In part 2 of a two-part series on the influence of TikTok on Retail Media Colin Lewis looks at what Retail Media Networks should do. Read the first part of the series here

TikTok has rewritten the rules of content and commerce: the impact of short form video looked at through a mobile phone – triggered by the popularity of Tiktok – means that shoppers move fluidly between streaming, scrolling, searching and shopping

I call this ‘Tiktokification’. What do I mean when I say this? The addictive algorithm-driven dopamine loop that causes a change in behaviour because of the influence of TikTok. TikTok trains users to respond to stimulus without structured journeys and its having an influence far beyond our mobile screens

TikTok by the numbers

TikTok is much bigger than most people think:

- 2.2bn unique monthly TikTok visits.

- 700m unique visitors per month.

- 118m users in the US, 30m in the UK.

- 1.5 million British businesses on TikTok.

- Average TikTok visitor spends 10 mins on site.

- TikTok Shop is the 4th largest health and beauty retailer in the UK – less that two years after the launch of TikTok shop.

Short form videos are now the present

What is at the heart of TikTok’s success?

In a world of limitless content options that can be found with just a swipe of a scroll, modern audiences are more receptive to content that quickly communicates the message and grabs attention or, in other words, provides instant gratification.

This has led to the evolution of video consumption trends specifically a shift towards short form, vertical video that can tell a story.

TikTok appeals to a mobile-first audience with short attention spans and caters to this audience’s overwhelming preference for visually-oriented media platforms.

Short form video has become a rising norm. The mimicking of TikTok’s style, format and algorithm‑driven feeds is felt right across all of social media. Think about Reels, Shorts, Spotlight and how they spread across Facebook, YouTube, LinkedIn, Snapchat, and Instagram.

But where will all this lead? Perhaps we already have an answer.

What’s next with the TikTokification of Retail Media?

There is a consumer market in the world which has already shown us what the TikTokification of Retail Media: China. China, like many other developing markets, did not follow the pattern of the West in going from physical shops to PC to laptop to smartphone. Many consumers just went straight to the smartphone and have never engaged directly with a website.

Any visitor to China will immediately be struck with the ubiquity of the smartphone to the Chinese consumer. If you think Westerners are addicted to their phones, wait until you visit Shanghai or Beijing: Chinese people live life through their mobile phone.

Mobile is ubiquitous in China – a way of life, not only a medium of communication. Brands are not just purveyors of products and services, but also partners helping consumers with daily living. Most Chinese companies build their advertising and marketing, social communication, shopping, purchasing and payment programmes around mobile.

As a result, China is app dominated. Tencent has the highest reach of internet users in China (95%) with 442 mobile apps, followed by Alibaba (88%), Baidu (81%), and ByteDance (73%).

Retail in China is dominated by ecommerce, influencers and livestreaming

Online retail sales in China are greater than in the rest of the world combined. However, just three companies make up 89% of the total Chinese ecommerce market. The biggest difference between ecommerce in Europe and in China is that in Europe, consumers go to a brand or retailer’s own website. In China, consumers visit retail eCommerce sites Taobao or Tmall to try and find the products there, including global brands like Burberry or Dyson.

These major ecommerce players – Tmall, Taobao, JD.com and Pinduoduo offer a fusion of ecommerce and livestreaming, known as ‘live commerce’. It centres around influencers, known in China as key opinion leaders (KOLs), broadcasting live to millions of viewers. KOLs showcase products, trying them on and describing them.

Livestream shopping is a live shopping event. Think QVC or the Home Shopping Network. Livestreaming centres around a brand with a celebrity or influencer demonstrating a product and answering questions from a digital audience in real time. Viewers can immediately purchase the item from an embedded link online. Livestreaming hosts sell clothing, cosmetics, electronics and food.

Alibaba first launched Taobao Live in 2016; now Tmall, JD.com and Pinduoduo are all offering live commerce – years before their Western counterparts offered these tools.

Livestreaming KOLs

Influencers are called ‘key opinion leaders’ in China – or KOLs. And there are lots of different variety of KOLs:

- Small KOL – up to 10000 followers.

- Micro-KOL 10,000-50,000 followers, particularly, in beauty, lifestyle and healthcare

- Large – KOL – 100,000+ followers. A campaign can cost tens of thousands to do livestreaming for 5 minutes.

- Famous KOL, for instance, movie star or pop star.

Digital marketing in China

Tmall has a range of sophisticated multiple paid auction advertising capabilities to support brand exposure to sales conversion. The advertising solutions such as search ads, display ads and feeds ads within Tmall and the Alibaba ecosystem – but they had them in 2017, way before EU and US retailers knew how to deliver Retail Media advertising.

