musicMagpie , the new and used electricals retailer and renter, has seen recorded a £44m profit fin its maiden full year results for 2021 on sales of £145m. While this is down some 5% on 2020, it shows a significant 10% growth from 2019 levels of £131m.

While this was in line with management expectations, consumer technology revenue increased by 3.1% to £86.1m (FY20: £83.5m: FY19: £70.4m), representing 59% of Group revenue. UK consumer technology revenue grew by 6.1% to £71.2m, a 16.2% CAGR on FY19 performance. Gross margin increased to 30.4% (FY20: 29.2%: FY19: 23.1%) due to buy and sell price focus combined with the increased contribution from rental contracts. Gross profit in Consumer Technology across the Group increased by 9.9% to £21.3m (FY20: £19.4m; FY19 £12.6m) with gross margin increasing from 23.2% to 24.4%.

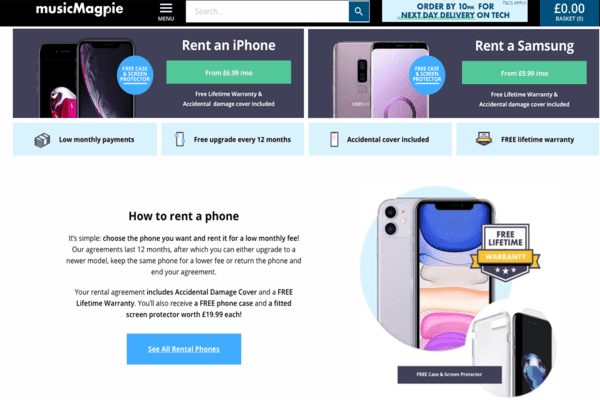

musicMagpie has had a momentous year. Strong progress from the Group’s innovative new device rental subscription service, launched in October 2020, saw some 19,000 active paying subscribers as of 28 February 2022. The success of this rental proposition has led the retailer to expand in to new product categories such as tablets, games consoles, MacBooks and wearables.

The retailer also launched a sustainability partnership with Asda in 2021, including a projected roll-out expansion of its innovative SMARTDrop kiosks to nearly 300 Asda stores commencing in March 2022: More than 8,000 devices were traded by 28 February 2022, paying out some £2.3m to consumers increasing inbound items.

The musicMagpie corporate recycling programme was also fully launched in February 2021, aimed at businesses looking to increase their sustainability efforts. Already contracts have been signed with Deloitte and Zurich .

Commenting on the results, Steve Oliver, Chief Executive Officer & Co-Founder of musicMagpie , says: “This has been a landmark year in the history of musicMagpie , and I am hugely proud of everything that the business has achieved. We have delivered strong operational and strategic progress in our first year as a listed company, and have done so while staying true to our clear environmental and social focus and our long-standing ’smart for you, smart for the planet’ ethos. During the year, we gave a ’second-life’ to over 400,000 technology products, as well as 2,500 tonnes of disc media and books. This helped to save over 50,000 tonnes of CO2, which is the equivalent to providing heating for over 18,000 homes.”

Oliver continiues: “In the current uncertain climate for consumers, the benefits of buying and renting refurbished consumer technology products, whilst helping the environment, has never been more compelling. We are particularly pleased with the progress being made by our rental subscription service, which provides customers with a more affordable and flexible option than an outright purchase or a pay-monthly contract. We are extremely excited about its future growth prospects, and scaling this area of the business further will be a major point of focus for us in the coming year.”

Russell Pointon, Director at Edison Group, comments: “In its maiden set of full year results since listing, musicMagpie (MMAG) has reported revenue and adjusted EBITDA in line with Refinitiv consensus for the year ended November 2021. Revenue declined by c 5% to £145.5m with growth in Technology of c3% partially offsetting declines for Media and Books of c 14% and c 21 respectively as the latter two categories normalise towards pre-COVID trading levels as previously flagged by management. Despite the revenue decline, Media’s gross profit increased from 35.7% to 38.8% given the focus on product selection and margin maximisation. In aggregate the group gross margin improved to 30.4% from 29.2%.”

Pointon adds: “As expected, Technology revenue growth was dampened by the substitution effect of one-off sales towards rentals, which has enjoyed strong growth and contributed positively to group profit in its first full year. Management is excited about the long-term growth potential for rentals, with the recent move to offer other consumer technology, and they expect the significantly higher margins to continue, gross margin of 72.5% in FY21 versus the group average of 30.4%. This should be positive for medium-term margins as its relative contribution increases.”

He concludes: “With respect to current trading, management points to continued strong growth in rentals (to c 19k subs by end of February) and a moderation of outright sales in consumer technology with higher sales price and lower volumes, which leads to expectations that outright Technology FY22 gross margin will be c 4 percentage points lower than FY21. Elsewhere, Disk Media has performed in line with management expectations and Books is in line with H221, implying down versus the start of FY21 given the comparative benefitted from COVID. The statement points to many recently launched initiatives that management believes will help to stimulative future growth including corporate recycling and device rentals.”