The latest European Marketplaces Report 2023, launched live at ChannelX World on 11 October 2023, highlights how marketplaces have come to define modern ecommerce, with European shoppers using them as a first port of call.

According to data, 35% of online purchases made globally now take place on a marketplace. If there were any doubts as to how dominant these platforms have become over the past five years, this is the statistic to dispel them and to put that is context, only 17% take places in a supermarket and just 12% in a retailer branded site.

This shift in use of marketplaces as a first port of call for online shopping has been a slow burn. The proliferation of third-party marketplaces globally has grown a staggering 500% since 2007 and is reported to be heading towards accounting for almost 60% of online sales by 2027. In China, marketplace sales account for 80% of total ecommerce sales in 2023.

This interest in marketplace buying has been driven by a range of factors: convenience, competitive pricing, wide variety of choice and even easy-to- manage delivery options. Factor in the ability for marketplaces to also act as ‘search engines for shopping’ – unifying both choice and convenience – and it’s easy to see why they are in the ascendence.

This can also be seen in the wide appeal that marketplaces have across the generations. While Millennials tend to be slightly more drawn to marketplace shopping than other cohorts of shoppers, they along with Gens X and Z are big marketplace shoppers, with between 72% and 77% of each demographic group doing so in 2022. Only Baby Boomers fall below the 70% mark, with just 53% of those aged over 57 years using marketplaces as their main online shopping location.

Part of this skew in the older region is down to data being from a global sample, which includes older shoppers in less tech-savvy and advanced markets, where older consumers are less likely to use the web for anything. When looking at the developed markets of Europe, a clearer picture emerges of marketplaces being incredibly popular across all age groups.

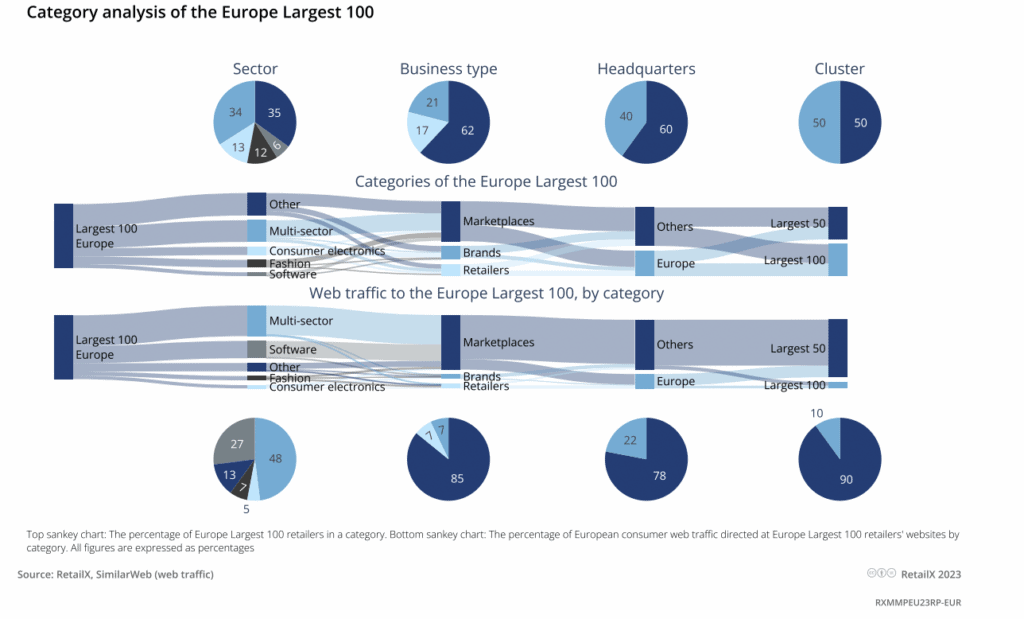

Marketplace distribution across Europe’s largest 100 retailers

The deep entrenchment of marketplaces among European consumers can be seen by how many of Europe’s Top100 retailers are marketplaces.

Of the Largest100 online retailers across the continent, 62% are marketplaces of one form or another. This dwarfs both brands and retailer sites. A similar picture emerges when looking at Europe’s largest online retailers by traffic. Here, a staggering 85% of visits are to marketplaces, again dwarfing the 7% to each of brand and retailer sites.

It is clear that, from a consumer’s point of view, marketplaces are the preferred way to shop online, since they attract the lion’s share of ecommerce traffic and they have grown to become the largest retailers within the region.

But more alarmingly for Europe’s retailers and brands is the fact that the majority of these marketplaces are based outside of Europe. As the chart shows, 60% of the Largest100 retailers in Europe by category and 78% by traffic are not based within Europe at all. Of the marketplaces, the split is close to two-thirds by category not being European- based and around four-fifths by traffic.

This has a number of causes and implications. One cause is that there are a few very large marketplaces that dominate the ecommerce market – notably Amazon, eBay and AliExpress. All are based outside of Europe, the first two in the US and the latter in China. While many more marketplaces do have HQs in Europe, most are relatively small compared with these three foreign giants.

The implications are less straightforward. The dominance of marketplaces is troublesome for retailers and brands, who are increasingly forced to use them to reach customers. The fact that the big three have something of a hegemony is even more problematic because it takes trade outside the region.

The upside is that across Europe, marketplaces are now springing up to take on these dominant players. While this increases the competitive pressure to use marketplaces, it at least keeps business relatively local. It has also inspired many retailers to set up their own marketplaces to tap into this market.

This feature originally appeared in the European Marketplaces Report 2023. Download it in full to discover:

- What factors are key to a successful marketplace?

- How are marketplaces working to try and protect both brands and customers from fraud, counterfeits, and piracy?