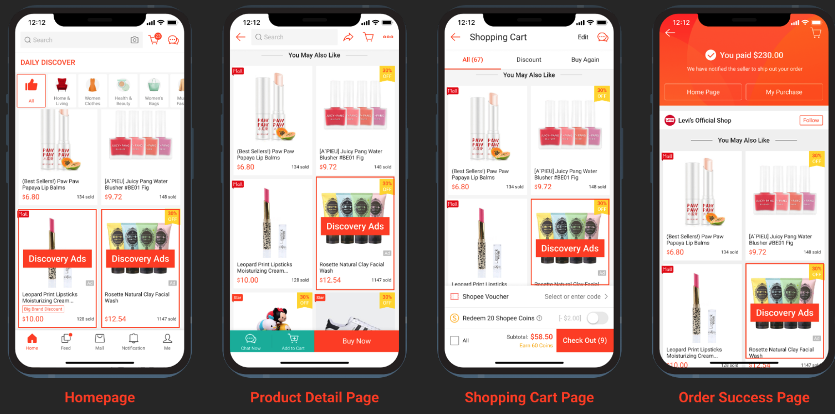

There is a huge emphasis on social interactions and engagement. All of Chinese shopping apps are very ‘busy’ in terms of UX by Western standards. Chinese shoppers expect immediate answers and immediate service, which generates a need for immediacy, ‘in-the-moment’ customer service with live chat and real-time content such as livestreaming and in-app games.

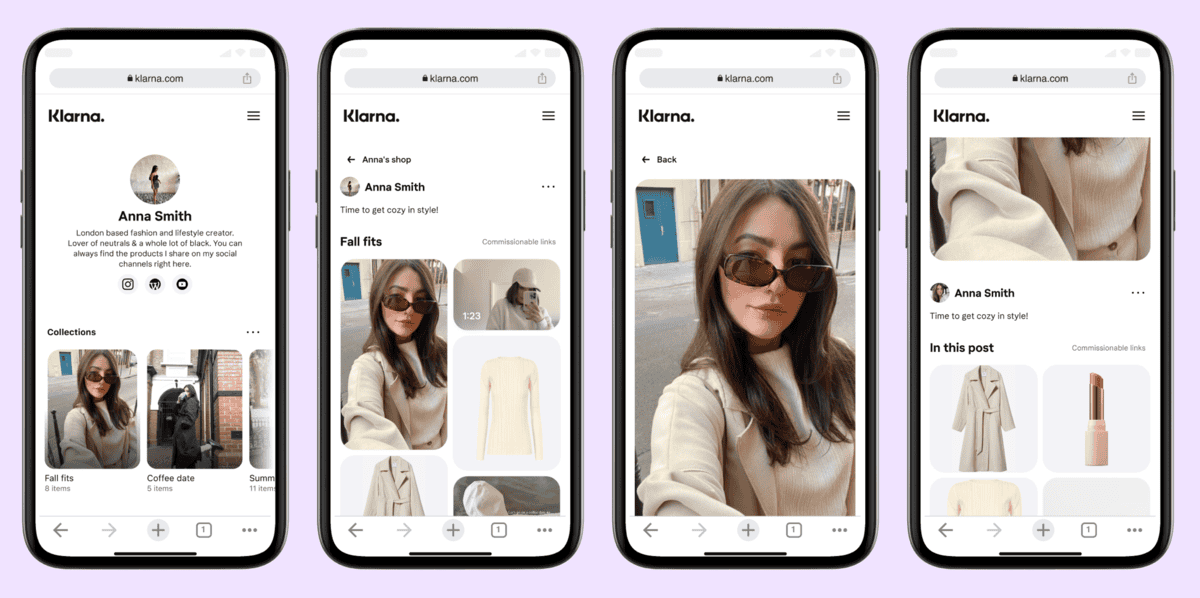

This notion of Integrating social media and retail, platforms to provide a seamless blend of social interaction, online shopping, streaming and promotions to encourage user interaction have permeated the apps in other markets in Asia such as Korea, Singapore and Hong Kong.

Shoppee app in Singapore

Instore

What about screens in store? Almost 10 years ago, Jack Ma, the founder of Alibaba, coined the phrase “new retail“ to explain Alibaba’s vision of blurring boundaries between the online and offline shopping world.

The Alibaba owned grocery chain Hema had interactive, digital screens eight years ago. The screens give customers product information, show similar products and what are the most popular items in the aisle (by age group if that is what you want!).

Prices on the screen can be changed via wi-fi – including products such as seafood where prices are determined by supply and demand. Shoppers engage with screens with QR codes and link directly with apps to do live chat.

The future

China was doing all the things that TikTok has now triggered in the West – but almost a decade ago. The impact of Bytedance, owner of TikTok, should therefore not be surprising.

However, this influence is only starting. The merger of TikTok style video on instore digital retail media screens cannot be far away. Using influencers on instore digital retail media screens to show products in action, with QR codes, live chat through the store app and special promotions all deliverable with today’s technology.

How can we capture what’s happened in China and the ubiquity of TikTok to help see how Retail Media could develop? Here are four takeaways for Retailers with Retail Media Networks and brand advertisers:

- Shoppers are streaming, scrolling, searching and shopping: short-form video is reshaping product discovery, impulse buying, and decision-making.

- Video is a demand engine, enabling instant discovery: Short form video compresses the time between inspiration and transaction.

- Social First: The evolution of retail to become more social – think of social media as the third shelf. Retailers should think about ‘how can this work on social media? What can I do instore to make everything tied into social? Can I use instore digital Retail Media screens to be ‘social’? Can I feature creators and influencers on my instore screens?

- ‘Conversion Everywhere’ : Make everything shoppable so conversion can happen on a retail partner, on Amazon, on Walmart, at a convenience story, directly from a digital ad, from a live stream or a social post.