Speed, responsiveness and communication

Schuh achieved close to the maximum index value in the Customer Dimension, strongly outperforming the only other retailer in the Elite category, Burberry. The shoe retailer’s success is down to a combination of a well-executed website and its responsiveness to customer enquiries.

“BECAUSE PRICING IS so transparent in an era where it’s easy for consumers to check for deals online, customer experience is becoming a key point of difference between retailers,” says InternetRetailing researcher Martin Shaw . “Companies claim to be investing heavily here, but our results suggest many have work to do. We were surprised at how even larger retailers were sometimes slow to respond to customer enquiries. This kind of issue can’t be solved by a technical fix, it’s about the culture of the retailer.”

The results achieved by both Schuh and Burberry suggest neither has a problem here. Schuh won out because its site performance was better (scoring the maximum index value of 100), while its customer service was also exemplary. Burberry’s ratings for site performance and customer service didn’t quite achieve such heights. Both rated highly on responsiveness to Twitter messages.

Schuh was the only company to achieve the maximum index value for site performance

The five retailers that make up the Leading cluster – Amazon , eBuyer , Majestic Wine , Moss Bros and Morrisons – all performed impressively. Morrisons, for instance, has a well-engineered site according to industry standard Page Speed and YSlow assessments. This was reflected in an index value of 76 out of a possible 100 for site performance.

Further down the list, the Model group features a variety of retailers. Where other Dimensions show bunching of companies from within the same sector, here there are retailers ranging from Selfridges to Staples , and Bathstore to BHS .

For companies within this group, the overall index value is often affected by a weaker showing in one or more areas. Debenhams , for example, has a high index value for Twitter responsiveness, yet its site performance is comparatively poor.

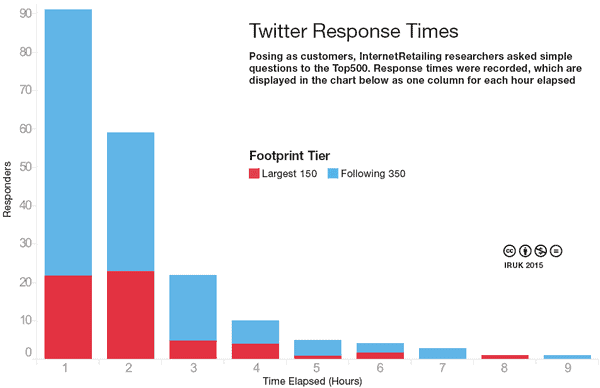

We conducted additional in-depth research on customer service for the largest 150 and this modifies the overall standings in this section. Some retailers outside of the largest 150 by Footprint showed impressive results, indicating further in-depth analysis will be interesting for the 2015 research.

Lingerie, swimwear and nightwear retailer Bravissimo , for example, has an index value of 94 out of a possible 100 for site performance and 93 out of a possible 100 for Twitter responsiveness. Had its customer responsiveness achieved the same standard, it would have made the Elite category of companies.

How Schuh achieves its site performance

Underlying Schuh’s remarkable web performance is an in-house platform that’s fully integrated with its in-house merchandising system, called Shark. It underpins a new site that was launched in September. “We’ve fundamentally reconsidered the way the website is built for a customer who’s touch, tap, swipe as opposed to click and we’ve thought very carefully about core elements like speed,” says Sean McKee , who heads a core ecommerce team of 32 at Schuh. “A number of colleagues have worked very carefully on site speed, thinking about elements like the way we code, the structure of pages on the site, everything that will help deliver increments of improvement in page load speed because we know there’s a very close relationship with speed and conversion. “They’ve thought about the things the industry has identified as best practice to be sure that our site, as far as we can, delivers those aspects. Speed is the one that most easily comes to mind – we’ve produced a much faster website than its predecessor.”

The new responsive site replaces three previous sites dedicated to the mobile, tablet and desktop and, so far in phase one, says McKee, “it’s a very good start.”

Features include real-time stock visibility, accurate to a couple of minutes, and is built first with the smartphone customer in mind: 42 per cent of traffic now comes from smartphone users, though slightly more sales come through tablets. By 2018, Schuh envisages a third of sales will come from each of mobile, tablet and desktop.

Traffic is already predominantly mobile and tablet. Mobile traffic tends to have a flatter profile, while desktop peaks during the day and tablet traffic in the evening. Mobile is also seasonal, peaking during periods including back-to-school and sales.

“Mobile is disproportionately London-centric, we discovered,” says McKee. For us London is about 19 to 20 per cent of traffic but it’s a about a quarter of smartphone traffic. There’s definitely a big conurbation commuter thing happening there.” There’s also been a big year-on-year increase in people checking store stock from the website, driven by smartphone. “These customers are more likely to be on the go and interacting with store stock,” says McKee.

WHAT WE LEARNED

While there are good reasons to build complex transactional websites in order to provide customers with high levels of service and to deliver persuasive content, there’s always a danger companies will lose sight of the basics in adding functionality. Sites can become slow to load, something revealed by our analysis of home page performance.

