A lack of real-world stores limits the cross-channel options for some leading brands, while mobile continues to grow in importance.

For many of today’s consumers, mobile commerce and cross-channel shopping have become a way of life, with a customer journey potentially moving from office desktop to physical store to smartphone or tablet to smart TV or call centre and back again – or any combination of same.

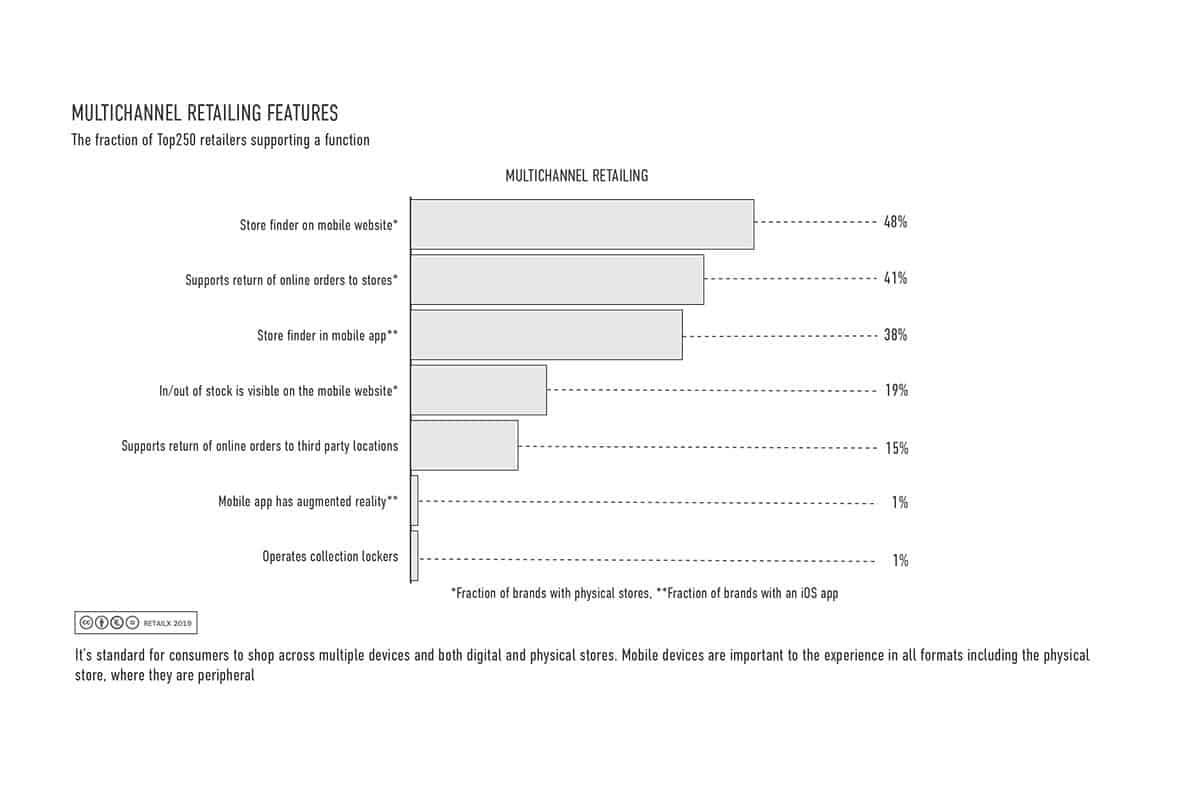

Leading brands have embraced such developments with a variety of mobile apps, as well as return and collection options, but many still have a long way to go when it comes to implementing stock visibility or insight into real-time store inventory on their mobile systems.

A challenge for those brands that are primarily manufacturers rather than retailers is lack of a multinational physical presence. Some – such as Adidas, Montblanc and Nespresso – work with local stockists or create a boutique concept, which may be standalone, franchised or concession, to give that essential convenience. Some may even consider pop-up shops. However, for many brands, achieving a seamless omnichannel and multinational experience will always

be difficult.

RetailX’s research reflects this dilemma. Overall, for example, just four out of 10 brands (40%) in the European Economic Area (with Switzerland also added) allow shoppers to return items to their stores. Since the bulk of brands in the Top250 are primarily retailers, this is surprising.

There is, however, some variation in that average figure by geography: from a high among localised Belgium brands of 48% to a low of 33% in Portugal. On average, 15% of brands allow returns to third-party locations with a high of one in five in the UK and Belgium, while the option is almost entirely absent among localised brands in Poland, the Czech Republic and Hungary.

It’s a similar story with collection – offered by just 40% of the Top250 brands in the EEA – although it may be a more attractive option for customers since the median charge for collection is £0.95 (€1.10), while the median delivery charge is £3.95 (€4.60).

Mobile continues to grow

With mobile estimated to account for as much as 60% of online sales in some product sectors, leading brands are focusing on this area with an average 44% including transactional capability in their mobile apps. Apps are most common among cosmetic (44%), sports and outdoor equipment (42%), and jewellery (40%) brands and least likely in the homeware sector (8%).

They’re also slightly more likely to be iOS compatible for iPhones than intended for the Android market, with around a quarter (26%) of brands offering Android and a third (33%) iOS. Brands localised in Spain, Italy, France, Germany, the Netherlands and Switzerland are the most enthusiastic app issuers with penetration typically 90% or more. In contrast, UK-localised brands are closer to the overall average with 22% offering Android apps and 29% iOS ones.

While social media and messaging apps – such as WhatsApp and Instagram – continue to grow, it is notable that some UK retailers, notably in the homewares sector, have quietly abandoned their apps in the past year as, perhaps, some discovered that downloads are minimal and customers rarely use them.

Comparing only those brands which were included in last year’s Top250 also revealed a 14 percentage point (pp) decline in the number with a store finder on their mobile sites: down from 62% to 48%. The result appears counter-intuitive in an increasingly omnichannel world where consumers are very likely to be consulting their phones while out shopping. Looking at product sectors, brands with a strong real world presence – cosmetics, homewares and apparel retailers – are most likely to include a store finder (61%, 57% and 55% of them respectively) while for consumer electronic brands in the Top250, companies such as Microsoft and Dell which have a much smaller real-world footprint, the figure falls to 7%. Store finders are also most likely for UK-localised brands, with 53% including the option on mobile.

Delivering stock visibility via a mobile remains challenging with only 19% of Top250 brands offering such information. Again there are notable geographic differences from 22% of UK localised brands to fewer than 5% in Portugal. It’s a similar story for checking available store stock with the EEA average again at 19% and the UK at 22% – although this time Poland is bottom of the list with just 3% of localised brands offering such functionality.

A fast loading speed is obviously essential for mobile sites and RetailX’s researchers found that the median mobile web page is 2.7MB. By product sector, sports and outdoor brands have the leanest pages at 2.2MB while cosmetics and apparel brands have the “fattest” at 3.3MB – with fashion footwear close behind at 3.2MB.

Research from Google last year suggested that 53% of people will leave a mobile page if it takes longer than three seconds to load, so the leaner the page the more likely customers will actually bother to look at it. RetailX’s researchers found that the median time across the EEA to fully load a landing page was 7.5seconds, which may suggest that a great many pages are abandoned before becoming visually complete.

Obviously, much depends on the device and network speed and as 5G becomes available significant improvements are likely. In the meantime, brands must hope that adding a powerful brand loyalty to the equation will ensure that shoppers prove to be rather more patient.