Our research shows that apps should be high on the agenda for multichannel retailers. Polina Modenova explains why

For multichannel retailers, we may be reaching a tipping point where an app is not a nice-to-have additional extra, but an essential technology investment. We say this because retailers that have invested in this area are discovering that apps deliver higher conversion rates, better marketing opportunities via geofencing and push notifications, and, because apps are less reliant on mobile data connection than mobile websites, more stability.

For retailers still working on the assumption that a mobile-optimised website is enough in itself to glue together different channels efficiently, this is information that needs to be taken on board because it’s no longer an assumption any retailer should lightly make. As InternetRetailing’s mobile editor, Paul Skeldon, points out in his strategic overview feature, consumers are driving change here by using apps – and, conversely, we would add, by declining to use apps that lack what they perceive to be essential functions.

We’re not just basing these comments on anecdotal evidence. Over the past year, our research into the Mobile and Cross-channel Dimension has developed and deepened. In the first place, it’s research that rests on surveying whether retailers actually have an app at all considering that, when we compiled the IRUK 500 for 2016, we found that, for example, Just 197 (41%) of the Top500 retailers have an app (up from 34% in 2015).

For those that do, we looked in more depth at their iOS apps, collating which features they offer. One headline finding here was that of the iOS apps we measured in detail, just 63% are transactional.

Apps on the rise

If these figures seem on the low side, one reason may be that specialist retailers, which have an offer that rests on sector expertise, as yet either don’t see the need for apps or don’t see a compelling case for making an investment. We would suggest this may change over the coming months and years as more and more retailers see the case for well-designed apps.

