Retailers are adopting a wide variety of strategic approaches to trading within Europe, reports Chloe Rigby

InternetRetailing research reveals a wide range of approaches towards expansion across Europe. Household brand names that sell online and through stores in more than 30 European markets stand alongside those that sell into just one market in the IREU Top500 index. Most IREU 500 businesses are at the lower end of this range, selling into an average of four European markets.

Nonetheless, for many of the retailers and brands that trade within Europe, it’s a given that they will offer local language websites in key strategic markets. In these territories, customers can make purchases in their local currencies using their preferred payment methods. Retailers go further by ensuring that they offer fast delivery and, where they have stores, services that make buying from the website and picking up in store as friction-free as possible. Some retailers are going well beyond this to offer local languages and fast-loading mobile apps to serve the growing number of shoppers who want to buy on the move. Forward-looking retailers also help shoppers to engage with them via favoured social media platforms.

For all, political influences, from Brexit to the potential protectionist policies of the Trump administration, are likely to make themselves felt in the years to come.

Setting the bar

While all retailers have roots in smaller domestic markets, it’s self-evident that gaining wider brand recognition usually requires reaching beyond these markets.

Ikea, for example, which was founded in Sweden but is now headquartered in the Netherlands, has focused on offering multichannel services in the European – and global – markets well beyond those territories. In the UK, for instance, it now operates small format stores where shoppers can place and collect online orders. In Spain, it goes well beyond the usual approach to offer not only Spanish but also Catalan and Basque versions of its website. In its latest full-year financial statement, for 2016, the homewares retailer emphasised the need to develop new capabilities in order to cater for its customers’ ever-changing needs. Peter Agnefjäll, president and chief executive of the Ikea Group, said: “We want to offer our customers a great experience at every touchpoint, whether it is online or in-store.”

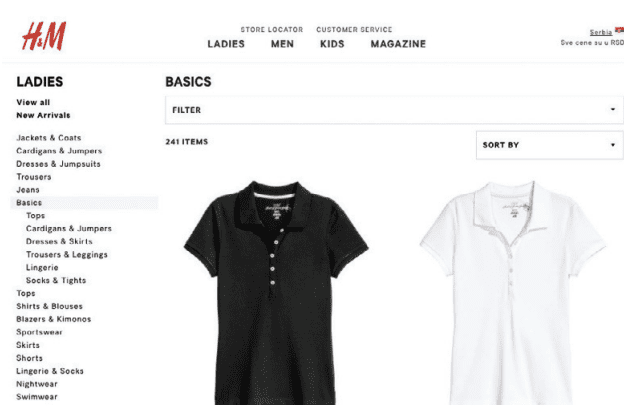

Fellow Swedish fashion retailer H&M said in its latest full-year results, published in January 2017, that even as its online businesses grow to account for a “significant” proportion of total sales in some markets, it still plans to continue opening stores in new and existing markets. Chief executive Karl-Johan Persson said: “Being close to the customers is key to success and even more important as the physical and the digital world become increasingly integrated.”

He added: “We have a clear omnichannel strategy in which we are integrating the digital and physical world in order to offer customers a more seamless shopping experience.” Services include enabling customers to pick up and return their online purchases in stores. In 2017, the company is set to increase the availability of next-day delivery, available in five markets at the time of writing.

Retailers from larger domestic markets have also developed European businesses that are highly responsive to trends in other markets. German fashion and footwear retailer Zalando , for example, invited brands and retailers in European countries, including Germany, France and the UK, to sell through its platform as it looked to offer the products that were most relevant to local shoppers.

Buy from Apple or Amazon , in the European markets they serve, and deliveries will be competitive and swift, while Amazon also offers an innovative dynamic pricing strategy across its markets. UK retailer Asos offers localisation across its markets: it has introduced the ability to offer different prices in different territories, and interacts with shoppers via local language mobile apps and websites.

Stepping back from store-based expansion

But commentators suggest that some retailers that have expanded through bricks-and-clicks international strategies are now changing tack. Jon Copestake, retail analyst at the Economist Intelligence Unit, says that while brands such as Ikea are expanding fast, other major retailers are consolidating at home. “The trend that I’ve seen over the last few years is about major retailers cutting their losses and selling their foreign operations to focus on domestic growth,” he says. “Firms like Tesco , Carrefour , Metro to a degree and even M&S are very much becoming very focused on offloading their foreign operations because of the complications of the supply chain, of local language, local currency, currency headwinds and tail winds that make them feel less competitive at home. One of the underlying trends in terms of strategy is a refocus on the domestic market.”

