Latin American countries have continued to enjoy steady and significant growth in their ecommerce sector since the outbreak of the pandemic. In Brazil alone, online retailers generated about 161bn Brazilian reals in revenue, according to Statista.

In line with the growth of ecommerce markets across Latin America, the region’s logistics scene has also seen many improvements in recent years. Today’s customers are able to enjoy streamlined and cutting-edge logistics solutions that ensure the safe, reliable, and quick delivery of their parcels.

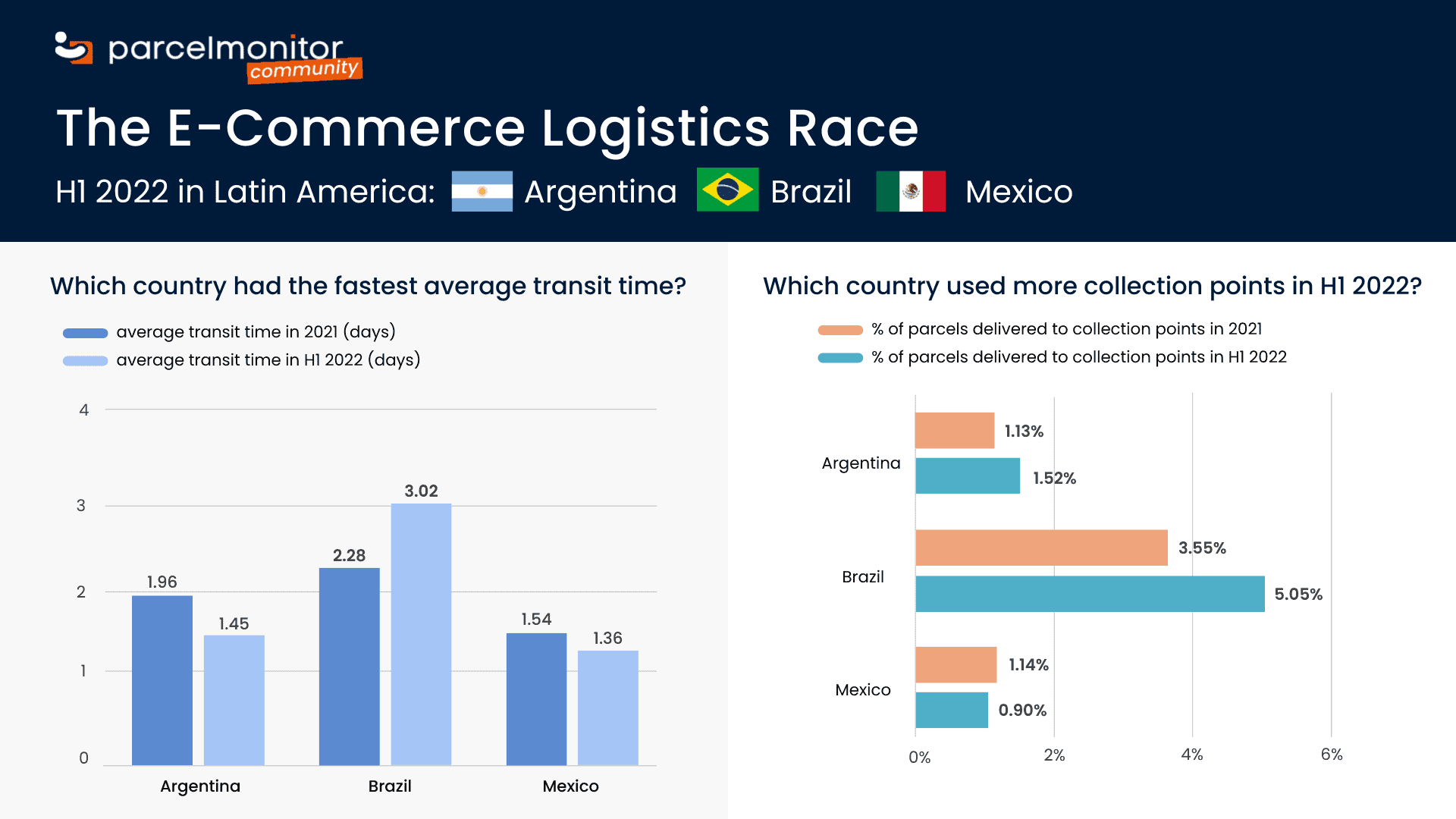

In this post, we will be taking a look at ecommerce logistics performances in three Latin American markets – Brazil, Mexico, and Argentina – during the first half of 2022.

