To drive growth, retailers need to maximise their visibility on the internet, be that through promoting and SEO-ing their own site, or by using marketplaces. While consumers have increased their ecommerce spending during and post-pandemic, the online market has become even more competitive.

This issue of visibility is exacerbated for smaller merchants, such as the Growth 2000, who are having to compete with each other in their sectors, as well as a growing number of giant brands, with very deep pockets, that are also coming to see the web as their main channel to market.

For many smaller retailers, the solution lies in using marketplaces to take on these large companies. A large marketplace, such as Amazon or eBay for instance, can offer them the reach and marketing power to compete. However these sites can also be competitive too. They are home to all their competitors and the big brands and retailers.

So just how are Growth 2000 retailers leveraging marketplaces and what sort of success are they having?

Marketplace of choice

More than half (56%) of the Growth 2000 selling on marketplaces appear on Amazon, with a third (33%) appearing on eBay. Zalando and Farfetch also figure prominently – and complete the top three by popularity – indicating that there is a bias among Growth 2000 companies towards fashion and apparel. The data also shows that many Growth 2000 companies are using more than one marketplace to sell online and, while they rely heavily on Amazon and eBay, these marketplaces are far from dominant.

How effective are marketplaces for retailer visibility?

Growth 2000 fashion brands and retailers are by far the most visible on marketplaces by some considerable margin, outstripping sports and leisure, multi-sector brands and consumer electronics. Interestingly, the confectionary sector, which has shows up throughout the Growth 2000 marketplaces research report as offering only organic search presence, scores very poorly indeed on visibility on global marketplaces.

Overall, we can see that brands are using marketplaces more in some sectors than others, with fashion out stripping all others and increasingly using all these marketplace channels to shift stock.

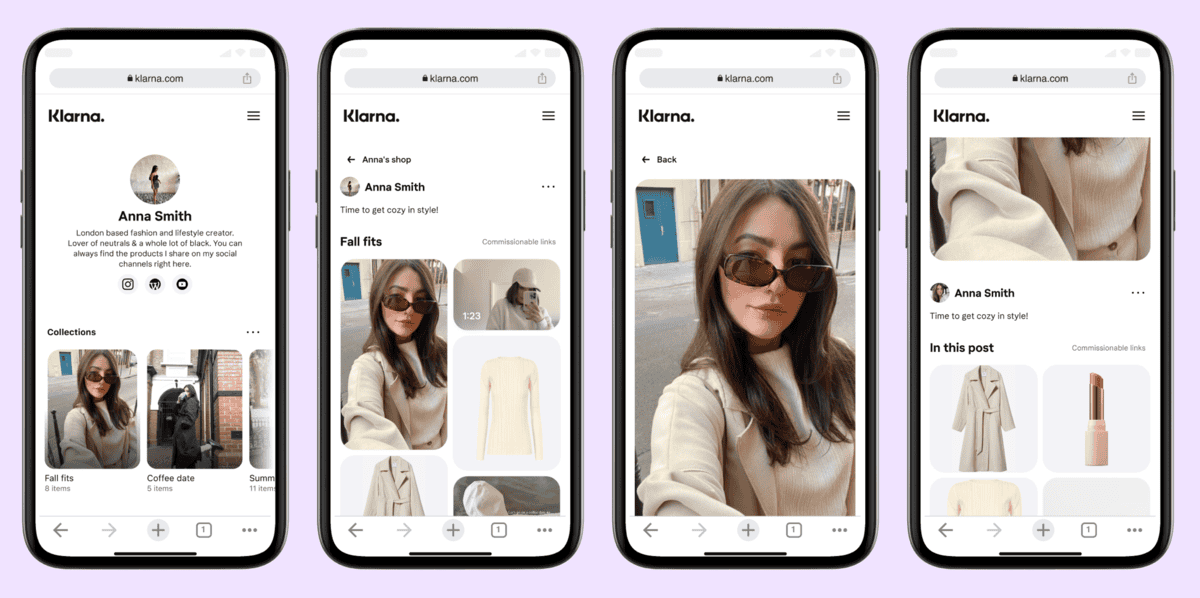

What role does social media play?

Social media sites are increasingly becoming an integral part of the marketing and promotional mix for retailers and brands and presence therein is directed at pushing shoppers onwards to marketplaces or merchant-owned websites.

However the wash of ‘not founds’ in the graph above, indicates that quite a number of smaller retailers are not using social media – or not using it as well as they might. Of those that do use it, Twitter comes out as being one of the chief social sites for retailers, often dominating all others. Twitter is non-transactional and is used primarily as a publicity tool, indicating that of those that are using social media they are not looking at it as a potential sales channel, but as a place for high-funnel engagement and promotion.

Pinterest seems to be an exception to the rule, with crafts, hobbies, pet care and children’s clothing vendors all appearing active on the image sharing platform.

Although not featured in the results, TikTok’s role in ecommerce is growing at quite some speed, with nearly 10% of UK shoppers making online purchases through the app in 2021. The platform is poised to grow its ecommerce capabilities in the year ahead, with many leading retailers including ASOS, Very and Co-op already cashing in on its 1bn plus viewers.

The analysis above can be found in further detail in the Growth 2000 Marketplaces Report 2021.

To discover more about the success rate of Growth 2000 retailers using marketplaces, including worldwide visibility, weighted visibility score on Google and challenges along the way – download the full report here.