Wickes today reports record sales in the first half of its financial year as shoppers looked for value alongside convenience and quality. During the first half the DIY and trade equipment retailer cut click and collect times to 30 minutes in order to improve convenience for time-pressed trade customers and also expanded its home delivery capacity by 10% by improving its in-store order fulfilment space.

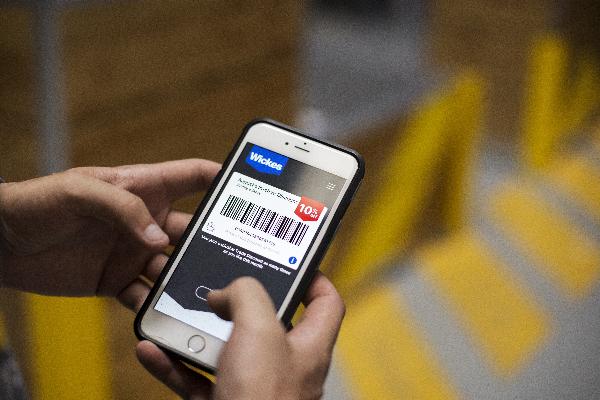

Wickes, ranked Top50 in RXUK Top500 research, says perceptions of its value and the strength of its digital offer – including the new faster click and collect service – are reflected in sign-ups to its Trade Pro loyalty scheme, which has seen about 10,000 new customers sign up each month, taking the total to more than 700,000.

It has used its predictive ‘missions motivate engine’ to focus on improving the digital experience for trade customers, and boost engagement throughout projects. It has used social campaigns and display marketing to boost awareness of the TradePro app.

During the first half Wickes eBay store launched with 4,000 lines – one of a number of channels through which the retailer aims to improve the accessibility of its range to more home improvement customers.

The retailer continues to refit its stores, and plans to open a further 20 over the next five years. It also says it will submit its science-based targets for carbon emissions reductions by the end of September.

David Wood, Wickes chief executive, says: ““This was a half in which we achieved record sales, as customers continued to be attracted to our market leading value, choice and availability and I would like to thank all my colleagues for their hard work and support in delivering these results. While market volumes have declined, we have made further market share gains and delivered a particularly strong performance in trade, with an acceleration in the rate of sign-ups to our TradePro membership scheme.”

Wickes today reports revenue of £822.3m in the 26 weeks to July 2 2022. That’s 1.3% higher than in the same period last year. Within that, sales in its core DIY market fell by 5.1% to £632.6m but sales in the emerging ‘do it for me’ part of its business grew by 30.6% to £189.7m.

Top-line pre-tax profits came in at £45.6m, 1.9% down from £46.5m last year, but after £12.1m in one-off costs, primarily related to separating IT systems from those of former parent company Travis Perkins, bottom line pre-tax profits came in at £33.5m. That’s 6.2% down from £35.7m a year earlier. The retailer says it continues to expect full-year pre-tax profits, before one-off costs, to come in at between £72m and £82m.

The state of the home improvement market

Wickes says that home improvement remains an attractive market that it puts at a value of £26.5bn, at a time when many people are continuing to work from home and want to improve their environments, including by making them more energy efficient and in general maintenance. However, it sees demand slowing moderately as price inflation – driven by rising energy costs and supply chain disruption – continues. In the first half, prices grew by an estimated 15%, driven by categories including timber and cement.

In its latest Mood of the Nation survey, Wickes found that 25% of trade respondents had order books for at least 12 months ahead, and 56% for at least three months ahead. It says that as yet it’s seen little sign of trading down or own-label purchases, but says that customers are shopping around more, and that it is well-placed to benefit. Its ‘do it for me’ (DIFM) order book has now started to decline, but by the end of the half-year was ahead of the same time last year and stood at roughly double pre-Covid levels.

Wood says: “In DIY, we continue to cater for an increased number of younger customers who first turned to home improvement during the pandemic, while in DIFM, delivered showroom sales have remained robust as we launched new kitchen and bathroom ranges and worked through the elevated order book.

“As previously stated, we have seen some softening in the DIY market from the very high levels of demand experienced during the pandemic. However, we continue to outperform the wider home improvement market and our confidence in our long term strategy is unchanged, reflected in our continued investment to drive further growth.

“Looking ahead, we remain confident that our uniquely balanced business model, coupled with our market-leading value, leaves us well-positioned within a large and growing home improvement market.”