Mexico had the fastest transit time of 1.36 days in H1 2022

Ecommerce logistics companies in Latin America have made several efforts to improve transit time. Among the Latin American countries under review, Mexico had the fastest transit time of 1.36 days in the first half of 2022. Conversely, Brazil and Argentina had transit times of 3.02 days and 1.45 days, respectively. Mexico’s transit time surpassed those of other Latin American countries as a result of couriers, including DHL, FedEx, and UPS, that offer express parcel delivery across the country.

What’s more, the Mexican Technology Integration Project (PITA) now makes it possible to streamline customs processes. This has helped improve the speed and efficiency of customs clearance and parcel delivery. PITA has also helped mitigate delays by customs during border crossing. On the other hand, Brazil’s ecommerce markets experienced excessive delays due to logistics challenges throughout the country, ranging from poorly maintained highways to cargo theft and limited rail lines.

First attempt delivery success rate increased in Brazil and Mexico

Additionally, the H1 2022 data indicates that Brazil and Mexico experienced an increase in their first attempt delivery success rate – from 92.35% to 92.59% and from 91.41% to 95.42% – respectively. This increase in Brazil has been made possible due to new laws and Provisional Measures on remote work enacted by the government.

Thanks to the new laws, remote workers now have more protection. Hence, more employees are able to work from the comfort of their homes. In addition to that, many residents across Brazil have been unable to go on tours or adventures due to repeated Amazon wildfires. Thus, shoppers are usually around to receive their parcel at the first delivery attempt.

In contrast, the first attempt delivery success rate in Argentina decreased in the first half of 2022 from 93.37% to 91.86%. Travel restrictions and lockdown laws throughout Argentina were eased or completely lifted in March 2022 for both vaccinated and unvaccinated persons. This meant that more people went out rather than staying at home to receive their parcels.

More Brazilians utilised collection points in H1 2022

The introduction of collection points has been gladly received by online shoppers in Latin America. The option to use collect points has provided a feasible alternative for online shoppers to get their parcels. By using collect points, shoppers can choose the preferred time to receive their package and don’t have to keep waiting at home or the office.

Of the three Latin American countries under review, Brazil ranked top in terms of collection point usage. Nearly 5.05% of parcels were delivered to collection points across the country. In contrast, less parcels were delivered to collection points in Argentina (1.52%) and Mexico (0.90%) compared to Brazil.

Lastly, Brazil enjoyed an increase in collection point usage as a result of the growing online shopping trends across the country. In fact, about 380 million online orders will likely be delivered to shoppers across the country before the end of 2022.

Final thoughts

In conclusion, when it comes to ecommerce logistics in Latin America, there is still room for improvement. For instance, the launch of additional warehouses or setting up of a more extensive collection point network would help ensure faster delivery and flexible collection of parcels respectively. As we look to the final quarter of 2022, we are excited to see what further improvements and innovations will evolve in ecommerce markets across the region.

For more exclusive reports, insights, and interviews on the latest updates in ecommerce and logistics, follow us on LinkedIn or join our community as a member.

About Parcel Monitor

RetailX Knowledge Partner Parcel Monitor is a community initiated by ecommerce logistics enthusiasts at Parcel Perform with the aim of inspiring the ecommerce logistics ecosystem to create a better delivery experience for everyone.

Parcel Monitor offers free parcel tracking across 900+ carriers globally on a single platform. Leveraging on our data and technology, we capture consumer trends, provide market visibility and derive industry insights while fostering collaboration across the entire ecommerce industry.