This matters. “Ultimately, site speed is becoming more and more of a critical issue,” says Alex Krohn, CEO of site performance specialist GTmetrix, which helped to research this Dimension. “Users’ attention spans are dropping, and they get frustrated more and more easily. If a site is slow to load, especially if a user arrives from a search, they will close the window and try the next site.”

Despite this, we measured numerous companies within the Top500 where the site performance was unsatisfactory. A dozen companies even dipped below an index value of 50 out of 100 here. This is surprising when you consider that simple fixes can improve a site’s performance, such as bringing down the file size of images.

“Part of the workflow for any competent content management system should be to optimise images,” says Krohn. “There are many tools that compress images ‘losslessly’, with no visual difference from the uncompressed version, and this can easily shave 10 to 50 per cent off the size of the image.”

Turning to customer service, even largest 150 retailers performed poorly here. One well-known travel company, for example, achieved an index value of zero for both its customer service and its Twitter responsiveness. This is an illustration of a strong correlation between these two figures. This perhaps isn’t too surprising. At InternetRetailing we’ve typically found that companies with a strong customer service ethos early on grasped the importance of social media.

Nonetheless, there are outliers here. Even companies in the Model group, such as Ocado and Vision Express, which each had an index value of 30 out of a possible 100 for customer service, scored highly for Twitter responsiveness – an index value of 99.9 out of a possible 100 for Ocado and 92 for Vision Express. A response to a tweet that took longer than 24 hours had an index value of zero, and a theoretical instantaneous response had a value of 100.

One explanation may be that some companies have staff specifically tasked with monitoring social media but not other channels. If so, we would ask whether some companies are in danger of creating a new silo – it’s no good responding to Tweets promptly if emails or phone calls aren’t dealt with adequately too.

The Elite group: what set them apart?

Schuh, Index Value: 299 out of a possible 300

The footwear retailer was close to flawless in site performance, customer service and Twitter responsiveness. The company has invested heavily in technology, meaning it has the systems in place to deliver superb customer service.

Link: How Schuh’s focus on internet retailing in store developed

Burberry, Index Value: 268

Similarly to Schuh, Burberry has covered off the basics of site performance and customer service. There’s still room for improvement, but Burberry’s imaginative approach to digitally driven retail suggests these improvements will be made.

Link: Burberry among the retailers testing new ‘buy from tweet functionality

WHERE NEXT?

After years of focusing on reducing the friction between different channels from the perspective of technology, logistics and systems, retailers are returning to an old battlefield, customer service. This is to be welcomed. In the digital era, it’s easy to compare prices, but customers don’t just shop on price. Such factors as convenience, the availability of expert help and, yes, whether retailers answer emails promptly all come into play.

Despite this, our research reveals that many companies still have plenty of work to do here. What good is a travel company that doesn’t respond to customer enquiries in an era when customers routinely ‘build’ their own holidays by booking flights and accommodation directly? Customer service has to be a point of difference for such a retailer, and that service level needs to be consistent across different channels.

This is hard to achieve. A major department store, for instance, had an index value of 30 out of a possible 100 for its customer service in our research. Have competitors caught up with and surpassed Middle England’s favourite department store when it comes to customer service within digital channels?

Turning to site performance, the number of retailers that had a moderate index value was surprising. Our research suggests that even though we all accept the benefit of well-engineered sites, the ongoing tension between size, complexity and change makes site optimisation easier said than done.

It’s important to realise that’s not the same as focusing on the desktop website. Mo Syed, head of user experience with technology company Amplience, points out that when a retailer begins to look at mobile, one of the first things it has to do is simplify existing designs. This isn’t work that has to stop with the mobile site. If there’s no space for a button or link on a mobile page, why not take the opportunity to see if it’s needed on the desktop site? A less-is-more mobile aesthetic gets transferred back to the website.

Over the next year, as more companies launch new sites, it will be fascinating to see if site performance improves across the industry – or whether there are whole new sets of problems out there we haven’t encountered yet.

The Methodology

Site performance specialists GTmetrix and retail technology specialists Micros Systems UK (now part of Oracle) provided important data to our research. Of the retailers listed in the InternetRetailing Top500, 46 companies achieved an index value of 200 or more out of a possible 300.

When analysing customer service, we also looked in more depth at the largest 150 retailers by Footprint, and this affects the relative standing of those companies to each other.

For site performance we measured Page Speed and YSlow score, standards developed respectively by Google and Yahoo! to assess the standard of engineering. We also measured HTML bytes, HTML load time, page bytes, page load time and page elements to assess site responsiveness. Engineering and responsiveness carried equal weighting in the final score.

Assessing customer service, we awarded an index value according to: responsiveness to email enquiries (time to respond); whether we were able successfully to find an answer to a standardised clarification query over the phone (time to respond; successful resolution). Query topics included delivery to a specific area, online tracking of orders and unwanted return policy.

Finally, we engaged retailers’ corporate Twitter accounts with standardised routine questions and measured responsiveness (time to resolve).