He says this focus is likely to be exacerbated by the effect of Brexit, Trump’s potential move towards protectionism, and the results of upcoming elections within the European Union. “One of the trends is going to be companies looking home even more than they have been,” says Copestake. “But I think there is still a significant opportunity abroad, and I think one of the things that will drive a trend towards more international operations [for UK retailers] is going to be the weakness of the pound, creating opportunities for cross-border selling into the EU.”

That’s likely to mean, he suggests, that online will be the vehicle of choice for retailers expanding within Europe, and following a tried-and-tested strategy of enabling local language sites with local payment and delivery options.

InternetRetailing research rates just local payment, currency, fast delivery and convenient multichannel collection as strategic and innovative services. That’s partly because while InternetRetailing research shows some retailers offer this level of service, most of the Top500 European retailers do not. The average IREU Top500 retailer sells to four of the 32 countries of the European Economic Area plus Switzerland. That average retailer offers its shoppers the option of paying in two currencies, or of reading its website in three languages. That’s a long way from the leading retailers in this Dimension, selling to 32 countries, in 24 languages, offering 13 different currencies. But it’s also well ahead of those that still sell to one country, in one language and one currency.

There’s a wide gap between the two, between the global household names and the traders that have made a success out of staying focused on their domestic markets. The efforts of retailers somewhere in the middle are revealing for what they say about how the retail sector is developing.

Expanding online

AO.com is one example of a company that is selling within Europe. The white goods and computing retailer branched out from its UK market only recently, opening a German operation in 2014. Since then, it has also started to sell in Holland. The size of its products and its specialist delivery services mean expansion has been relatively slow, built on infrastructure that includes a regional warehouse in Bergheim, Germany and a local fleet of delivery vehicles. The emphasis has been on taking the UK customer experience to new markets – with deliveries that are as fast as same day.

John Roberts, chief executive of AO.com, said in the company’s latest half-year results, that the retailer is aiming high. “We have made progress in our mission to become the best electrical retailer in Europe, cementing our operations in Europe with the opening of our new distribution centre in Germany and launching new categories for customers in both the UK and Europe,” he noted. “We’re retailing these categories the AO way, offering a simply better customer experience, executed brilliantly by a brand and team that customers and suppliers trust.”

The strategy has seen European sales rise to £29.6m in the six months to September 30 2016, 89.5% up on the same time in the previous year, and AO World expects the European operation to become profitable sometime in 2020.

Meanwhile, mid-market retailers are also taking steps to ensure payment options are relevant for the local market. Women’s clothing retailer Boden, for example, makes a little go a long way when it offers visitors a choice of currencies (sterling, dollars

or pounds) and languages (English or German) depending on which country they are visiting from. Visitors to its German website can choose from the local Rechnung (bank transfer) payment option, PayPal, Mastercard and Visa.

Ensuring relevant service

These are small but important details, says Julian Wallis, country manager, Ingenico ePayments UK&I. “International success in online retail depends heavily on the localisation of payment options, currency and language – without these, retailers will struggle to build trust and increase conversion,” he says. “While credit and debit card payments dominate the UK, in the Netherlands it’s iDeal. Completely different methods of payment are popular in other parts of the world, such as invoice payments, deferred payments and direct bank transfers.” He says that if retailers don’t go beyond the major currencies, such as the US dollar, Euro, Sterling and Renminbi, customers that don’t use those currencies may struggle to understand how much they are paying and abandon the transaction.

Meanwhile, Georges Berzgal, Pitney Bowes’s vice president Europe, global ecommerce, says choice is important. “Limiting options for payment alienates a significant number of would-be consumers,” he says, pointing to the company’s own research that showed most cross-border purchases were made using credit cards or e-wallet systems such as PayPal and Alipay. “Not taking this into account will damage retailers’ reach and prevent them from having the best customer experience they can offer,” he says. “It is not a matter of offering a broad set of payment options but the right set for your particular target markets.”

What’s clear is that retailers must ensure they offer the most relevant services for their target markets if they are to succeed in selling overseas. That means not only offering the right payment methods but also enabling shoppers to buy via the devices they want to use. Recent research from the Centre for Retail Research, carried out for Vouchercodes.co.uk, suggested that mobile devices would be involved in 27.9% of online retail sales across Europe – rising to 40.1% in the UK, where the number of mobile shoppers is set to rise from 23m in 2016 to more than 28m by the end of 2017. The growth, it said, would come as more retailers adopted a mobile-first strategy.

InternetRetailing research in this Performance Dimension found innovative use of mobile apps by retailers such as Ikea, which provides an augmented reality feature in its mobile app to show how an item will look in the visitor’s home, and footwear specialist Deichman, which was among a small minority of IREU Top500 retailers with an app that offered advanced functionality, including a barcode scanner and store stock checker. If retailers continue to prioritise international expansion via digital, it is likely that mobile apps, and mobile web speeds, will improve as a cost-effective and relevant way to serve shoppers around Europe.