People hate to wait, which makes Jonathan Wright wonder why more retailers don’t focus in on website performance

While cultural differences will always exist across European territories, certain ideas defy borders. Chief among these is the idea that customers hate to wait. Time and time again, surveys and research suggest that we don’t like to wait more than a couple of seconds for digital services to load. Even tiny improvements, measured in fractions of seconds, will make our initial responses to a website far more positive.

For this reason, when we came to select metrics for The Customer Dimension, we included web performance measures among the key indicators of performance. If the idea of fast page-loading times being desirable seems obvious, that’s because it’s fundamental to multichannel success. If retailers can’t get this right, it undermines other efforts to engage customers through advertising, merchandising and marketing.

What the Top500 do

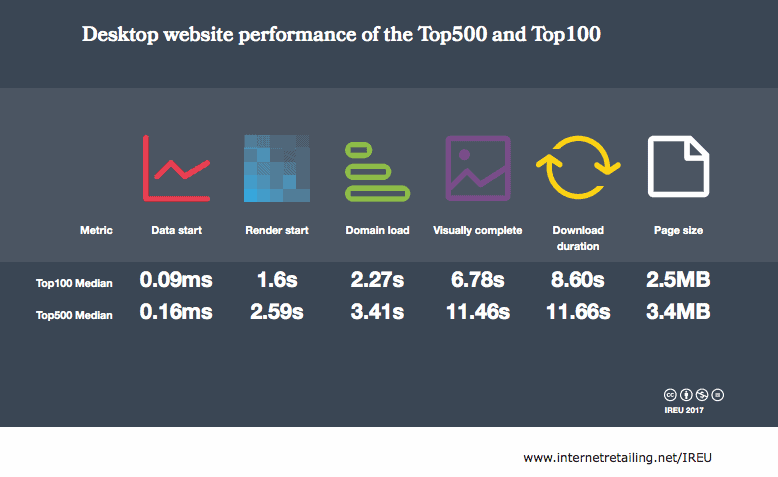

In order to measure speed, we worked with InternetRetailing Knowledge Partner NCC Group to test how quickly the landing pages of Top500 retailers loaded. The company’s Speed Index brings together metrics that include the time each site took to be fully loaded and visually complete. It also includes metrics such as time to first byte, when the first page begins to be downloaded; when the page starts and finishes rendering; and the number of web requests needed to complete the page.

While this is an area that changes rapidly – although not always for the better considering that, according to Soasta research, the average web page surpassed 2MB in 2015, a figure that had doubled from three years previously – we found that Top500 retail websites fully loaded in an average of 7.7 seconds, becoming visually complete in an average of 8.7 seconds. Time to first byte was achieved in an average of 0.4 seconds, while rendering started in an average of 3.2 seconds.

Breaking that down by territory, retailers trading in Norway, the Netherlands and Denmark performed most strongly in the Speed Index. Those selling in Belgium, the Netherlands and Denmark had sites that were, on average, fastest to visual completion. Belgian Top500 websites had the fewest number of web requests, an average of 107, compared to a Top500 average of 126.

What leading retailers do

While this falls outside the scope of our research, it’s nonetheless intriguing to consider why some websites aimed at particular territories outperformed those aimed at countries close by in geographic terms. It may be in part down to competition, in that we’re surprisingly sensitive to delays.

As Jakob Nielsen pointed out when writing about usability as long ago as 1993: if there’s a delay of any longer than 0.1 seconds, we won’t think a system is reacting instantaneously.

It may be that even the tiniest time lapses

get punished by clicking away where consumers are used to better performance, something we may need to look at in more detail in future research.

It’s also noticeable that many of the retailers that performed best in this Dimension overall had the fastest page-load times. Apparel retailer Next , for example, doesn’t just feature in the Top50 for this Dimension because it enables the use of local currencies, supports 11 European languages and has an exemplary call centre operation supporting customers 24/7 across territories. It’s because its local sites are fast. Next’s country-specific websites loaded in an average of 2.7 seconds, 183% faster than the average load time for Top500 retailers.

Similarly, homeware retailer IKEA operates 26 country-specific websites in 21 European languages, sites that scored well on softer metrics such as user-friendly design. Again, though, they were also fast. Its UK website had a full page loading time of 3.8 seconds, while its Romanian and Lithuanian landing pages rendered in less than 2 seconds.

These figures may be partly explained by both Next and IKEA operating at scale across borders. Perhaps if the idea of selling at volume is integral to a company’s DNA, focusing on every efficiency comes naturally. Since their margins are lower than retailers that trade in higher-value goods, maybe

fast-loading websites are a no-brainer.

In conclusion

None of this should be taken as an argument that speedy websites are enough in themselves. As we’ve explored throughout this Dimension Report, retail offerings are increasingly being built around customers.

A fast site is not the same as a ‘good’ site but fast sites are a critical component of holistic customer experience, especially with mobile browsing the dominant ecommerce channel for the majority of retailers.

In this context, it may be that a fast and efficient site is evidence of a retailer focusing on customers and their needs, understanding that even the smallest delays cause irritation. In an era when page sizes are on the up and when retailers surprisingly still often fail to resize images for mobile, it may be that the Speed Index is especially revealing for the way it shows how some retailers are taking care of basics while others most definitely are not.