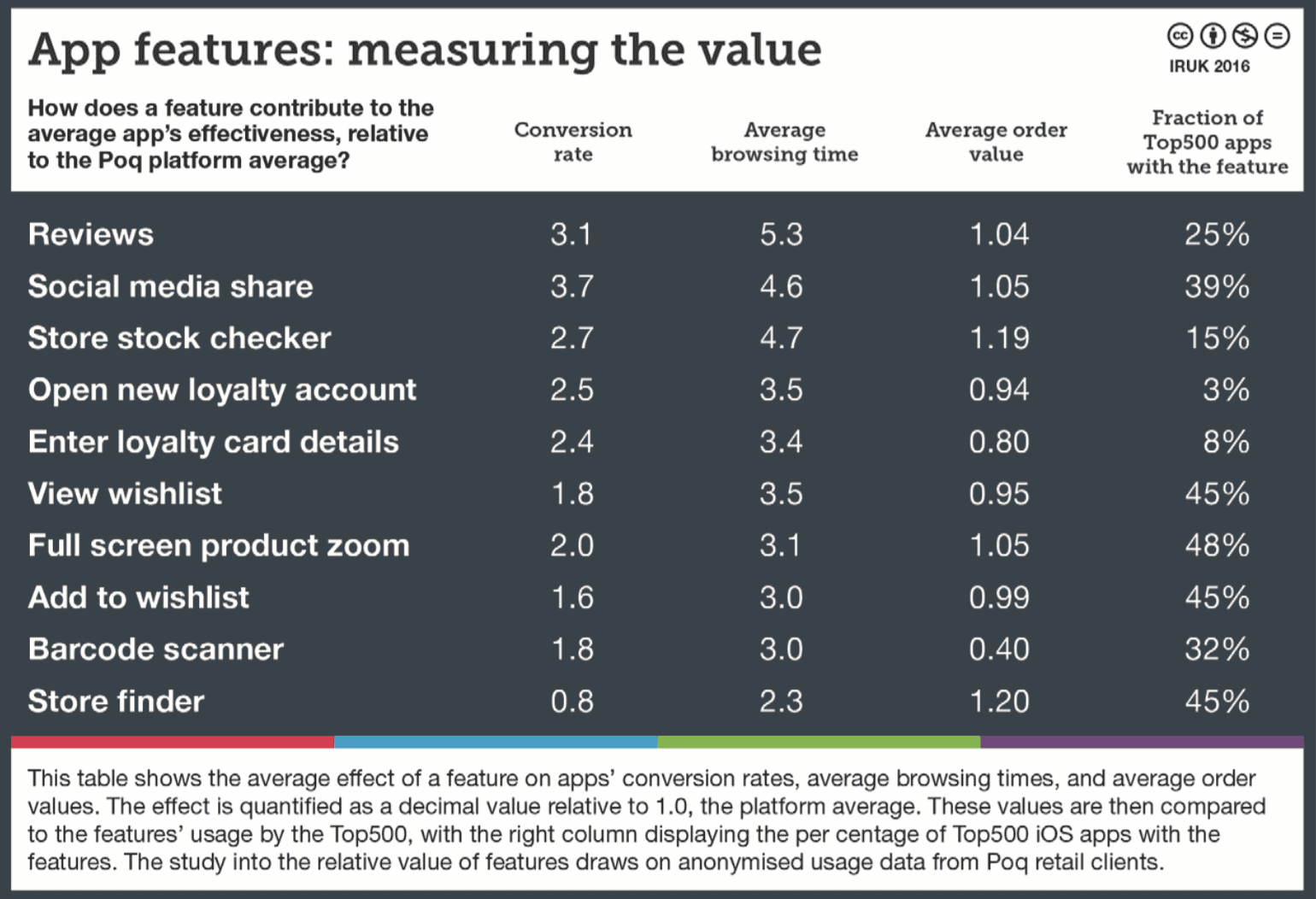

In the meantime, for this research, Poq undertook anonymised analysis of retailers using its app platform with the aim of uncovering the extent to which different features contribute to conversion, average order value and browsing time. We then matched these findings to the use of these features by IRUK 500 retailers. The features we looked at included the ability for customers to see and add reviews, a barcode scanner, full-screen product zoom, personal sizes, social media-sharing capability, a store finder facility and so on.

The most common feature we found was the ability to view a wishlist from the app. The figures in themselves show why this may be a wise investment, because Poq analysis suggests apps with this feature have a conversion rate 1.8 times the platform average, browsing time that’s 3.5 times longer, and have an average order value of 0.95, where the platform average is 1.0. Just 45% of Top500 iOS apps have this feature.

The usage statistics are even more impressive when it comes to the ability to share on social media. Poq analysis shows apps with this feature have a conversion rate that is 3.7 times the platform average, browsing time that’s 4.6 times longer and an average order value 1.05 of the platform average. In total, 39% of iOS apps offered by the Top500 have this feature, which translates to just 14% of the Top500.

The broader picture

We could go on, but the overall message is clear: well-designed apps work. This yet again raises the question of why more retailers aren’t using mobile apps. Here, to the idea of specialist retailers not yet seeing a need for apps, we might add the cost factor, plus a lingering suspicion of apps rooted in such factors as seeing poorly executed apps or agencies pushing the idea of an app without necessarily being clear enough about the expected ROI.

To tackle those two points head on, we might begin by saying that a state-of-the-art app isn’t cheap. Zoom out from looking at the effectiveness of individual app features and it soon becomes clear that the most effective apps have both a lot of features and well-curated features. In website parlance, they’re sticky.

To zoom back in, a store stock-checking facility within an app, for example, is one of the most valuable multichannel tools a retailer can employ, with customers checking items are available before visiting a specific store. Apps that offer this facility have an average conversion rate that’s 2.7 times higher than the platform average, according to our study drawing on anonymised data from Poq clients.

Make it personal

One answer to the second objection to apps we’ve identified – a suspicion of the technology rooted in poor execution and uncertainty about ROI – lies within such figures. That’s especially true when we also factor in the use of personalisation techniques. For example, apps that allow customers to enter their loyalty details have, according to Poq figures, an average conversion rate 2.4 times higher than the platform average. Apps that facilitate the opening of new loyalty accounts have a conversion rate 2.5 times higher than the same benchmark.

For retailers, this is hugely significant. It’s a retail truism that mobile both helps to glue together different channels and helps retailers track customers across different channels. Add in the incremental improvements that employing an effective app brings and there are even greater gains to be made.