Online shoppers want to take Delivery of purchases in ways that works for them, writes Chloe Rigby.

Delivery is what makes the difference in online retailing. Shoppers choose to buy online at least in part because they can take possession of the goods in a way that works for them, whether that’s home delivery or picking it up from a convenient place – a petrol station, locker, local store or somewhere else. Convenience and price both matter when it comes to designing delivery and collection services – and are now increasingly important when shoppers want to return an item.

RetailX research analysed how quickly Growth 2000 retailers could deliver orders, whether that’s to the customer’s home or to a store or third-party pick-up point. Researchers looked at how much they charged, both for delivery and collection and, if they had a threshold for free delivery, what that threshold was. They also considered whether retailers in this group offered pre-paid returns, and how long their returns policy was. The study then moved on to compare how members of the Growth 2000 perform compared to the InternetRetailing Top500.

Designing delivery and returns

RetailX researchers looked at how much Growth 2000 retailers charged for delivery, and how quickly they promised to deliver. G2K retailers had a median threshold of £45 for free delivery – the same as among Top500 retailers. Their median delivery charge was £4. One third (35%) offered next-day delivery, while 3% offered same-day delivery. Among Top500 retailers, 59% delivered the next day and 6% delivered on the same day, showing a large gap between the leading and following group on speed of delivery.

More than half of G2K retailers that sell drinks offered next-day delivery. That was followed by those selling health products and garden products (both 39%).

Drinks retailers also offered the fastest standard delivery, at a median of three days for a median price of £5.10. Those selling health goods and software delivered in a median of four days, for between £3.70 and £4, respectively. Those selling books were both the slowest to deliver – at a median of six days – and the most expensive, at £6.30. In a sector where Amazon dominates, this seems to be much slower than ideal.

RetailX analysis of Top500 retailers showed that most offered a median of three delivery options. Two or three options seem a solid ambition for this Growth 2000 group as well: standard delivery of three days is likely to be affordable for most shoppers, while next-day will serve well those that need items faster and are prepared to pay. A third option could be a slower, no rush delivery, costing very little for those shoppers who are prepared to wait.

When it comes to returns, 31% of the G2K offered pre-paid returns. The median period in which retailers will accept returns comes in at 15 days from purchase. That’s 12 days shorter than the more generous 27 days allowed by the median Top500 retailer. These relatively less-generous returns policies may well be down to affordability for smaller retailers. Nevertheless, this is an area worth some thought at a time when customers expect to send back items as easily as they bought them.

Collection

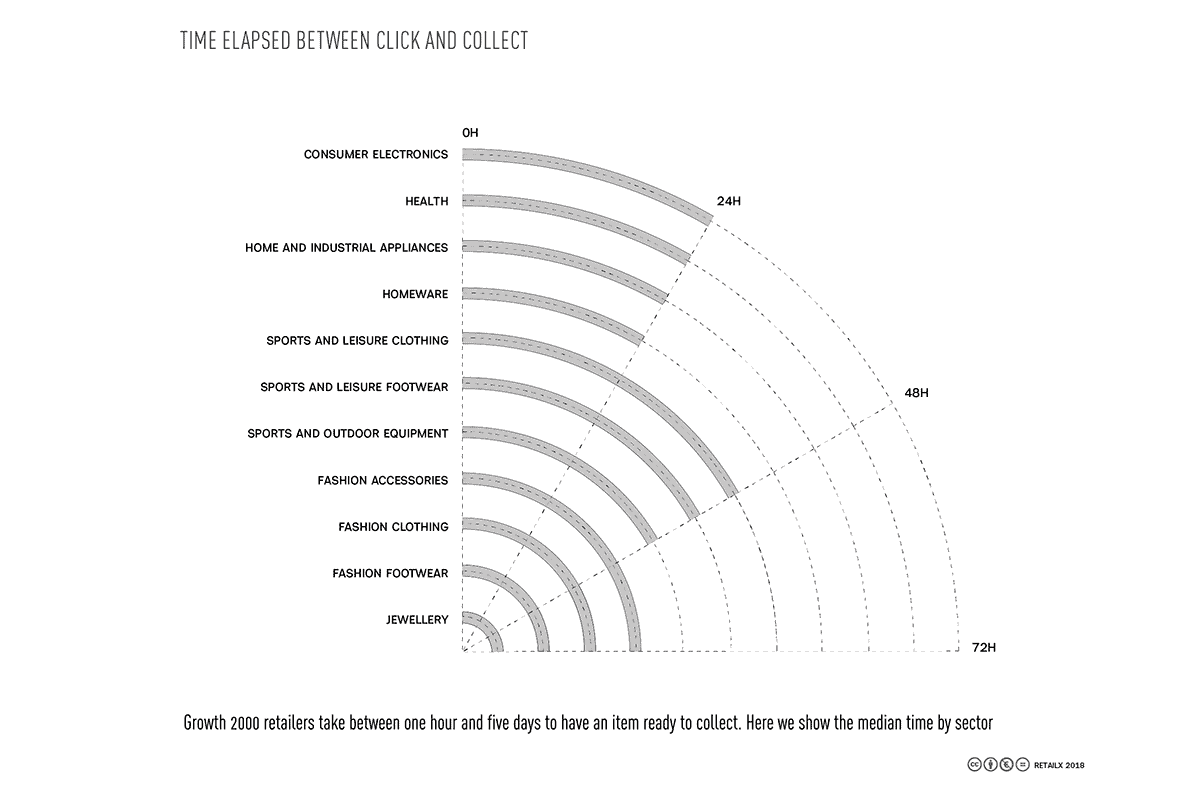

Click-and-collect is offered by 12% of the G2K. This is one area where members of the ranking are well behind the Top500 – where 61% offer the service. That’s 49 percentage points more than the Growth 2000. But where retailers did offer the service, it tended to be faster. G2K retailers promised collection faster than Top500 retailers, with the median time to collection stands at 24 hours for this index, compared with 48 hours for the Top50. Typically, members of both groups offered the service for free.

The click-and-collect service that G2K retailers give varied depending on their sectors. One in five (21%) of retailers selling garden goods offered it, with a similar proportion of fashion footwear (20%) and children’s toys (20%) retailers doing so. It was least widespread among retailers of books (3%), automotive goods (6%) and music, film and TV (6%).

Strong performers

G2K retailers that stood out in this delivery, collection and returns research area included Beauty Bay, Sigma Sports, Mannace, Smythson and The Dressing Room. Timberland, Rituals, Linzi, Bottega Veneta and Bobbi Brown were also highly rated.