Unilever’s ecommerce sales grew by 61% in its latest financial year as shoppers turned online to buy its hygiene and ‘at home’ food brands during Covid-19 lockdowns. Ecommerce and digitisation are now one of Unilever’s five strategic choices. It plans to “position our business for success in the channels of the future, focusing particularly on ecommerce and digitising the distributed trade, underpinned by advanced shopper insight as the consumer and customer landscape continues to evolve.”

This comes alongside strategic commitments to move into high growth categories, making its brands a force for good, growing sales in the US, India and China, and building a “purpose-led, future-fit organisation and growth culture.”

In 2020, 9% of Unilever turnover was from ecommerce – although overall turnover of €50.7bn was down by 2.4% compared to the previous year. Underlying sales – before currency fluctuations – grew by 1.9% over the year and by 3.5% in the fourth quarter. More than 50% of sales in its prestige beauty division took place online for the first time – although overall sales in this division also declined, by “low single digits” compared to the previous year. Underlying operating profits came in at €9.4bn – 5.8% down on the previous year – while operating profit of €8.3bn was down by 4.6%, as a result both of currency fluctuations and as profitability reduced amid increased supply chain and Covid-19 costs. Net profit of €6.1bn was 0.8% ahead of last time.

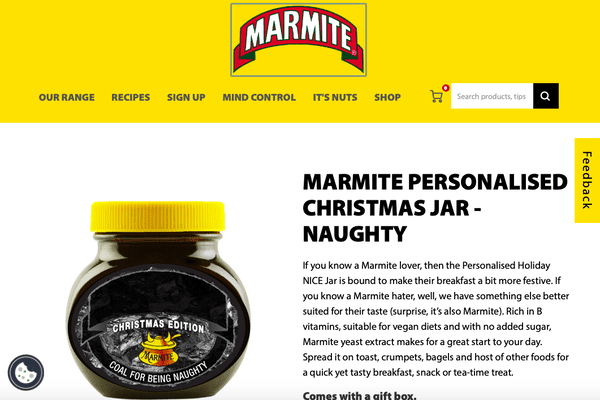

When Unilever bought snack subscription brand Graze in 2019, it said it planned to use its technology and and ecommerce expertise across its business. Now more Unilever brands are selling their wares for home delivery. Ben & Jerrys launched ecommerce sales this year, while shoppers can buy personalised jars of Marmite – as well as Marmite mugs and posters – on its ecommerce shop.

Over Unilever’s latest year, its strongest sales growth was in hygiene products – from Lifebuoy to Cif – and food and refreshments eaten at home – such as Graze, Ben and Jerry’s, Marmite and Hellmann’s. But sales for food eaten outside the home declined, as did sales of beauty and personal care products, outside of hygiene categories. Sales in developed (+2.9%) and emerging markets (+1.2%) grew as economies in China and India grew following strict first-half lockdowns and as North Americans bought more food to eat at home. Sales in Europe fell over the full year, but returned to growth in the final quarter of the year.

Unilever chief executive Alan Jope says Unilever has shown resilience and agility throughout the pandemic. It is winning market share in more than 60% of its business while setting “ambitious new targets” for its commitment to sustainability.

“Today we are setting out our plans to drive long term growth through the strategic choices we are making and outlining our multi-year financial framework,” he says. “While volatility and unpredictability will continue throughout 2021, we begin the year in good shape and are confident in our ability to adapt to a rapidly changing environment.”

The business will invest about €1bn in 2021 and 2022 on restructuring the business having saved costs of €2bn a year through its Fuel for Growth programme.