The secondhand market continues to grow, fuelled by a number of factors, including ecological and economic. These are driving purchases by consumers, as well as the rise in the number of third-party marketplaces for secondhand goods and brand-owned sites, according to the brand new Global Sustainability 2024 report.

The global market for secondhand clothing alone is valued at almost $200bn in 2023, with Statista predicting sales to grow by around $100bn by 2026. Another report, the Global Second-Hand Products Market report, predicts the secondhand market for all types of products will continue to grow with a CAGR of 17% during 2025-2030.

Clothing accounts for the largest share of sales, a fact that is backed up by ConsumerX research which shows that 28% of consumers surveyed had bought a garment secondhand in the previous 12 months. These purchases are not always of economic necessity. A third of respondents who classify themselves as higher income have bought secondhand clothes in the past year, compared to 28% of middle-income respondents and 26% of lower-income consumers.

A fifth of consumers had bought secondhand or refurbished consumer electronics, and almost a quarter had bought books secondhand. There is a market for most types of goods, including shoes, movies, luxury items and toys, with many sold on consumer-to-consumer sites, something on which eBay originally built its business.

Today, 40% of eBay’s GMV is from pre-owned and refurbished products, which considering that secondhand goods usually have a lower price than new, as a percentage of items the number will be even higher. The marketplace says that in 2023, it created $4.9bn in positive economic impact while avoiding 1.6 million metric tons of carbon emissions and 69,000 metric tons of waste.

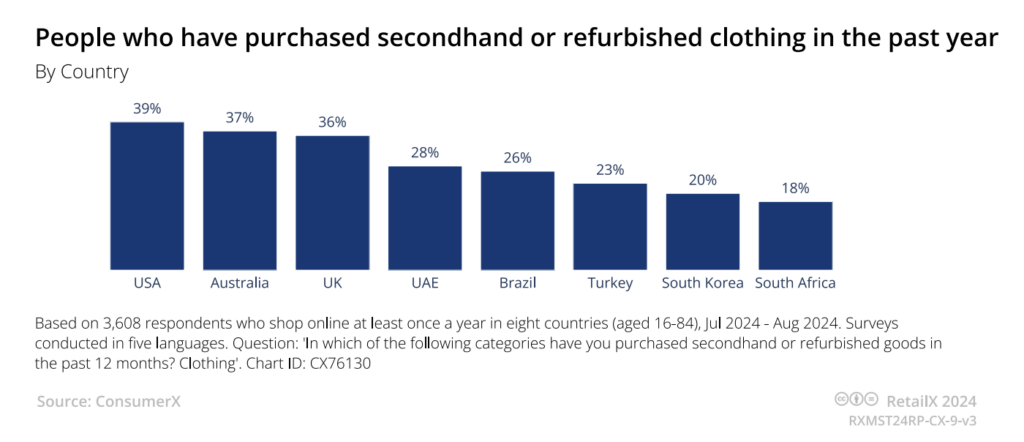

Consumers in some countries are more likely to shop secondhand than others. A higher percentage of consumers in the United Arab Emirates have bought secondhand or refurbished luxury goods in the last year than shoppers in any of the other countries surveyed by ConsumerX. In the summer of 2024, ConsumerX surveyed consumers across eight countries – the UAE, the US, UK, South Korea, Australia, South Africa, Brazil and Turkey – to understand current behaviour and thoughts on the environment and retail services.

Some 11% of consumers in the US had bought secondhand luxury goods and 5.3% of shoppers in Brazil. The US has the largest market for secondhand clothes, out of the eight countries. Almost 40% of shoppers had bought secondhand clothing. In the UAE, the percentage was closer to 28%. South Africa is the smallest market by percentage of consumers, with 18% buying secondhand clothes.

Across the world, Millennials and GenZ are the most likely to buy secondhand goods, with 30% having bought something secondhand in the previous 12 months. A quarter of GenerationX and 23% of Boomers had done likewise.

Retailers owning the market

Taking back items from customers for resale or recycling is becoming more common among the RetailX Global Top1000. Some of the brands and retailers are working with partners to process products in the best way for their condition, either reselling them on behalf of the brand or recycling them. A fifth of the Global Top1000 offer customers a recycling scheme for products they sold originally.

In 2024, Shein rolled out its secondhand marketplace, Shein Exchange, to Europe following the resale platform’s success in the US. Since its launch in October 2022, the platform has continued to attract new users and listings. In 2023, over 4.2 million new users signed up to join Shein Exchange in the US, with over 115,000 pre-owned items listed for sale.

European fashion brand Zara is doing similar in reverse. Its re-sale platform which it operates via its core ecommerce site is expanding to the US following successful implementations in 14 countries in Europe.

H&M is pioneering a switch from fast fashion towards more sustainable manufacturing while also helping the factories that produce its clothes to switch to sources of renewable energy. The brand recently took secondhand onto the high street offering a “carefully curated” assortment of garments at its Götgatan store in Sweden’s capital, Stockholm.

This is an excerpt from the Sustainability 2024 market report, which brings together the information from RetailX’s ecommerce market reports and performance-based ranking reports with consumer sentiment and behaviour data from ConsumerX to give a rounded view of the current state of sustainability communications and services in retail and ecommerce globally.

Data and analysis will cover a number of key themes to highlight trends and opportunities, while company profiles will showcase activities of individual brands and retailers of note.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.