to social media by geography among the Top250 which may reflect differing trends in the use of such networks as online markets mature. The “share with friends” option, for example, averages 36% across the EEA but that disguises differences ranging from 60% of Polish-localised sites to just 29% of all UK-localised sites in the Top250 with this function.

Comparing those brands which were included in the Top250 in both 2018 and 2019 the decline in use of a “share with friends” button is marked: down by 20 percentage points (pp) from an average of 54% in 2018 to 34% this year; while among UK-localised sites measured in both years the decrease was even more significant – down by 31pp from 55% to 24%. The opposite was true in Belgium where there was an increase of 14pp from 50% to 64% among those brands measured in both years, while this year’s average for localised Belgian sites was 53%.

All online retailers must be responsive to changes in customer behaviour so the decline in the use of share with friends buttons among UK sites probably reflects their lack of use by shoppers.

Leading brands also appear reluctant to enable their customers to Like a product. Among Top100 brands, only 12% include this option – marginally more than the average for Top250 brands of 10%. As with the “share with friends” option, Polish-localised sites are most likely to offer this function with 24% allowing customers to Like products while 7% or fewer localised sites in the UK, Ireland, Hungary and Austria offer the Like option. As consumer use of social media continues to change in different geographies, we may see even greater divergence between regions in the future.