PolinaModenova explains how InternetRetailing researchers measured Strategy & Innovation in Top500 retailers – and what they found

Retailers putting true shopper convenience at the heart of businesses that sell across channels and at scale stand out in this year’s Strategy & Innovation Performance Dimension. These are the merchants that act quickly and decisively to develop services that lead the market. They do that because these services are genuinely useful to their customers, and because they work. These retailers take time to make sure that the improvements they introduce give real benefits. That could mean ensuring that personalisation really is relevant, that products are easy to find and that pricing is responsive. Retailers that enable international shoppers to buy as easily as domestic customers also stand out.

“Leading traders are now responding to demand from overseas shoppers. More than half now offer international delivery”

Polina Modenova, InternetRetailing

Our approach

Our research brings together the metrics that we judge to be the most strategic and innovative from the other five Performance Dimensions that make up our IRUK Top500 research.

These include response times to customer queries, mobile load times, apps that are bug free, the ability to offer nominated-time delivery, search visibility and how retailers respond when no products match a shopper’s search. We’ve assessed which retailers offer international delivery, the number of payment options they use and whether retailers make it clear that payment is secure. We’ve also used Wiser data on pricing strategies to see which retailers compete with Amazon on price and which compete using other strategies. Its pricing review compares the relative prices of products that are sold both by the largest 50 retailers and by Amazon, and ranks our Top50 on their ability to beat Amazon.

What the Top500 do

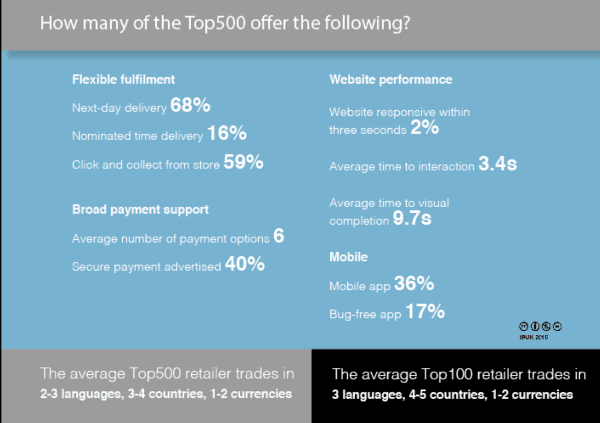

Top500 retailers are taking relatively responsive approaches to fulfilment. More than two-thirds (68%) now offer next-day delivery, although as yet only 16% enable shoppers to say exactly when they’d like to take delivery through a nominated-time delivery service. Click-and-collect services can offer that extra flexibility, since shoppers can pick up their orders whenever it’s convenient for them, and our study found that more than half (59%) of Top500 retailers now offer this service.

These leading traders are also responding to demand from overseas shoppers. More than half (58%) now offer international delivery. Many go beyond this to localise websites for different markets. The average Top500 retailer sells into 3.3 countries and offers the option of buying in one or two currencies. They trade in an average 2.5 languages. Retailers are also fairly flexible in the way they enable shoppers to buy, offering between five and six payment options. This might include different credit card options as well as alternative payments such as PayPal.

Customer service varies by channel. More than half of Top500 retailers (53%) responded to an email query in under 24 hours, while just over a third (35%) responded to a query on social media in under 12 hours. Leading retailers were rewarded in the Top500 ranking for how quickly, and how effectively, they resolved common customer issues in testing conducted by InternetRetailing researchers.

In merchandising, one key measure that we considered innovative was the ability to show relevant content when a search produced no results. Some 36% used such a ‘no results’ page to promote other items, an approach that rewards rather than frustrates customers looking for an item and could make a sale more likely.

As a group, Top500 retailers had a relatively low propensity to be seen by those searching for relevant search terms. Research from Knowledge Partner OneHydra showed that the average Top500 retailer has a 33% average search visibility – or chance of being seen in a relevant organic search. The Top500 ranking rewards retailers who have improved the SEO for their relevant keywords, achieving a higher share of visibility than their peers.

When it comes to mobile, there’s still room for improvement. We found that less than half (48%) had a bug-free mobile app, while a relatively low 12% had mobile homepages that were fully loaded in less than five seconds. This is an area where work to improve the service is likely to pay dividends. It’s well established that the mobile channel is driving growth in retail, and now accounts for more than half of online sales for many retailers. And it’s more than just raw speed – the Top500 analysis rewards retailers where websites become visible and usable before they are fully loaded.

Leading the way

Across the Top500, retailers in competitive markets stand out for a forward-thinking approach to strategic planning. Multichannel retailers that have created strong digital and mobile links between stores and online do well in this Dimension. Thus, House of Fraser stands out in this Dimension for a well-rounded strategic approach. It offers highly convenient delivery options that are planned around its customers’ needs. It performs strongly on mobile and responds quickly to customer enquiries. As well as this, it innovates by experimenting with new technologies such as augmented reality.

Fellow department stores Debenhams and John Lewis also perform strongly in this Dimension. Apparently shoppers see value in the sophisticated multichannel approach used by these retailers. The Wiser study earlier this year found that where identical products are sold by Amazon, the leading department stores typically sell them for 5-10% more. Debenhams has taken a consistent approach to some of the strategic markers measured in this Dimension Report. It has fine-tuned its ecommerce delivery service, responding to the needs of its customers in recent years. Meanwhile, John Lewis has focused on innovation, using virtual reality in its stores and encouraging startups both through its JLAB innovation lab programme and, through its tie-up with incubator and investment fund TrueStart, enabling the creators of new technologies to test them out in a multichannel retail environment. It also performs well in this Dimension for reliable customer service, as well as for the delivery and collection choices that it offers.

Another notable multichannel retailer that stood out in this Dimension was Holland & Barrett, which was particularly impressive for a search reach that meant the health and wellbeing retailer would be visible in 61% of searches of relevant search terms in December 2015. That was well above the average of 33%.

Amazon may not have UK shops, but this online giant stands out for strategies that give its customers reasons to be loyal. The retailer ensures that customers, especially those who have opted into its paid-for Prime membership scheme, find it as convenient as possible to buy from it. It offers fast delivery and collection services that bely its pureplay retailer status and ensure loyalty from shoppers. Innovations are constantly being trialled by Amazon. Most fail but some succeed. Amazon Prime, Amazon Marketplace and AWS (Amazon Web Services)

all started in this way.

Fellow pureplay Asos also does well in this Dimension for its great command of search and for its delivery and mobile capabilities. It has an average search reach of 60% – well above the average for the Top500 of 33%. The fast-fashion retailer has an outstanding delivery offer, which includes next-day, nominated day and nominated time deliveries, as well as click and collect through third-party stores. It has native and transactional iOS and Android apps, which offer incentives in the form of daily deals, and engaging content such as product page videos.

“Amazon may not have UK shops, but this online giant stands out for strategies that give its customers reasons to be loyal.”

Polina Modenova, InternetRetailing